Author: Maddie Emerson | February 1, 2022

With ‘Twosday’ upon us (2-2-22), we anticipate a social media frenzy over the novelty of palindrome dates, as well as the next pair of (cleverly-selected) filing deadlines for regional grid operators’ plans for compliance with FERC Order No. 2222 (O. 2222). Here, we use Twosday to refer not only to February 2, but also – more broadly – to a time (likely, years from now) when the concept of O. 2222 is actualized and when its intentions are realized.

FERC Order No. 2222- Where Are We Now

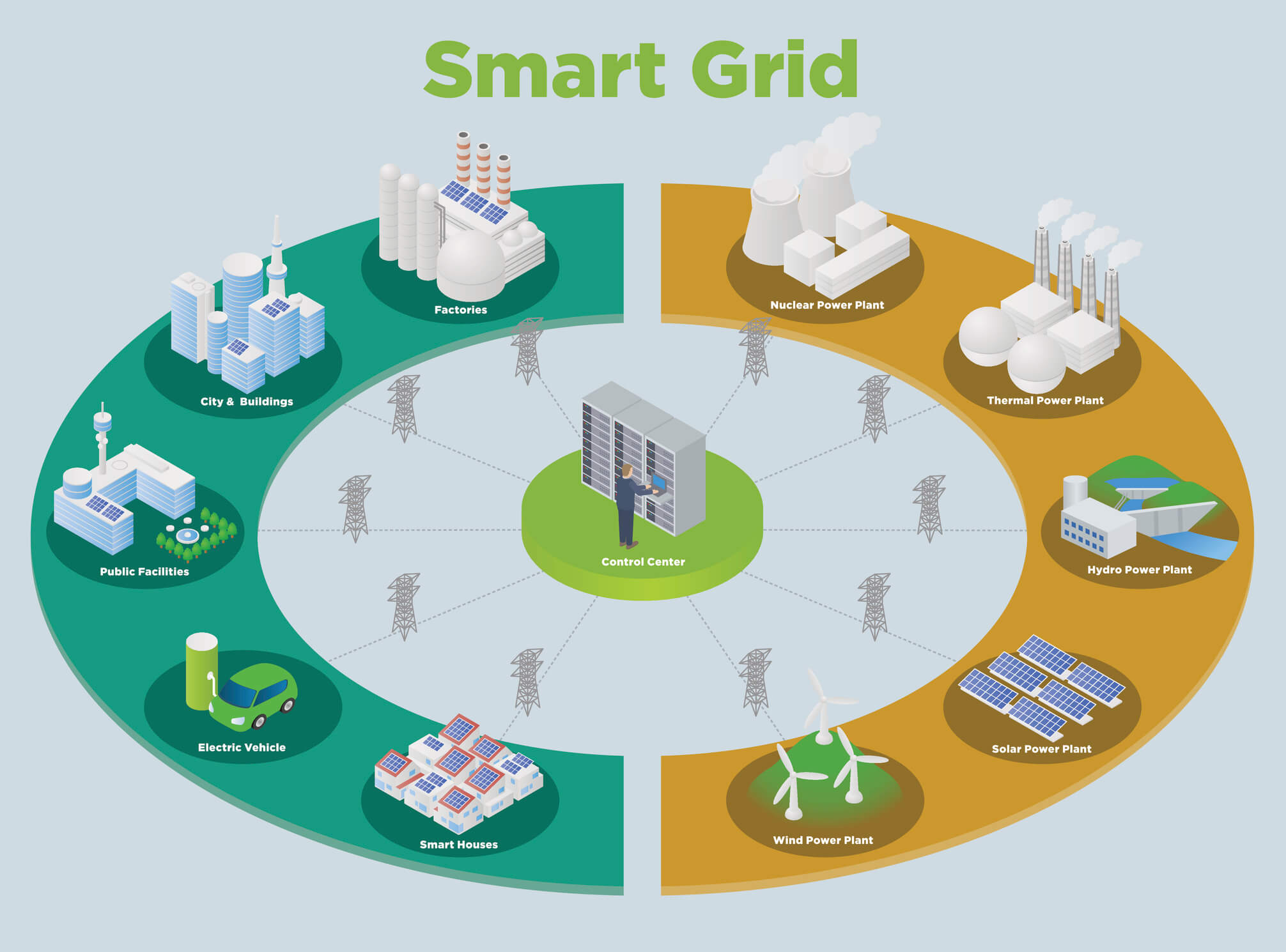

FERC Order No. 2222, issued in September 2020, aims to facilitate distributed energy resources (DERs) participation in regional wholesale markets. The order requires regional grid operators to revise their tariffs, allowing qualified market participants to aggregate DERs and offer their capacity, energy, and ancillary services through participation models that accommodate their unique characteristics. DERs, including electric storage, distributed generation, and demand response, can enhance grid flexibility, resilience, and decarbonization.

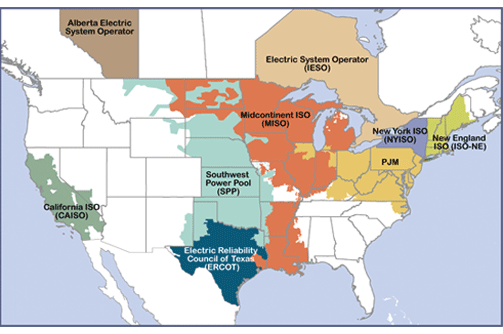

To achieve these goals while accounting for DERs’ unique characteristics, FERC directed regional grid operators (shown below*) to revise their tariffs which govern participation in these competitive wholesale markets. Specifically, the operators must enable qualified market participants to aggregate (or bundle) these smaller DERs and offer their capacity, energy, and ancillary services into wholesale markets through ‘participation models’ that accommodate their unique physical and operational characteristics. A ‘participation model’ refers to a set of rules and procedures that provide a path for a given market participant to offer their resources’ services in the market. Presently, many distributed resources including flexible/dispatchable loads, energy storage, and distributed generation, are able to participate in certain wholesale markets, primarily through demand response participation models, which do not adequately account for the range of services that these DERs are technically capable of providing (including, in some cases, injecting energy onto the grid). O.2222 is meant to ensure that market rules enable DERs to provide all services that they are technically capable of providing through aggregation.

*Note: These grid operators are referred to as independent system operators (ISOs) or regional transmission organizations (RTOs). Only FERC-jurisdictional ISOs/RTOs are subject to O. 2222 (this excludes the Canadian territories and ERCOT in Texas).

Originally, RTO/ISOs’ compliance plans (including proposed tariff revisions) were to be filed with FERC by July 19, 2021. CAISO and NYISO – the two ISOs which, at the time of O. 2222’s issuance, already had FERC-approved participation models for DER aggregations – filed timely compliance plans, which are working their way through regulatory review processes (CAISO (Docket No. ER21-2455-000)), NYISO (Docket No. ER21-2460-000)). The four remaining RTOs whose market rules require a greater overhaul to reach compliance requested and have been granted extensions to the original deadline through the Spring of 2022. Details on their progress to date can be found in their stakeholder groups here: PJM, ISO-NE, MISO, SPP. Compliance plans for PJM and ISO-NE are expected to be filed Tuesday, February 1st and Twosday (really, Wednesday) February 2nd (2-2-22), respectively.

To prepare for Twosday today, we need to revisit the idea of value stacking that lies at the core of O. 2222’s expected impacts and understand what electric utilities and other industry actors can do now to promote a smooth and informed transition to compliance.

A Deeper Dive: Podcast Discussion

TRC’s Experts Discuss FERC Order No. 2222

To hear a deeper dive into O. 2222 and its implications for our industry, you may be interested in listening to our recent “TRC Talks Energy” Podcast, where we discuss “the Good, the Bad, and the Ugly” of this historic final rule – including our Senior Policy Advisor’s theory that O. 2222 can be conceptualized as “Uber for Electrons.”

Value Stacking

DERs can be capable of providing various services to their owners and operators, as well as to other market participants and to the grid as a whole. Today, while it is common for resources’ behind-the-meter (BTM) and retail services to be valued in those markets, wholesale market compensation is less accessible, resulting in the under-utilization of services that DERs do or could perform for the bulk power system. Some of these additional services can be extracted from existing resources, maximizing the benefits from investments made to date; in other cases, the prospect of new revenue streams may change the business case dynamics and motivate investment in additional DERs.

Take, for example, my Ecobee smart thermostat. I admit that the primary value of this technology to me is the convenience of adjusting the temperature of my home from the comfort of my own bed by using the Ecobee app on my smart phone. However, this thermostat provides a secondary value to me in managing my retail energy bills. The scheduling and setback functionalities that optimize the operation of my home’s HVAC system save me roughly 10% on my heating and cooling costs each year.

In St. Louis, Missouri, the value stack does not end there. The local electric utility, Ameren Missouri, aggregates these thermostats from thousands of other residential customers, and operates them as a DR resource to reduce load when energy costs are high (putting downward pressure on rates for all of their customers). In exchange for the ability to operate my home’s HVAC system as a DR resource, Ameren Missouri provides me with a one-time payment for enrollment in their retail DR program, as well as an annual performance bonus. While these payments are less substantial than my annual bill savings, they make the economic case for purchasing a smart thermostat even more attractive for residents in my area (Note: There are other opportunities for me to capture value in the retail market, including an optional time-of-use rate, but we’ll set those aside for the sake of this example).

Presently, Ameren Missouri calls on my device for DR events a handful of times per year by increasing my thermostat setpoint by a few degrees for short periods of time. Depending on the compensation they may offer, I might be willing to allow more frequent and/or more significant adjustments, which could benefit the grid (and myself) while continuing to drive down costs for other ratepayers.

Under O. 2222 (depending on yet-to-be finalized compliance plans), distribution utilities like Ameren Missouri as well as possible third-party aggregators could design a program to offer the aggregated capabilities of residential smart thermostats into wholesale energy, capacity, or ancillary services markets, and pass along a portion of the revenue from these bulk system services back to DER owners like me – adding to the value stack for this technology, maximizing the grid benefits derived from existing resources, and strengthening the case for investments in additional DERs.

The Utility POV

This smart thermostat example may have raised red flags for those thinking from the perspective of an electric distribution utility. These utilities are required to maintain distribution grid reliability and make informed, cost-effective plans about necessary system investments. How can this be done effectively when third parties are able to enroll BTM or distribution system-connected resources and operate them at the direction of bulk power system operators, according to wholesale market signals, which may conflict with local system needs?

For certain utilities (both traditionally integrated monopoly utilities and in deregulated jurisdictions, utilities that serve as providers of last resort), there is an additional layer of complication with O.2222. Again, if third parties bring BTM resources directly to wholesale markets (outside of utility retail programs), how can the utilities ensure that this does not create “missing load” in their load forecasts and system-level generation plans, jeopardizing their abilities to ensure all customers can be reliably served?

These are the strongest concerns that we have heard TRC clients express, in response to O. 2222.

Fortunately, we have time to prepare.

First, we need pilots – new ones and syntheses of the findings of projects conducted to date. Surely, the pilots solicited to inform NYISO’s DER Roadmap will have useful lessons to offer to other jurisdictions currently considering topics like the effectiveness of certain metering and telemetry technologies and baseline methodologies for accurately capturing aggregated resource performance. In terms of innovative program designs, the Michigan Public Service Commission has called on the states’ investor-owned utilities to propose tariffs that provide retail and pass-through wholesale values to participants for energy storage resources (Note: this recommendation was made more directly in response to FERC Order No. 841 than O. 2222). The pursuit of attractive program designs like this one will be an important strategy for utilities seeking to retain maximum control of the resources on their distribution grids, at a time when states’ restrictions on the activity of unaffiliated third-party aggregators are in question.

Secondly, as expectations, rules, and requirements guiding market operations evolve in different regions, it will be important to stay on top of the details, including:

- Opt-in provisions for small utilities, and opt-out rights for states to restrict the participation of DR aggregators in those jurisdictions;

- Criteria and processes for utility review of DER interconnection/enrollment and for utility override of ISO/RTO dispatch of distribution system-connected resources;

- Processes for defining and mitigating double counting of services (identifying overlap between retail programs and wholesale market services);

- Expectations for data sharing between aggregators, utilities, and ISO/RTOs for settlement;

And more.

How TRC Can Help

TRC’s Advanced Energy Practice offers advisory and consulting services across the spectrum of O. 2222 compliance topics, from impact/gap assessments, to software architecture review and planning, to DER program planning, design, and implementation for utilities, agencies, and businesses. To learn more, contact advancedenergy@trccompanies.com.

Angela Gordon, Andrea Thompson, and Derek Kirchner also contributed to this article.

Achieve New

Possibilities

Partner With TRC’s Tested Practitioners

Related Materials

NYISO Pilot Program Guide

NYISO Pilot Program Guide

Published October 2, 2017

FERC Order No. 2222

FERC Order No. 2222

Published February 2, 2022

Sharing Our Perspectives

Our practitioners share their insights and perspectives on the trends and challenges shaping the market.

TRC Earns U.S. Department of Energy (DOE) Qualification to be a Provider of Industrial Assessment Centers (IAC) Equivalent Energy Assessments

September 24, 2024

TRC can now provide IAC equivalent energy audits to small and medium-sized manufacturing (SMM) firms, who can receive grants of up to $300,000 for implementation of audit recommendations.

Utility Carbon Data Management

May 27, 2024

We’re pleased to announce Episode 7 of TRC’s Energy Talks Podcast, where we join experts from utilities and carbon accounting solution providers to discuss how our industry is understanding, measuring, and working to improve our collective carbon footprint.

Empowering Stakeholders to Co-Create Solutions that Address Inequity

April 23, 2024

Addressing inequality and ensuring that the benefits of the clean energy transition are accessible to all requires close examination of long-relied-upon processes that may have hidden inequities ingrained within them.

Monetizing the Environmental Attributes of Building Decarbonization Programs

March 27, 2024

Tune in to Episode 6 of TRC’s Energy Talks Podcast, where we join industry experts from the wholesale energy and environmental commodity markets to discuss how utilities and project developers are valuing the environmental attributes of building decarbonization projects.

Hydrogen Hub Funding Provisions

March 26, 2024

TRC’s panel of practitioners discuss the Hydrogen Hub (H2Hub) funding provisions of the Bipartisan Infrastructure Bill (BIL).

TRC Companies, Inc. selected to participate in Department of Energy (DOE) Multi-State Clean Hydrogen Hub

October 13, 2023

TRC received an award for advancing the transition to a clean-hydrogen, low-carbon economy by supporting the Appalachian Regional Clean Hydrogen Hub (ARCH2) consortium.

Download Whitepaper: 10 Years of Insights for Clean Community Microgrids

March 1, 2023

Clean, community microgrids represent a promising and timely opportunity for you to advance your customer offering and deliver meaningful societal benefits, all while modernizing your grid and providing you with load flexibility.

Start Your Batteries: Mass Fleet Electrification is Coming (And What We Can do to Prepare)

April 13, 2022

As we plan for and make early investments for fleets, we’ll be paving the way for higher degrees of market penetration of passenger vehicles and other modes of transportation as well.

Ensuring a Just Transition: Optimizing Opportunities for All in the Low-Carbon Future

January 24, 2022

Carbon elimination of the magnitude needed to address climate change requires systems-level change that can only be reached by incremental, ground-up progress, building upon what we have achieved thus far.

Decarbonization: A Systems-Level Challenge and Actions to Address Climate Change

December 7, 2021

Carbon elimination of the magnitude needed to address climate change requires systems-level change that can only be reached by incremental, ground-up progress, building upon what we have achieved thus far.

10 Takeaways from the COP26 Climate Meeting

November 17, 2021

There are compelling reasons to be optimistic about the outcomes of the COP26 meeting. Notably, agreement among all nations that more needs to be done, by both private and governmental bodies, to contain and mitigate climate change.

The Price of Natural Gas: Onward and Upward or Just a Temporary Blip?

November 12, 2021

Most industry experts agree that weather aside, the global energy and gas markets are likely to remain uncertain with supply and market demand becoming tighter and more challenging to forecast.

On the Road to Decarbonization: The Role of All-Source Competitive Solicitations

October 14, 2021

All-Source Competitive Solicitations offer utilities an alternative to centralized planning, construction and dispatch of power supplies, helping to usher in a new era of market-driven technology innovation.

Pacific Gas and Electric Selects TRC as Program Implementer for New Construction Residential All-Electric and Mixed Fuel Programs

September 27, 2021

Pacific Gas and Electric Company (PG&E) formally announced TRC as the designated lead Program Implementer for the Statewide New Construction (SWNC) Residential All-Electric and Mixed Fuel Programs following a competitive solicitation process.

TRC and Slipstream partner with the Minnesota Department of Commerce to launch energy conservation R&D project

June 24, 2021

TRC, Slipstream, and the University of Minnesota are working with controls system manufacturers and contractors to develop such a standardized and streamlined building control retrofit process leveraging ASHRAE Guideline 36

TRC Companies Inc. Acquires EMI Consulting

January 27, 2021

Today TRC Companies (“TRC”), announces the expansion of its advanced energy capabilities with the acquisition of EMI Consulting (“EMI”), a Seattle based firm that consults on the strategic development of clean energy solutions including energy efficiency, demand management, decarbonization and customer engagement.

City of Camarillo, California approves moving forward with Hybrid Solar Microgrids at five critical community facilities

November 6, 2020

On October 28, the Camarillo City Council unanimously approved moving forward with the design of Hybrid Microgrids at five City facilities: City Hall, the Corporation Yard, Camarillo Public Library, Police Station, and Wastewater Treatment Plant. The microgrid at the Camarillo Public Library will be designed with solar+storage only, while the other four sites will employ a hybrid design of solar+storage+diesel.

TRC Digital partners with Dominion Energy to evolve its distributed energy resource strategy

September 22, 2020

Dominion Energy, one of the nation’s largest producers and transporters of energy, has partnered with TRC Digital to evaluate, implement and integrate technology to further the utility’s distributed energy goals. TRC Digital will facilitate Dominion Energy’s strategy development and technology execution, allowing Dominion Energy and its customers to accelerate the shift to distributed energy resources (DER) and net carbon reduction.

Strategic Electrification

February 4, 2020

As we look to spur strategic electrification across the US, it will be up energy providers and solution implementers to continue sharing ideas, insights and lessons learned

A place called home: Helping California families rebuild after wildfires

November 21, 2019

A place called home: Helping California families rebuild after wildfires

TRC and partners win $1 million grant for engineering innovative New York microgrid

April 20, 2017

TRC is proud to support Huntington, NY bolster power reliability and climate-change resiliency with a sophisticated new “community microgrid’’ combining solar energy, a fuel cell, biogas and traditional natural gas to deliver electricity and heat to local customers and institutions.

The Transformative Benefits of 3D Facility Mapping for Utilities

June 26, 2025

Discover how modern 3D facility mapping empowers utilities to modernize infrastructure, improve asset management, and enable remote workflows with accurate digital twins, delivering cost savings and operational efficiency.

Why Utilities Need a Comprehensive Data Management Strategy

June 17, 2025

Though traditionally late adopters, most utilities today are evaluating, if not implementing, digital technologies.

Exceed Compliance Demands and Improve Leak Survey & Management with Mobile Asset Mapping

April 30, 2025

Leak detection and management is one of the most critical functions for utility companies managing gas infrastructure. As regulatory pressure mounts and public expectations shift, utility operators face a new era where legacy leak survey workflows are struggling to keep up

Grid Resiliency: Perspectives Across the Power Grid

April 16, 2025

In today’s changing energy landscape, grid resiliency is a top priority for all power system owners and operators. The ability to absorb disruptions and maintain power is crucial in an increasingly unpredictable world.

NFPA Establishes Consolidated Standard for Combustible Dust

January 23, 2025

NFPA 660 will make it easier for all industries to manage dust related hazards making for safer work environments.

General Permit (GP) for CII Stormwater Discharges Proposed for the Charles, Mystic and Neponset River Watersheds

January 8, 2025

On November 1, 2024, FERC Commissioners led a technical conference regarding co-locating large loads at generating facilities.

Ozone Nonattainment Areas in Midwest Reclassified to Serious

January 3, 2025

On Tuesday, December 17th, the United States Environmental Protection Agency (USEPA) issued a final rule reclassifying several ozone nonattainment areas as “Serious” nonattainment for the 2015 ozone national ambient air quality standard.

Deadline Imminent for New Texas Annual Permit Reporting Requirements

December 19, 2024

In 2023, the Texas State Legislature approved Senate Bill 1397 and House Bill 1505, which require that “A person who holds a temporary permit or permit with an indefinite term shall report to the commission annually whether the activity subject to the permit is ongoing” and that the person “shall first report to the Texas Commission on Environmental Quality the status of the permitted activity not later than December 31, 2024”. The Texas Water Code has been amended to include this requirement in Sec. 5.587.

FERC Reviews Large Load Integration at Technical Conference

December 6, 2024

On November 1, 2024, FERC Commissioners led a technical conference regarding co-locating large loads at generating facilities.

What Is Grid Modernization?

December 2, 2024

Additional Restrictions for Major Modifications Other restrictions will come into play for new Major Sources, those that have a potential to emit 50 tons per year or more of VOC or NOx and “major modifications” that result in a VOC emission increase that exceeds 25 tons per year and also exceeds 25 tons per year when aggregated with all creditable increases and decreases in emissions of VOC from the source over any period of five consecutive years, which includes the calendar year in which the increase will occur. For sources that are major due to NOx emissions, a NOx emission increase that exceeds 25 tons per year and exceeds 25 tons per year when aggregated with creditable increases and decreases over the five-year period is also deemed to be a major modification. If a major modification occurs, the source is required to utilize the Lowest Achievable Emission Rate (or LAER) for the pollutant(s) that exceed 25 tons per year aggregated over the five-year period. However, Best Available Control Technology (BACT) can be substituted for LAER under certain conditions. Additionally, emissions must be offset as a means to advancing the area toward attaining the ozone standard. These same requirements will apply to newly constructed Major Sources. Upcoming Deadlines With these actions, the impacted areas will now have until August 3, 2027, to reach attainment. If they do not, USEPA is again obligated to reclassify ongoing nonattainment status to Severe nonattainment, reducing the Major Source threshold in half to just 25 tons per year. In the meantime, the states will be required to revise State Implementation Plans to demonstrate that attainment will be achieved by this deadline. A unique consideration in Wisconsin affects sources subject to a Registration Operation Permit. These permits establish annual emission limits as a percentage of the Major Source threshold (25, 50, or 80 percent depending on the Permit). For these sources, the annual emission limit for VOC and NOx will automatically be cut in half on January 16, 2025. Sources in the ozone nonattainment areas that hold these permits should evaluate whether the Registration Permit provides a long-term option given that the annual emission limits have been cut in half now and may again be cut in half in three years’ time. Next Steps: TRC Can Help TRC is available to support your air compliance and permitting needs by offering expert in-house resources to perform: Ambient Monitor Siting Evaluation Ambient Monitor Deployment, Operation and Maintenance For more information, contact Melanie Klamar, Robert VandenMeiracker and Mike Zebell.

FERC Addresses Future Reliability Risks at Technical Conference

November 26, 2024

On October 16, 2024, the Federal Energy Regulatory Commission held its annual Commissioner-led Reliability Technical Conference.

FERC Issues Guidance to Improve Power System Security and CIP Compliance

September 30, 2024

This update provides details from FERC 2024 staff report from CIP audits, so utilities can improve compliance and reduce security risks.

TRC Acquires Garanzuay Consulting, Amplifying TRC’s Energy Transition Consulting Services in Europe

September 26, 2024

Garanzuay Consulting provides a foundation in Ireland to continue TRC’s growth and expansion in Europe in support of the energy transition for all energy market participants.

NERC Releases 2024 State of Reliability Report

September 19, 2024

The North American Electric Reliability Corporation (NERC) recently released its 2024 State of Reliability report, examining power system performance in calendar year 2023.

Facility Ratings Compliance Through a Corporate Community Approach

August 30, 2024

Facility Ratings play a critical role in the reliable planning and operation of the Bulk Electric System (BES) and yet maintaining compliance with relevant NERC standards remains an industry challenge.

Extreme Geomagnetic Disturbances Impact NERC Planning

August 8, 2024

Learn about the recent geomagnetic disturbance which caused stakeholders within the bulk power system to react swiftly to protect grid reliability. Find out the impacts and what NERC and the industry are doing about it.

Joint Use: Best Practices for Project Success

July 15, 2024

Joint use has never been as important as it is today. With demand for telecommunications infrastructure skyrocketing, governments are investing big in initiatives like the $42.5 billion Broadband Equity Access Deployment Program (BEAD) and the $20.4 billion Rural Digital Opportunity Fund (RDOF).

Consistent NERC Compliance Evidence for Successful Audit Outcomes

June 27, 2024

While utilities often work in technical silos, NERC auditors are trained to cross check compliance evidence and data between interrelated standards.

New NERC Standards Help Protect Against Cyber Attacks

May 23, 2024

As part of NERC’s ongoing effort to bolster Critical Infrastructure Protection (CIP) requirements and enable the implementation of a security improvement concept known as virtualization.

Five Generational Challenges Facing the Utility Workforce

May 10, 2024

In the actively changing energy landscape, utilities are grappling with many workforce-related challenges linked to the ongoing shift towards cleaner energy and the modernization of power grids. As veteran employees retire, it is critical to bridge the knowledge and skill gap by recruiting and developing younger talent.

NERC Compliance Success Through a Corporate Community Approach

May 6, 2024

Additional Restrictions for Major Modifications Other restrictions will come into play for new Major Sources, those that have a potential to emit 50 tons per year or more of VOC or NOx and “major modifications” that result in a VOC emission increase that exceeds 25 tons per year and also exceeds 25 tons per year when aggregated with all creditable increases and decreases in emissions of VOC from the source over any period of five consecutive years, which includes the calendar year in which the increase will occur. For sources that are major due to NOx emissions, a NOx emission increase that exceeds 25 tons per year and exceeds 25 tons per year when aggregated with creditable increases and decreases over the five-year period is also deemed to be a major modification. If a major modification occurs, the source is required to utilize the Lowest Achievable Emission Rate (or LAER) for the pollutant(s) that exceed 25 tons per year aggregated over the five-year period. However, Best Available Control Technology (BACT) can be substituted for LAER under certain conditions. Additionally, emissions must be offset as a means to advancing the area toward attaining the ozone standard. These same requirements will apply to newly constructed Major Sources. Upcoming Deadlines With these actions, the impacted areas will now have until August 3, 2027, to reach attainment. If they do not, USEPA is again obligated to reclassify ongoing nonattainment status to Severe nonattainment, reducing the Major Source threshold in half to just 25 tons per year. In the meantime, the states will be required to revise State Implementation Plans to demonstrate that attainment will be achieved by this deadline. A unique consideration in Wisconsin affects sources subject to a Registration Operation Permit. These permits establish annual emission limits as a percentage of the Major Source threshold (25, 50, or 80 percent depending on the Permit). For these sources, the annual emission limit for VOC and NOx will automatically be cut in half on January 16, 2025. Sources in the ozone nonattainment areas that hold these permits should evaluate whether the Registration Permit provides a long-term option given that the annual emission limits have been cut in half now and may again be cut in half in three years’ time. Next Steps: TRC Can Help TRC is available to support your air compliance and permitting needs by offering expert in-house resources to perform: Ambient Monitor Siting Evaluation Ambient Monitor Deployment, Operation and Maintenance For more information, contact Melanie Klamar, Robert VandenMeiracker and Mike Zebell.

NERC Proposes Changes to Registration Criteria for Inverter Based Resources (IBRs)

April 19, 2024

NERC has submitted for FERC approval new compliance criteria for the registration of IBRs as part of continuing efforts to address reliability risks. It is critical for renewable energy developers, generation owners and transmission owners to understand the potential implications for interconnection studies and interconnection queues.

Shifting to the Cloud: Debunking the Myths of Migrating Utility Data Off Premises

April 14, 2024

This blog delves into common misconceptions surrounding cloud migration in the utility industry, addressing concerns about security, reliability, regulatory compliance, cost effectiveness, and complexity, while highlighting the substantial benefits and strategies for successful adoption.

NERC Proposes Clarifications to EOP Cold Weather Standards

March 26, 2024

NERC has submitted proposed revisions to the EOP-012-2 – Extreme Cold Weather Preparedness and Operations standard, for FERC approval on an expedited basis. The proposed revisions address the remaining key recommendations from the FERC–NERC Joint Inquiry Report into Winter Storm Uri and directives arising from a 2023 FERC Order regarding the previously submitted cold weather standards.

Update to FAC-003-5 Brings Sweeping Changes to Transmission Classifications Starting April 1

March 19, 2024

Update to FAC-003-5 Brings Sweeping Changes to Transmission Classifications Starting April 1

Prevent NERC Compliance Failures with Readiness Reviews

February 20, 2024

Every NERC-registered utility must strive for continuous compliance with their portfolio of applicable NERC Reliability Standards

NERC Releases 2024-2026 Standards Development Plan

January 26, 2024

NERC has submitted its 2024-2026 Reliability Standards Development Plan to the Federal Energy Regulatory Commission (FERC), outlining its current priorities and future standard development plans to protect the reliability of the Bulk Power System over the next three years.

NERC & FERC Release Winter Storm Elliott Report

January 2, 2024

NERC and FERC have released their final report on Winter Storm Elliott which provides reinforcement for recommendations in prior cold weather-related disturbance event reports. The Report identifies critical reliability performance shortcomings and the reliability related near misses. NERC states that a crisis was “narrowly dodged.” The Report outlines the steps the industry must take to avoid a repeat in the future.

FERC Order 901 Calls for Standards to Address IBR Reliability Gaps

November 27, 2023

Inverter Based Resources are playing central role when it comes to adding new electric generation capacity into the bulk power system.

Locana Awarded Modern Network Management at Esri Infrastructure Management and GIS Conference

November 22, 2023

Locana, an international leader in spatial technology, received the Modern Network Management Award at the 2023 Esri Infrastructure Management and GIS (IMGIS) Conference held in Palm Springs, California, October 10-12, 2023.

NERC Releases Inverter Based Resources Webinar Series

October 19, 2023

As the power delivery system continues to rapidly evolve due to decarbonization policy initiatives, inverter-based resources (IBRs) are playing an ever-more significant role in generation additions to the bulk power system. NERC and other technical organizations have taken numerous actions to support the reliable integration of these resources.

Esri Awards Locana with the ArcGIS Cloud Services Specialty Designation

October 4, 2023

Locana, an international leader in spatial technology, received Esri’s ArcGIS Cloud Services Specialty, which designates Locana as an expert in deploying and managing ArcGIS in cloud environments such as Amazon Web Services (AWS) and Microsoft Azure.

The Digital Transformation of the Utility Operations Model: Essential Telecom Network Upgrades to Make Now

October 4, 2023

As technology advances and cybersecurity threats loom, companies must prioritize communications retrofits and upgrades to ensure reliability, availability and business continuity.

FERC Issues Order 2023 to Resolve Interconnection Process Issues

September 25, 2023

The Federal Energy Regulatory Commission has approved Order 2023 to facilitate and improve the speed and reliability of adding new energy resources to the power system

FERC Hosts Technical Conference on the Effectiveness and Improvements to CIP-014-3

August 30, 2023

Expert Discussions and Key Takeaways Focus on Physical Security

Offshore Wind: A Critical Energy Solution on the Path to Grid Resiliency and Decarbonization

August 29, 2023

As the urgency to decarbonize and build resiliency grows, renewable energy continues to be a pivotal solution for reshaping the future of power in the U.S. From solar to wind, hydro, geothermal and biomass, each renewable resource has its sweet spot for efficient development, deployment and optimal performance. And while they all have their own pros and cons, it is imperative that we leverage them all into the energy mix to achieve decarbonization goals and ensure adequate capacity to meet increasing load demands.

Intro to NERC Regulatory Guidance on Inverter-Based Resources

August 29, 2023

As renewable energy proliferates across the US power system, the North American Electric Reliability Corporation (NERC) continues to actively address reliability risks resulting from the implementation of inverter-based resources (solar and wind generation technology) connected at both transmission and Distributed Energy Resources (DER) levels.

U.S. EPA’s EJScreen Evolves as the Agency Advances Environmental Justice

August 21, 2023

EJScreen is currently at the forefront of federal efforts to identify potential disproportionate environmental burdens and communities with potential environmental justice (EJ) concerns.

Strengthening the Future Utility Workforce through Immersive Learning Technology

August 7, 2023

Leveraging new tools and technologies such as mixed and virtual reality (MR/VR) to develop a new generation of skilled engineers and technicians to maintain the reliability and resiliency of the future grid.

FERC Extreme Weather Initiative Will Change the Transmission Planning Process

July 26, 2023

FERC issued a Final Rule directing NERC to develop a new or modified reliability standard addressing transmission system planning performance requirements for extreme heat or cold weather events.

Unleashing the Power of a Human Performance Mindset to Ensure the Next Generation Utility Workforce

June 27, 2023

The impact of adapting behavioral and cultural norms to focus on the principles of human performance cannot be underestimated in building the power workforce of the future.

Advanced Metering Infrastructure (AMI) – How Smart Should A Smart Meter Be?

June 26, 2023

According to the Edison Foundation’s Institute for Electric Innovation, over 124 million smart meters were expected to be installed in 78 percent of US households by the end of 2022.

FERC Approves Plan to Register Certain Inverter-Based Resources as part of NERC Mandatory Standards Compliance Program

June 21, 2023

FERC issued an order approving NERC’s compliance filings.

Modernize Your Field Services with GIS and Work Order Management Combined

June 15, 2023

The role of field service management continues to dominate the world economy, as the market grows at an exponential rate. The market was estimated at 3.2 billion in 2021 and is projected to reach 5.7 billion by the end of 2026.

Advancing Telecommunication Projects: A Guide for High Level Design

June 6, 2023

TRC has developed utility network Master Plans and designed and architected utility-wide networks

NERC Files Report on Effectiveness on CIP-014 Physical Security Standard

May 25, 2023

On behalf of the North American Electric Reliability Corporation (NERC), its President and CEO Jim Robb, recently presented to the Federal Energy Regulatory Commission (FERC) a summary of NERC’s report on the effectiveness of NERC’s CIP-014 Physical Security Standard. There were almost 1,700 physical security incidents reported to the Electricity-Information Security Analysis Center (E-ISAC) in 2022, an increase of 10.5% from 2021.

FERC Issues Order on Cold Weather Reliability Standards

April 27, 2023

FERC has approved two NERC proposed cold weather-related reliability standards.

Modeling Power System Hosting Capacity

March 31, 2023

As renewable energy development booms, and distributed energy resources (DERs) proliferate across the grid, the demand for a more efficient and timely interconnection process is at an all-time high. To meet regulatory deadlines and satisfy the needs of both developers and customers, utilities must tackle an increasingly complex array of system impact studies, analyses and reports, under ever shrinking timelines.

FERC Orders Internal Network Security Monitoring Rule to be Finalized

March 14, 2023

FERC directed NERC to develop Reliability Standards to implement INSM within trusted CIP environments.

TRC Companies Assisting LS Power Grid Maine with New Transmission Project in Maine

March 2, 2023

TRC Companies announces its role as a consultant in supporting the new transmission project by LS Power Grid Maine.

Insights from the Odessa II Power System Disturbance

February 22, 2023

NERC and TRE release the Odessa II Power System Disturbance Report

Carrots and Sticks for Building Decarbonization: Incentive Programs and Codes & Standards

January 11, 2023

Additional Restrictions for Major Modifications Other restrictions will come into play for new Major Sources, those that have a potential to emit 50 tons per year or more of VOC or NOx and “major modifications” that result in a VOC emission increase that exceeds 25 tons per year and also exceeds 25 tons per year when aggregated with all creditable increases and decreases in emissions of VOC from the source over any period of five consecutive years, which includes the calendar year in which the increase will occur. For sources that are major due to NOx emissions, a NOx emission increase that exceeds 25 tons per year and exceeds 25 tons per year when aggregated with creditable increases and decreases over the five-year period is also deemed to be a major modification. If a major modification occurs, the source is required to utilize the Lowest Achievable Emission Rate (or LAER) for the pollutant(s) that exceed 25 tons per year aggregated over the five-year period. However, Best Available Control Technology (BACT) can be substituted for LAER under certain conditions. Additionally, emissions must be offset as a means to advancing the area toward attaining the ozone standard. These same requirements will apply to newly constructed Major Sources. Upcoming Deadlines With these actions, the impacted areas will now have until August 3, 2027, to reach attainment. If they do not, USEPA is again obligated to reclassify ongoing nonattainment status to Severe nonattainment, reducing the Major Source threshold in half to just 25 tons per year. In the meantime, the states will be required to revise State Implementation Plans to demonstrate that attainment will be achieved by this deadline. A unique consideration in Wisconsin affects sources subject to a Registration Operation Permit. These permits establish annual emission limits as a percentage of the Major Source threshold (25, 50, or 80 percent depending on the Permit). For these sources, the annual emission limit for VOC and NOx will automatically be cut in half on January 16, 2025. Sources in the ozone nonattainment areas that hold these permits should evaluate whether the Registration Permit provides a long-term option given that the annual emission limits have been cut in half now and may again be cut in half in three years’ time. Next Steps: TRC Can Help TRC is available to support your air compliance and permitting needs by offering expert in-house resources to perform: Ambient Monitor Siting Evaluation Ambient Monitor Deployment, Operation and Maintenance For more information, contact Melanie Klamar, Robert VandenMeiracker and Mike Zebell.

New FERC Orders Will Change Regulatory Process for Inverter Based Resources

January 9, 2023

The Federal Energy Regulatory Commission (FERC) recently proposed actions to keep the regulatory process and requirements ahead of reliability risks resulting from the accelerated deployment of Inverter Based Resources (IBR) based solar, wind and battery storage projects.

NERC Releases Facilities Ratings Best Practices Report

December 19, 2022

NERC report on best practices for utilities that have encountered facility ratings program challenges.

NERC Files Comments in the FERC Generator Interconnection Notice of Proposed Rulemaking

November 21, 2022

The rulemaking addresses improvements needed to reliably facilitate the power industry’s transition to renewable and distributed generating resources utilizing inverter-based technologies.

NERC Releases Inverter-Based Resource Strategy Plan

October 25, 2022

The North American Electric Reliability Corporation (NERC) recently released an Inverter-Based Resource (IBR) Strategy, which details the steps needed to successfully integrate IBR facilities into the planning and operation of the power system. The strategy was put in place due to the rapid interconnection of IBR systems, which are extensively used for solar and wind generating facilities, including new battery-based energy storage systems and are one of the most significant drivers of power grid transformation. Because of control system inconsistencies, IBR facilities pose well-documented risks to power system reliability when this strategy’s practices are not adhered to. NERC’s plan calls attention to the need for thoughtful integration of IBRs and identifies current and future work required to mitigate reliability risks resulting from the deployment of this technology.

NERC Releases 2022 State of Reliability Report

September 16, 2022

The North American Electric Reliability Corporation (NERC) recently released its 2022 State of Reliability report, which examines power system performance in calendar year 2021 and evaluates reliability performance trends. The 2022 report identified six key findings regarding power system performance that are summarized as follows:

NERC Proposes Implementation Guidance for PRC-019-2

August 22, 2022

NERC has proposed implementation guidance for PRC-019-2, the standard that verifies coordination of generating unit facility or synchronous condenser voltage regulating controls, limit functions, equipment capabilities and protection system settings.

The Use Case Benefits of GIS Modernization for Utilities

August 10, 2022

Additional Restrictions for Major Modifications Other restrictions will come into play for new Major Sources, those that have a potential to emit 50 tons per year or more of VOC or NOx and “major modifications” that result in a VOC emission increase that exceeds 25 tons per year and also exceeds 25 tons per year when aggregated with all creditable increases and decreases in emissions of VOC from the source over any period of five consecutive years, which includes the calendar year in which the increase will occur. For sources that are major due to NOx emissions, a NOx emission increase that exceeds 25 tons per year and exceeds 25 tons per year when aggregated with creditable increases and decreases over the five-year period is also deemed to be a major modification. If a major modification occurs, the source is required to utilize the Lowest Achievable Emission Rate (or LAER) for the pollutant(s) that exceed 25 tons per year aggregated over the five-year period. However, Best Available Control Technology (BACT) can be substituted for LAER under certain conditions. Additionally, emissions must be offset as a means to advancing the area toward attaining the ozone standard. These same requirements will apply to newly constructed Major Sources. Upcoming Deadlines With these actions, the impacted areas will now have until August 3, 2027, to reach attainment. If they do not, USEPA is again obligated to reclassify ongoing nonattainment status to Severe nonattainment, reducing the Major Source threshold in half to just 25 tons per year. In the meantime, the states will be required to revise State Implementation Plans to demonstrate that attainment will be achieved by this deadline. A unique consideration in Wisconsin affects sources subject to a Registration Operation Permit. These permits establish annual emission limits as a percentage of the Major Source threshold (25, 50, or 80 percent depending on the Permit). For these sources, the annual emission limit for VOC and NOx will automatically be cut in half on January 16, 2025. Sources in the ozone nonattainment areas that hold these permits should evaluate whether the Registration Permit provides a long-term option given that the annual emission limits have been cut in half now and may again be cut in half in three years’ time. Next Steps: TRC Can Help TRC is available to support your air compliance and permitting needs by offering expert in-house resources to perform: Ambient Monitor Siting Evaluation Ambient Monitor Deployment, Operation and Maintenance For more information, contact Melanie Klamar, Robert VandenMeiracker and Mike Zebell.

Revisions to FAC-001 and FAC-002 Submitted for FERC Approval

July 12, 2022

Reliability Standards FAC-001-4 and FAC-002-will resolve uncertainty regarding the meaning of “materially modify” under the currently effective standards.

FERC Order No. 881-A Has Implications for NERC Compliance Programs

June 23, 2022

Updated Order will have significant impact on NERC compliance programs related to both PRC standards and facilities ratings. Utilities should review the Order’s requirements and prepare for changes needed to remain compliant.

Brookings Municipal Utilities Streamlines Processes, Boosts Efficiency with Modern GIS

June 14, 2022

Locana, a global leader in technology consulting and geospatial systems development, announced Brookings Municipal Utilities (BMU) successful deployment of a modern geospatial enterprise leveraging Locana services.

Omaha Metropolitan Utilities District Drives Reliable Operations with Locana Lemur Mobile GIS Solution

June 8, 2022

Locana, a global leader in technology consulting and geospatial systems development, today announced the successful deployment of its LemurSM Solution by Omaha Metropolitan Utilities District (M.U.D.).

NERC’s Revised PRC-024-3 Standard for Inverter-Based Generation Effective in October 2022

May 11, 2022

Changes to PRC-024-3 in support of inverter-based generation performance are going into effect in October of this year. Interconnection programs and documentation procedures may need to be updated in order to maintain compliance.

FERC Issues Notice of Inquiry Regarding Dynamic Line Ratings

April 25, 2022

There are significant technical challenges involved in implementing Dynamic Line Ratings in the planning and operation of utility systems. Utilities should be prepared to modify their NERC compliance programs as necessary to address the potential introduction of DLR in their businesses.

Creating a Culture of Safety During Plant Decommissioning

April 13, 2022

Creating intrinsically motivated safety cultures within nuclear power plants is imperative, especially during the decommissioning process. Employees’ long-standing beliefs and attitudes often determine their decisions and actions, so cultivating a safety-first culture requires commitment and accountability.

Start Your Batteries: Mass Fleet Electrification is Coming (And What We Can do to Prepare)

April 13, 2022

As we plan for and make early investments for fleets, we’ll be paving the way for higher degrees of market penetration of passenger vehicles and other modes of transportation as well.

TRC Selected as Systems Integrator for Otter Tail Power Company’s Advanced Metering Infrastructure Program

April 5, 2022

Otter Tail Power Company selects TRC to serve as systems integrator for their AMI program covering northwestern Minnesota, eastern North Dakota, and northeastern South Dakota.

Webinar Replay: Substation Automation – Best Practices for IEC 61850 Implementation

March 29, 2022

Modernizing utility equipment, standards and processes pays dividends for improved safety, security and reliability. But transitioning to a new high-tech system model can be challenging.

New NERC Guidance Supports the Implementation of Grid Forming Inverters

March 8, 2022

NERC has issued a new report highlighting the key attributes of various inverter controls to support proper implementation and to protect reliability.

NERC Recommends Approaches for Underfrequency Load Shedding Programs

February 24, 2022

In a recently released reliability guideline, NERC recommends additional approaches for Underfrequency Load Shedding (UFLS) program design to help utilities effectively consider the effects of Distributed Energy Resources (DERs). The guidance was developed to address the accelerated transition of the power system to locally installed, decarbonized resources that depend on inverters. These new technologies introduce operational controls issues into the electric grid. UFLS data gathering and analysis methodologies may require modification to address reliability risks.

The Best Process for Transforming Thermal Generation Power Plants

February 9, 2022

Faced with an aging fleet, stricter environmental regulations, reduced costs for natural gas and competition from renewables, more than 600 power plants have been decommissioned in the last 20 years, a pace that will increase with the announced closure of nearly 350 additional plants by 2025.

Ensuring a Just Transition: Optimizing Opportunities for All in the Low-Carbon Future

January 24, 2022

Carbon elimination of the magnitude needed to address climate change requires systems-level change that can only be reached by incremental, ground-up progress, building upon what we have achieved thus far.

NERC and FERC Recommend Protection System Commissioning Improvements

January 18, 2022

Between 18 and 36 percent of reported utility misoperations were attributed to issues that could have been detected through a properly implemented PSC.

FERC & NERC Issue Joint Report on Freeze Reliability Failures

December 15, 2021

The in-depth report outlines twenty-eight recommendations to address freeze reliability failures, including operating practices and recommendations for NERC standards modifications surrounding generator winterization and gas-electric coordination.

Decarbonization: A Systems-Level Challenge and Actions to Address Climate Change

December 7, 2021

Carbon elimination of the magnitude needed to address climate change requires systems-level change that can only be reached by incremental, ground-up progress, building upon what we have achieved thus far.

NERC Accelerates Additional Cold Weather Standards Changes

November 22, 2021

At its November 2021 meeting, NERC’s Board of Trustees took aggressive action to advance critical cold weather Reliability Standards. Most notably, the group approved the 2022-2024 Reliability Standards Development Plan, which prioritizes standards projects for the coming years including a resolution to include new cold weather operations, preparedness and coordination standards as high priority development projects.

PRC-002-2 Disturbance Monitoring and Reporting Standard: Initial Mandatory Implementation Plan Dates Approach

November 18, 2021

The Federal Energy Regulatory Commission approved PRC-002-2 in September, 2015. The initial due date for system studies necessary to identify locations for the collection of disturbance related data under Requirement R1 is January 1, 2017.

10 Takeaways from the COP26 Climate Meeting

November 17, 2021

There are compelling reasons to be optimistic about the outcomes of the COP26 meeting. Notably, agreement among all nations that more needs to be done, by both private and governmental bodies, to contain and mitigate climate change.

The Price of Natural Gas: Onward and Upward or Just a Temporary Blip?

November 12, 2021

Most industry experts agree that weather aside, the global energy and gas markets are likely to remain uncertain with supply and market demand becoming tighter and more challenging to forecast.

Six Considerations for a Successful Utility Network Cloud Implementation

October 26, 2021

For any GIS manager or IT professional tasked with implementing ArcGIS Utility Network (UN), knowing where to start can be daunting. If not properly planned, a UN setup in the cloud can be significantly more expensive and less accessible, stable, and secure.

How Do Energy Storage Systems Work?

October 18, 2021

For more than five decades, TRC has brought efficient, resilient energy systems to the world. We understand the challenges of implementing energy storage projects.

New Potential Compliance Standards Identified at FERC Technical Conference on Reliability

October 18, 2021

With a focus on the reliability impact of extreme weather and the shortcomings of current system planning approaches, both NERC and FERC conference participants opened the door to potential forthcoming compliance standard enhancements or changes.

On the Road to Decarbonization: The Role of All-Source Competitive Solicitations

October 14, 2021

All-Source Competitive Solicitations offer utilities an alternative to centralized planning, construction and dispatch of power supplies, helping to usher in a new era of market-driven technology innovation.

How Does a Distribution Grid Work?

October 2, 2021

Electric distribution systems rely on sophisticated technology to provide power when needed. Electricity is generated on-demand, which means there are often peak periods when providers see a greater need for power and the system must prove responsive.

Amplifying the Next Phase of Fleet Electrification: The Pickup

September 30, 2021

TRC’s analysis for one client fleet shows that even a $70,000 EV can compete on cost with a comparable gas-hybrid vehicle priced at $40,000 – at least in California where upfront and ongoing incentives stack up quickly.

NERC Issues Odessa Texas Disturbance Report

September 29, 2021

While NERC has analyzed multiple similar events in California, this is the first disturbance involving a widespread reduction of PV resource power output observed in the Texas Interconnection.

Pacific Gas and Electric Selects TRC as Program Implementer for New Construction Residential All-Electric and Mixed Fuel Programs

September 27, 2021

Pacific Gas and Electric Company (PG&E) formally announced TRC as the designated lead Program Implementer for the Statewide New Construction (SWNC) Residential All-Electric and Mixed Fuel Programs following a competitive solicitation process.

TRC Digital Selected by Snohomish County Public Utility District to Implement Siemens EnergyIP® Meter Data Management

September 15, 2021

Snohomish PUD selected TRC to implement, integrate and deliver their meter data management system (MDMS) on the Siemens EnergyIP® platform as a part of the utility’s Connect Up program.

FERC Approves Modifications to NERC’s Cold Weather-Related Standards

September 7, 2021

The Federal Energy Regulatory Commission has approved changes to three mandatory NERC Reliability Standards that aim to better prepare the North American power system to withstand extreme cold weather events.

NERC’s Generator Relay Loadability Standard is Now in Effect

August 30, 2021

Faced with an aging fleet, stricter environmental regulations, reduced costs for natural gas and competition from renewables, more than 600 power plants have been decommissioned in the last 20 years, a pace that will increase with the announced closure of nearly 350 additional plants by 2025. With a goal of being net-zero carbon by 2050, many power generators are faced with critical decisions regarding their thermal generation plants. Should they continue operation, repower, re-purpose or retire their plants? In the competitive power generation market, coal-fired plants are getting squeezed on multiple fronts including lower prices for renewables (e.g., wind and solar) and gas, inefficient cyclical operation and, in some instances, by state efforts to curtail the use of coal. Foregoing the retail market and partnering with a data center for mining cryptocurrency can represent a winning financial proposition for both parties. Some states are actively encouraging the co-locating of data centers at generation sites, while others are actively working to keep plants operational in order to preserve the jobs at the plants and in the mines. In some regional transmission organizations, such as PJM, newer natural gas fired generation units are favored over older units because of their more efficient turbines and larger size. Older natural gas units are at risk of becoming stranded assets as cheaper renewables come online and the industry commitments to net zero emissions. There are reports that banks Citigroup Inc and JP Morgan Chase & Co will strengthen their financing restrictions on thermal gas plants, similar to what they’ve already done for coal projects.

NERC Seeks to Improve GADS Reliability Performance Reporting

August 26, 2021

Faced with an aging fleet, stricter environmental regulations, reduced costs for natural gas and competition from renewables, more than 600 power plants have been decommissioned in the last 20 years, a pace that will increase with the announced closure of nearly 350 additional plants by 2025. With a goal of being net-zero carbon by 2050, many power generators are faced with critical decisions regarding their thermal generation plants. Should they continue operation, repower, re-purpose or retire their plants? In the competitive power generation market, coal-fired plants are getting squeezed on multiple fronts including lower prices for renewables (e.g., wind and solar) and gas, inefficient cyclical operation and, in some instances, by state efforts to curtail the use of coal. Foregoing the retail market and partnering with a data center for mining cryptocurrency can represent a winning financial proposition for both parties. Some states are actively encouraging the co-locating of data centers at generation sites, while others are actively working to keep plants operational in order to preserve the jobs at the plants and in the mines. In some regional transmission organizations, such as PJM, newer natural gas fired generation units are favored over older units because of their more efficient turbines and larger size. Older natural gas units are at risk of becoming stranded assets as cheaper renewables come online and the industry commitments to net zero emissions. There are reports that banks Citigroup Inc and JP Morgan Chase & Co will strengthen their financing restrictions on thermal gas plants, similar to what they’ve already done for coal projects.

Prepare for Upcoming NERC Compliance Deadlines

August 20, 2021

With 2020 right around the corner, there are many new NERC standards and standards requirements set to go into effect in the areas of Critical Infrastructure Protection and Transmission Operations and Planning.

TRC Talks – Attaching Telecommunications Fiber in the Supply Space

August 10, 2021

Today’s utility and communications infrastructure is being challenged to support a growing demand for automation, broadband and 5G network services. Attaching fiber in the power distribution or supply space can mitigate risks related to overloading and overcrowding.

Oklahoma Gas & Electric Company uses AI to assess and repair distribution pole damage

August 4, 2021

As part of its grid enhancement program, OG&E will leverage collaborative AI-powered image recognition technology that enables engineers to complete distribution pole inspections with greater accuracy and helps to reduce manual review of images.

Reasons for IT/OT Modernization

August 1, 2021

Opposites attract, and information technology (IT) and operational technology (OT) are no exception. At one end of the digital grid sits IT as a business application, while OT exists at the other end of the digital grid as an asset-oriented application. For decades, IT and OT have been operating separately and are often physically isolated.

IT/OT Convergence Best Practices

August 1, 2021

A successful IT/OT convergence strategy involves identifying desired outcomes, managing the fragmentation of OT solutions, and developing common key performance indicators (KPIs) for both IT and OT teams. This approach helps in optimizing resources, driving effective collaboration, and ensuring a smooth transition towards a unified IT/OT environment.

NERC’s FAC-008 Guidance on Facility Ratings

May 24, 2021

FAC-008 is one of the most data-intensive standards in the NERC regulatory framework. Compliance has been difficult for many utilities. Recently, FERC made public it’s intent to address serious allegations of facility ratings violations, including a lack of rigor by one utility.

What’s Next? Preparing for Utility Network Migration

May 12, 2021

In preparing for Utility Network Migration, taking an intermediate approach will allow you to resolve some key points. Utility Network Migration will run smoother if you build a “sandbox environment” and begin to 1) prioritize features 2) explore licensing options and 3) practice moving data.

NERC Issues Battery Energy Storage Systems Reliability Guidance

April 22, 2021

While NERC has recently published a reliability guideline addressing inverter-based resources generally, they are now giving more attention to the various potential uses of BESS to support effective implementation with newly released guidance.

5 Persistent Questions About ArcGIS on HANA

April 9, 2021

While ArcGIS on HANA implementation patterns are emerging rapidly, we continue to hear 5 persistent questions about how implementing ArcGIS on HANA would benefit an organization. Let’s walk through these 5 questions, I’ll show you how we help you get started with ArcGIS on HANA. Then you may realize the benefits this solution promises.

NERC Proposes Revisions to CIP-008

March 27, 2021

NERC’s CIP-008 standard aims to mitigate reliability risks resulting from a Cyber Security Incident by specifying incident response requirements. Newly proposed revisions would augment mandatory reporting to include incidents that compromise, or attempt to compromise, a utility’s Electronic Security Perimeter (ESP) or associated Electronic Access Control or Monitoring Systems (EACMS).

NERC Releases 2021 Compliance Monitoring and Enforcement Findings

February 8, 2021

NERC’s 2021 Compliance Monitoring and Enforcement Program reframes the previous year’s risks and their associated areas of focus. Utilities should review their compliance programs and internal controls to determine if enhancement or changes are need to maintain compliance.

NERC Proposes Revision of Pending TPL-001-5.1 Standard

January 20, 2021

NERC has recently undertaken important standards and guidance development activities related to the proliferation of inverter-based technologies such as solar and wind generation, as well as battery energy storage which is growing as an industry solution to ensure the reliability of renewable power for end-use customers.

NERC and FERC Take Action on Facilities Ratings

December 4, 2020

There has been significant work across the electric industry to improve facility ratings related processes, programs, frameworks, internal controls and best practices. Yet this continues to be a challenging area for utilities, particularly from an asset management and regulatory compliance perspective.

FERC Issues Annual Report on Critical Infrastructure Protection (CIP) Reliability Audits

November 17, 2020

In its 2020 Report on CIP Reliability Audits, the Federal Energy Regulatory Commission found that most of the cybersecurity protection processes and procedures adopted by utilities met the mandatory CIP requirements for protecting the Bulk Electric System. However, there are areas for improvement.

NERC Issues 2020 State of Reliability Report

September 22, 2020

The Report identifies areas of ongoing concern including generation reserve margins and the reliability risk from shifting the resource mix toward renewables.

TRC Digital and Reactive help utilities measure inertia for a more resilient grid

September 21, 2020

Together, TRC and Reactive combine TRC’s industry-leading power engineering expertise with Reactive’s machine learning software to provide utility teams with high-resolution frequency monitoring and automatic event analysis.

NERC Reliability Standard PRC-024-3 Approved: Frequency and Voltage Protection Settings for Generating Resources

July 28, 2020

On July 9, 2020 NERC standard PRC-024-3 was approved, paving the way for improved protection systems in support of keeping generating resources connected during defined frequency and voltage excursions.

Summary of NERC CIP Standards Updates

June 29, 2020

FERC has released a notice of inquiry seeking comments on potential enhancements to NERC’s Critical Infrastructure Protection (CIP) Reliability Standards.

TRC Digital Partners with Treverity to Put Utility Engineers at the Center of Their Data

June 26, 2020

As part of TRC’s LineHub solution, Treverity helps transmission engineers get a holistic view of the grid through powerful digital data visualization and a customer-centric user interface.

TRC Digital and Enbala can help utilities monitor, control and optimize distributed energy resources

April 17, 2020

Distributed energy resources (DERs) are changing the way utilities think about power generation and energy flow. TRC and Enbala can offer utilities a multi-layered solution that highlights the strengths of each company.

NERC Protection System Compliance Studies Due This Year

February 24, 2020

NERC’s PRC-027-1 standard was approved by FERC in 2018 and is set to go into effect on October 1, 2020. Utilities should begin preparing now to meet compliance requirements which include significant system studies.

Strategic Electrification

February 4, 2020

As we look to spur strategic electrification across the US, it will be up energy providers and solution implementers to continue sharing ideas, insights and lessons learned

New York State Finalizes Emission Limits for Power Generators

January 21, 2020

On January 16, 2020, the New York State Department of Environmental Conservation (NYSDEC) finalized a rulemaking limiting nitrogen oxide (NOx) emissions from existing simple cycle and regenerative peaking combustion turbines with a nameplate capacity of 15 megawatts (MW) or greater during the ozone season (May 1 – October 31).

NERC Compliance Assurance: Maintaining Cross Functional Data Integrity

January 21, 2020

Assuring continued power system reliability is a complex undertaking for utilities. Balancing the demands of system changes and regulatory compliance is an essential strategy for optimizing ongoing operations. Given the wide range of NERC standard families that require simultaneous data management for compliance, data integrity, data flow and data verification are critical for avoiding violations that can impact electric service to customers and communities.

NERC Reliability Report Prioritizes Power System Security Risks for Action

January 2, 2020

NERC’s 2019 ERO Reliability Risk Priorities Report identified and prioritized the major risks facing the utility industry with a particular focus on security issues.

NERC Reliability Report Prioritizes Power System Risks

November 21, 2019

Looking ahead to the many changes coming to North America’s Bulk Power System (BPS), NERC’s 2019 ERO Reliability Risk Priorities Report highlights the top issues requiring industry and regulatory attention and recommends actions for the ongoing protection of BPS reliability.

NERC Pursues Changes to Protection Relay and Control (PRC) Standards

September 24, 2019

Two Standards Authorization Requests currently being debated in the NERC stakeholder engagement process could help clarify PRC standards obligations for generator owners and operators.

New York State Proposes Emissions Limits for Power Generators

March 22, 2019

On February 27, 2019, the New York State Department of Environmental Conservation (NYSDEC) released a proposed rulemaking limiting nitrogen oxide (NOx) emissions from existing simple cycle and regenerative peaking combustion turbines with a nameplate capacity of 15 megawatts (MW) or greater during the ozone season (May 1 – October 31).

NERC to Modify Standard and Develop Compliance Guidance to Accommodate Inverter-Based Generation Technologies

February 20, 2019

Renewable energy systems have dramatically changed the power generation resource mix. These new generation technologies no longer involve directly coupled rotating generators which were once standard in the industry. Now, inverters that change Direct Current (DC) electricity to the Alternating Current (AC) electricity suitable for delivery via AC transmission systems are becoming more prevalent, raising reliability…

NERC Addresses Single Points of Failure in Protection Systems Among Other FERC Concerns

October 25, 2018

In 2017 Oregon Governor Kate Brown took bold action by directing state agencies to chart a 10-year course towards greater energy efficiency in affordable housing to help remove the energy burden on low-income communities. This initiative took flight under the direction of the Oregon Housing and Community Services, the Oregon Public Utility Commission and the Oregon Department of Energy, which created the newly released Ten-Year Plan: Reducing the Energy Burden in Oregon Affordable Housing. Last summer, OHCS hired TRC to assist in the development of these two deliverables. As the Project Lead, I was given the opportunity to experience first-hand both the excitement and challenges of this initiative. After almost 15 years working on low-income energy efficiency programs, this project allowed me to view this familiar topic through a new lens. Instead of designing a building-level incentive program, I was focused on the low-income population – the actual people living with energy challenges – and evaluating how efficiency could help to reduce their economic, health and housing burdens. One of my first discoveries was an analysis of the energy burden gap of the low-income population in Oregon that showed the difference between a typical low-income household’s actual energy costs and an affordable energy cost (6 percent of the household’s income) is significant – and totaled $345 million statewide in 2017. (Nationwide, that gap is over $47 billion per year.) Despite my surprise at the size of this gap, I still wasn’t prepared for what we found next.

NERC Proposes Compliance Monitoring and Enforcement Plan for 2019

September 26, 2018

This month, NERC released the first draft of its 2019 Compliance Monitoring and Enforcement Plan (CMEP) which identifies power delivery system risks and outlines compliance audit requirements for next year. The risk elements outlined in the plan include significant differences from previous years, as shown in the table below. Each NERC region must consider these risks as they develop their monitoring and audit scopes for utilities. Utilities should be prepared to be audited and implement any necessary compliance initiatives in these areas.

NERC Calls for New Approach to Reliability Planning Due to Gas Supply Disruption Risks

December 14, 2017

A recently published NERC report concludes that as reliance on natural gas to meet electric generation requirements increases, additional planning and operational measures must be considered to mitigate power system reliability risks.

NERC CIP-013-1 Standard for Supply Chain Risk Management

September 29, 2017

NERC has filed mandatory standard CIP-013-1 for supply chain risk management, requiring controls to mitigate cyber threats and their impact to the reliable operation of the Bulk Electric System.

NERC Identifies New Reliability Risk due to Utility Scale Solar Generation Inverter Design

June 13, 2017

NERC has released a report documenting its findings and recommendations related to reliability risks from utility scale solar generation projects with implications for PRC-024 compliance, as well as generation, interconnection and protection system technologies.

TRC and partners win $1 million grant for engineering innovative New York microgrid

April 20, 2017

TRC is proud to support Huntington, NY bolster power reliability and climate-change resiliency with a sophisticated new “community microgrid’’ combining solar energy, a fuel cell, biogas and traditional natural gas to deliver electricity and heat to local customers and institutions.

Looking ahead: a changing energy landscape and strategies for success

February 13, 2017

Amid all the changes in the energy industry in 2017, one of the most interesting and complex is playing out in California and New York as those states begin to re-think how best to value and purchase energy efficiency. As TRC’s Carmen Henrikson and Bob Callender explain in this TRC article, the era of paying…

Successful Interconnection of Utility Scale Solar Projects – Strategies to Stay on Schedule and on Budget

November 2, 2016

Growth in solar power creates challenges for both project proponents and utilities. TRC has reviewed hundreds of interconnection applications for utility partners, and we’ve learned important strategies for reducing the time and costs associated with interconnecting projects 1 megawatt or greater.

NERC Standard Extends Maintenance Program Obligations to Generators

February 3, 2014

The approval of NERC Standard PRC-005-2 extends protection system maintenance obligations to Generators and crates one comprehensive standard establishing minimum maintenance activities and maximum time intervals for protection systems and load shedding equipment affecting the bulk electric system.

Maddie Emerson

Maddie Emerson is a Strategy & Regulatory Associate Manager within TRC’s Advanced Energy practice. Based out of St. Louis, MO, she supports initiatives to drive decarbonization in the commercial, industrial, and residential sectors, primarily through energy efficiency and electrification. Contact her at MEmerson@TRCcompanies.com.