The impact of continually climbing gas prices will directly affect the domestic electric generation markets. If natural gas prices remain high or continue to increase, some gas plants based on availability and economics would presumably run less, while certain coal plants may run more. While most of the least-efficient coal plants have already shuttered, plants that remain open are well-equipped and positioned to take advantage of more expensive gas prices. In Europe, high gas prices coupled with lower wind generation (due to climate changes) have, for the first time since 2019, meant more coal is being used than natural gas.

This article is republished from the 2021 issue of Energy Currents, a publication of Enerdynamics.

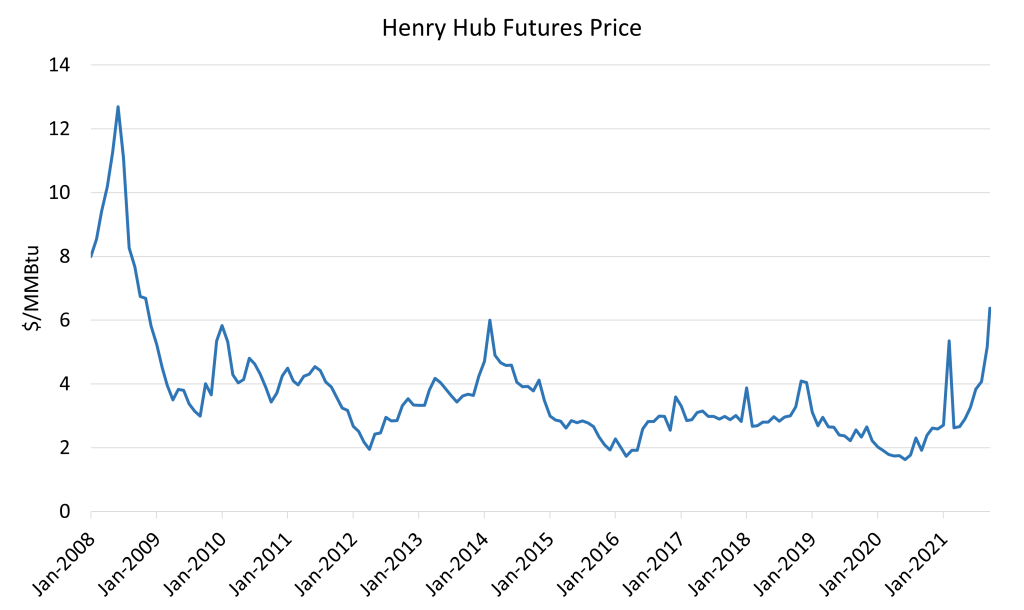

Natural gas in the U.S. has been relatively cheap for more than a decade. The impact of low gas prices is seen across the U.S. economy in lower winter bills for customers and low-cost feedstock for the industry. Such prices also have contributed to some of the lowest wholesale electric prices in the country with natural gas-fired generation. It was back in 2008 when gas prices last exceeded $13/MMBtu. Gas has remained below $4/MMBtu for the past five years (with a few minor exceptions) and even under $2/MMBtu in the past few years. For the first time in years, natural gas prices have recently surged, hitting more than $6/MMBtu in early October 2021. This is double the price from earlier this year, and there are troubling signs that this up-tick in price may remain higher for the seeable future.

While there have been short periods over the past decade when gas prices have jumped due to severe weather (e.g., polar vortex and Texas cold snap), disruptions in production, and lack of pipeline capacity, the current trends seem to indicate more prolonged higher natural gas prices. While the expert view differs, even if prices remain only higher until next spring (the next 4-6 months) there will be an impact. This article reflects a review of the most relevant commentary and insights around the natural gas price increase and subsequent impacts on the energy industry and domestic and global economies.

Related Services

Why the gas price increase?

There are many reasons behind the rise of natural gas prices, all of which are attached to a broader set of domestic and international factors. Within the U.S., the rise in gas prices is attributable to a confluence of considerations. One factor is infrastructure disruption due to severe storms like Hurricane Ida. About one-third of natural gas output was still offline more than three weeks after Ida hit the Gulf Coast. Climate also plays a role as most of the country experienced very hot temperatures this summer, even in places where this has not been the norm. This pushes natural gas use for electric generation into longer run times, increasing demand for natural gas.

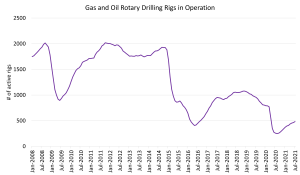

The gas price spike can also be tied to the impact of low prices for so long, making the economics to invest in gas production by increasing rig counts more challenging as companies weigh how much to spend and whether prices will remain high. Some experts believe that eventually, supply will increase and put downward pressure on gas prices, but that remains to be seen.

Another factor at play is the impact of natural gas in the global markets and competition for U.S. output. The rise in gas prices is more significant overseas affecting countries in Asia and Europe. Futures contracts for November natural gas (based on the Dutch TTF Hub) were up 19%, and front month contracts for the year are up nearly 400%. A cold European winter and spring also meant supplies were heavily depleted by the summer contributing to higher prices. Also, soaring wholesale gas prices resulted from a surge in demand, particularly from Asia, as economies emerge from Covid-19-induced lockdowns.

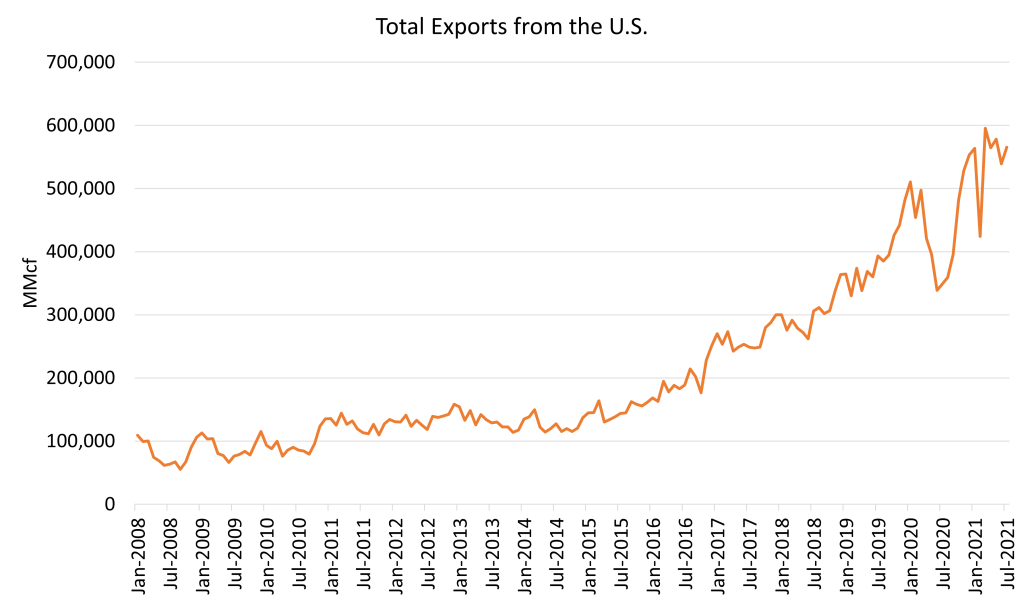

The global trade of natural gas from the U.S. to international markets has been a central means of selling gas for higher prices overseas. This strategy has been in place for several years as U.S. gas prices remained low. Getting higher prices from Europe and Asia has allowed for greater opportunity for low-price U.S. domestic gas resources. Given the price disparities as well as expansion of LNG export facilities and export pipelines to Mexico, U.S. exports have grown dramatically in recent years. However, there have been recent calls from trade groups (e.g., Industrial Energy Consumers of America), to reduce gas exports so as to ensure supply and prevent price spikes.

Implications of the gas price run-up

The run-up in natural gas prices poses some issues, which still need to play out. The low cost and extent of natural gas use affects critical areas within the energy industry. Some of the more prominent considerations follow:

The near-term impact on customer bills is worrisome to many, especially as the colder season approaches. Most U.S. ratepayers who use natural gas will likely see a noticeable increase in their monthly bills as the cost of commodity is passed through directly to end users. Exact increases are hard to predict as they depend on the forward cost of natural gas and prevailing weather conditions, but some experts believe an increase of 30-40% greater than last year is possible. This will be a particularly challenging issue for low-income or income-qualified customers with limited energy budgets.

Higher customer bills may also mean a higher production cost that is passed on to consumers. So far many companies have yet to increase their costs to address the higher price of production, but that scenario may change. Additionally, since energy prices strongly contribute to the domestic economy, the impact on inflation may also be noted.

On the positive side, if natural gas prices continue to climb and stay high relative to the past decade, it will have a direct impact on energy efficiency markets in the U.S. Since most ratepayer-funded energy efficiency programs must pass a series of economic benefit-to-cost analytics, the larger the natural gas prices, the higher the avoided-cost economics for DSM investments. Regions where gas energy efficiency was challenged may find stronger economics moving forward. Even relative ROI and payback calculations will improve, pointing to greater rationale to invest in gas-based energy efficiency. And in states that are developing policies to encourage electrification as a means of achieving carbon reduction goals, the rise in gas prices will make electric substitution more economic.

Where do things go from here?

The jury is still out on where prices are headed. There seems to be some consensus that prices will stay at higher levels than previously seen, at least until the Spring 2022, when supply can catch up and the winter heating season is over.

The uncertainties impacting overall demand (domestic and global), ongoing impacts of the pandemic, and the behavior and economic reward of production companies to increase drilling will be central to the story. Additionally, a frigid winter could push prices higher, risking further shortages, possible industry shutdowns, and a likely hasty response from regulators and lawmakers.

Most industry experts agree that weather aside, the global energy and gas markets are likely to remain uncertain with supply and market demand becoming tighter and more challenging to forecast. And it is likely that as global electricity markets follow a path of shifting from fossil to clean energy, the path will be impacted by increasingly volatile markets and energy prices.