Author: David Contant and Daniel Weed | December 7, 2020

What is EHS Due Diligence?

EHS due diligence, especially during the pandemic, involves utilizing technologies like AI and virtual site visits to efficiently identify and understand risks earlier in the deal process. This process ensures that time and resources are focused on key risk areas and helps companies consider ESG factors in their investments.

Like in everyday life, the COVID-19 global pandemic has impacted the global financial markets, including mergers and acquisitions and TRC’s Transaction Advisory Service (TAS) is no exception. Here are some of observations and trends in the EHS due diligence market since the beginning of the pandemic.

Use of Technology/

Digitalization and Artificial Intelligence (AI)

AI has been around for a decade or so, however, recently we have seen that M&A transaction platforms and data room providers (such as Intralinks, Datasite, etc.) are now routinely using this technology to improve deal team collaboration, process efficiencies, content control and deal diagnostics. Increasingly, this technology is being used for both sell-side deal flow and buy-side diligence, which can increase the efficiency and therefore the speed of the data room review process. As a result, clients are able to understand the EHS risks much earlier in the deal process, ensuring that time and resources are focused on the key risk areas.

The pandemic has forced EHS due diligence providers to think differently. For example, virtual site visits are increasingly becoming more common. Whether it be a virtual real-time Zoom visit, or a having local staff upload a video to a data room, this technology is here to stay. Though virtual won’t replace the value of in person site visits, they can be beneficial when providing information to a wide audience (i.e. multiple advisors, or even multiple bidders, concurrently), minimizing travel and controlling safety risks.

Attention to Environmental, Social and Governance (ESG)

TRC continues to see more and more interest in ESG from our clients. In our experience, it’s being driven by a number of key stakeholders, including the limited partners, regulators and operational management teams. Given the pandemic, we have seen an inflection point in the demand for companies to consider ESG in their investments. Our team has developed an ESG Risk Screen tool that compares a company’s perceived or inherent ESG risk, based on factors including its sector and geographical footprint, with its actual or residual risk, based on the specifics of its operations, supply chain, customer base and risk controls. This information is used during due diligence to identify ESG risks and opportunities.

We are also seeing an increased demand in driving ESG management, monitoring and improvement through system frameworks, standards and programmatic development as part of our advisory services and post-transaction support. TRC has a developed several digital solutions to support data collection, management and reporting for both corporate and private equity clients. We have a deep bench of ESG experts who can effectively execute risk management and operational improvement projects, including greenhouse gas quantification and reporting, climate risk assessment, energy reduction, on-site and off-site renewables projects, waste minimization and water efficiency.

COVID-19 Independent Assessments for Certain Market Sectors

When working on transactions our team is frequently being asked to take a hard look at COVID-19 procedures, protocols and metrics as private equity (PE) strives to “bake in” potential down-size risk into their cost models as they negotiate transactions over the next 3 to 6 months. This has resulted in the inclusion of TRC health and safety experts in nearly all our transactions and the development of key questions and topics to discuss with target company representatives. The value that TRC brings to investment, HR and operation leads managing deals for PE firms is our practical approach to assessing and communicating COVID-19 risks, and providing reasonable cost scenarios for capital and procedural, protection and monitoring improvements. Private equity clients value this insight because it helps them to understand from an investment perspective how much impact COVID-19 could potentially have on the business until vaccines are readily available and readily accessible, which some experts estimate will not be until the 3Q-2021.

Focus on “Reshoring”

As the pandemic is forcing companies to take a hard look at their supply chains and time of delivery to their clients, many are looking at ways to be in more control and independent of third-party suppliers, which often are overseas. TRC is seeing this shift in “reshoring” as more and more companies are developing warehouse and distribution facilities closer to their end markets. Over the coming years we also expect this to be reflected in increased manufacturing, particularly of crucial supplies such as pharmaceuticals, key engineered products and food and drink, in the United States and western Europe. Our team is well suited to support this recent shift from due diligence services as properties are being sold and acquired to a host of other services along the value chain of this recent movement.

Like other transaction professionals, our team has seen a rapid increase in EHS due diligence since August 2020, and it looks like 2021 will continue to be very busy for the M&A market.

Gain

Peace-of-Mind

Partner With TRC’s Tested Practitioners

Sharing Our Perspectives

Our practitioners share their insights and perspectives on the trends and challenges shaping the market.

EPA Unveils Largest Deregulatory Initiative in U.S. History

April 1, 2025

Environmental Protection Agency (EPA) Administrator Lee Zeldin has announced the Agency’s plan to undertake 31 deregulatory actions with the stated goal of driving down the cost of living for Americans and revitalizing the American energy and auto industry.

Fostering an Enjoyable and Resilient Project Management Career

March 10, 2025

In his final contribution to EM Magazine, TRC’s David Elam shares his thoughts on the health, well-being and success of project managers everywhere. These takeaways go beyond skills and habits in the workplace, and explore how project managers can align their lives outside of work with their professional goals.

Changes to EPA’s Risk Management Program (RMP) Regulations Are Coming

April 14, 2023

Changes to the Risk Management Program (RMP) regulations were signed into a final rule on February 27, 2024, by EPA Administrator Michael S. Regan.

Routinely Evaluating the Health & Effectiveness of Integrated Systems to Manage EHS/ESG Risks – Part I

March 1, 2023

Once established, an EHS/ESG management system must be routinely evaluated to ensure it remains effective to identify and control risks, as well as accommodate and adjust for changes that occur to/within the organization.

EPA Publishes Effluent Guidelines Program Plan 15

February 14, 2023

The EPA announced updated effluent limitations guidelines under Plan 15, focusing on the evaluation and rulemaking process for per- and polyfluoroalkyl substances (PFAS) discharges.

Proactive Enforcement is Key in the EPA FY2022-2026 Strategy

October 19, 2022

A core element of the EPA FY2022-2026 Strategic Plan focuses on environmental compliance.

Optimizing EHS/ESG Information Management and Reporting Systems by Leveraging Innovative Digital Technology Solutions

August 10, 2022

A single, integrated enterprise wide EHS/ESG IMS can significantly improve performance and communicate progress towards organizational requirements and goals.

Five New PFAS Added to EPA Regional Screening Levels (RSLs)

June 24, 2022

EPA announced the addition of five new PFAS to the list of Regional Screening Levels (RSLs)

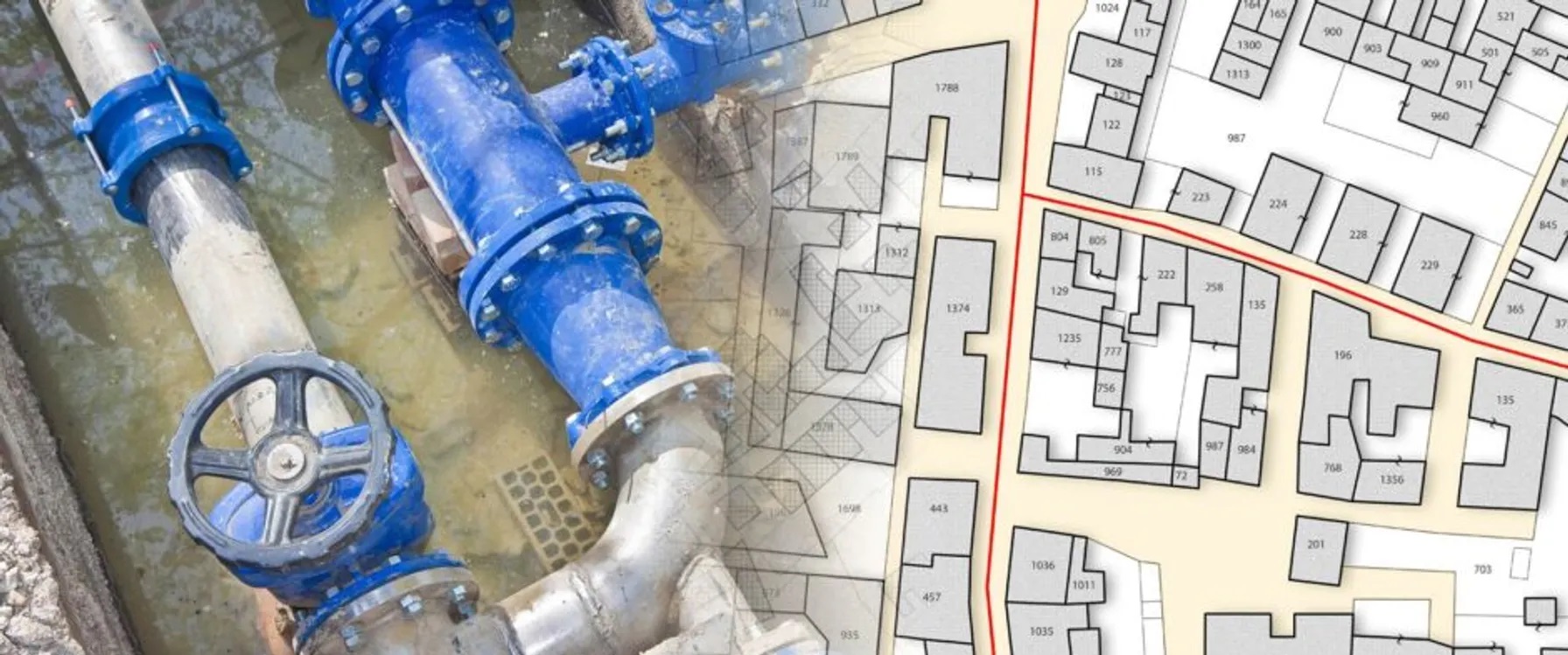

Integrating Sustainability, Digital Connectivity and Design Optimization in Wastewater Treatment Systems

June 20, 2022

Some organizations rarely think about water and wastewater treatment, until there is a problem. American industry depends on the ability to treat wastewater discharges while complying with regulatory standards and addressing emerging contaminants. If wastewater treatment fails, our environment is negatively impacted, and companies are exposed to shutdowns, delays and fines.

Support an Integrated EHS/ESG Management System

June 10, 2022

What Is an Indoor Air Quality Assessment? An indoor air quality assessment involves identifying and addressing air quality issues within a facility to ensure a healthy and safe environment for occupants. The assessment process typically includes an initial inspection, laboratory testing for contaminants, and recommendations for improvements. LEED-certified buildings prioritize indoor air quality, adopting measures to maintain good IAQ throughout construction and occupancy. Contact Us

Worst Case Discharges of Hazardous Substances – Proposed Rule

May 25, 2022

In compliance with the Clean Water Act (CWA), the U.S. Environmental Protection Agency (EPA) recently proposed a new rule for onshore non-transportation-related facilities requiring specified facilities to plan for worst case discharges (WCDs) of CWA hazardous substances that could cause substantial harm to the environment.

PFAS Discharges and NPDES Permits

May 25, 2022

On April 28, 2022, the U.S. Environmental Protection Agency’s (EPA) Office of Water released a memo addressing the use of National Pollutant Discharge Elimination System (NPDES) permits to restrict per- and poly-fluoroalkyl substances (PFAS) discharges to water bodies.

How to Use an Integrated Approach To Manage EHS and ESG Risks

April 20, 2022

What Is an Indoor Air Quality Assessment? An indoor air quality assessment involves identifying and addressing air quality issues within a facility to ensure a healthy and safe environment for occupants. The assessment process typically includes an initial inspection, laboratory testing for contaminants, and recommendations for improvements. LEED-certified buildings prioritize indoor air quality, adopting measures to maintain good IAQ throughout construction and occupancy. Contact Us

SEC Releases New Proposed Rules Requiring Public Companies to Disclose Climate Risks

April 12, 2022

On March 21, 2022, the U.S. Securities and Exchange Commission (SEC) issued its proposed rules for The Enhancement and Standardization of Climate-Related Disclosures for Investors which would require public companies in the U.S. to disclose information in their annual financial reports.

PFOA & PFOS As CERCLA Hazardous Substances: What Does This Mean and How Can You Be Prepared?

February 17, 2022

A plan to designate two per- and polyfluoroalkyl substances (PFAS) as “hazardous substances” under CERCLA was recently submitted by the EPA.

EPA Adds First New Hazardous Air Pollutant Since 1990

January 14, 2022

EPA finalized a rule to add 1-bromopropane to the federal list of hazardous air pollutants (HAPs) on December 22, 2022.

EPA Finalizes TRI Reporting Requirements for Natural Gas Processing Facilities

December 7, 2021

EPA finalized rule to add natural gas extraction and/or processing plants to Toxics Release Inventory reporting requirements

OSHA’s National Emphasis Program on Heat-Related Illness and Injuries

November 3, 2021

On September 20, 2021 in an OSHA National News Release, OSHA published a memorandum establishing an enforcement initiative that is designed to prevent and protect employees from heat-related illnesses and death. This initiative, which develops a National Emphasis Program (NEP) on heat inspections, is an expansion of an already existing Regional Emphasis Program (REP) in OSHA’s Region VI, which covers Arkansas, Louisiana, New Mexico, Oklahoma and Texas.

NJDEP Implements New Jersey Environmental Justice Law Through Administrative Order

October 5, 2021

On September 22, 2021, the New Jersey Department of Environmental Protection (NJDEP) Commissioner announced the issuance of Administrative Order (AO) No. 2021-25 to implement New Jersey’s Environmental Justice (EJ) Law. This order is effective immediately, and applicants seeking to site new major source facilities, renew major source permits or expand existing facilities with major source permits (e.g., Title V air permits) in overburdened communities are affected. There are more than 4.5 million people that live within 331 municipalities that are overburdened communities in the state of New Jersey.

OSHA’s Call for Comments on Mechanical Power Press Standard Changes

September 30, 2021

OSHA has recently published a call for comment regarding mechanical power presses. The reason behind OSHA’s request is that the American National Standards Institute (ANSI) consensus standard for mechanical power presses has been updated numerous times since the implementation of OSHA’s standard.

OSHA Returns to In-Person Inspections As COVID-19 Restrictions Lift

August 4, 2021

The Occupational Safety and Health Administration (OSHA) is authorized by the Occupational Safety and Health Act of 1970 (OSH Act) to assure employers provide safe and healthful work conditions free of recognized hazards and by setting and enforcing standards and providing training, outreach, education and technical assistance. OSHA has recently announced the return to in-person inspections as COVID-19 restrictions begin to lift.

EPA Proposed PFAS Reporting Requirement

July 29, 2021

New proposed rule would require all manufacturers and importers to report any amount of PFAS onsite

Managing EHS & ESG Risks Through Integrated Systems Today and Beyond

July 22, 2021

It has been more than 50 years since the development and establishment of the federal Environmental Protection Agency (EPA) and the federal Occupational Safety & Health Administration (OSHA) which were formed to protect our environment and workplaces across the United States. Significant laws, policies and regulations followed to establish the “regulatory programs” that all applicable businesses and entities must address and meet to ensure these compliance-driven legislative programs would create a foundation to protect our society.

OSHA COVID-19 Guidance, Regulation and Enforcement to Protect Workers

April 13, 2021

The Occupational Safety and Health Administration (OSHA) has signaled their intent to provide more guidance, regulation and enforcement with respect to protecting workers from contracting COVID-19 at their place of work. Among the key developments:

2020: A Year to Remember or a Year to Forget?

December 20, 2020

Published in EM Magazine, December 2020, this article by TRC’s David Elam speaks to the importance of pausing to reassess the work challenges we’ve faced due to COVID-19 this year and our accomplishments despite the challenges, and how to prepare for the coming year, after one of the most difficult years in modern history.

TRC Companies Inc. Acquires 1Source Safety and Health

November 11, 2020

TRC Companies (“TRC”), a leading technology-driven provider of end-to-end engineering, consulting and construction management solutions, has acquired 1Source Safety and Health, a firm that provides management consulting services in areas such as indoor air quality, asbestos management, industrial hygiene and safety management systems.

TRC Awarded a Yahara WINS Grant

August 28, 2020

TRC was recently awarded a Yahara WINS grant to develop a pilot scale simple aeration method for removing phosphorous from the discharge of manure digesters. The grant application was developed and submitted by: Bob Stanforth, Alyssa Sellwood, Mike Ursin, Ted O’Connell, Ken Quinn, and John Rice, who are members of multiple TRC CORE teams.

Ecological Risk of PFAS from AFFF-Impacted Sites

June 30, 2020

The facts on evaluating exposure to wildlife

How to Implement ISO 45001 – 2018, Occupational Health and Safety Management System

April 1, 2020

In March 2018, ISO finalized its occupational health and safety (OH&S) management system standard ISO 45001-2018. For those companies certified under the former occupational health and safety management system standard OHSAS 18001, the clock is ticking if you are considering migrating to the new ISO standard and maintaining your current certification. Companies that have implemented OHSAS 18001 and are interested in maintaining certification have until March 2021 or about a year to implement the new standard or lose certification.

TRC Brings Environmental Services to Manchester with Second UK Office

March 5, 2020

In continuing to expand our presence in a key British market, TRC is opening our second UK office in Manchester, England

2020 New Year’s Safety Resolution? How About Construction Safety?

February 20, 2020

Safety isn’t all about tracking statistics. To make it work, you need to interact positively with people. TRC construction health and safety specialist Cody Gladstone explains how to gain credibility on the jobsite and get everyone home safe at the end of the day.

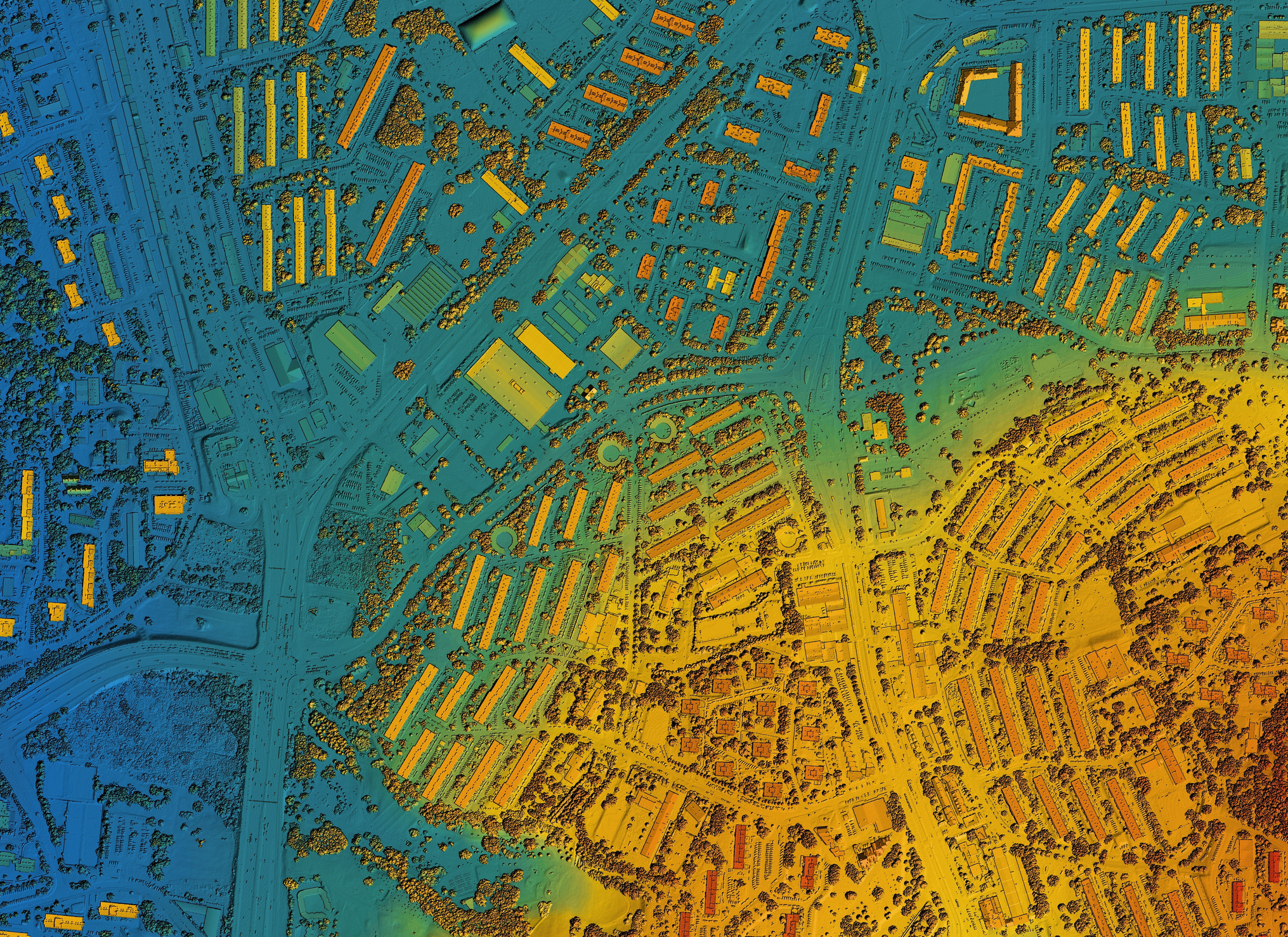

The Transformative Benefits of 3D Facility Mapping for Utilities

June 26, 2025

Discover how modern 3D facility mapping empowers utilities to modernize infrastructure, improve asset management, and enable remote workflows with accurate digital twins, delivering cost savings and operational efficiency.

Why Utilities Need a Comprehensive Data Management Strategy

June 17, 2025

Though traditionally late adopters, most utilities today are evaluating, if not implementing, digital technologies.

How to Build Resiliency Through Innovation—and Why It Matters Now More Than Ever

May 8, 2025

Around the world, resiliency matters more than ever for utilities. Consider this—In 2024, the U.S. experienced 27 separate billion-dollar weather and climate disasters, the second-highest number on record.

Exceed Compliance Demands and Improve Leak Survey & Management with Mobile Asset Mapping

April 30, 2025

Leak detection and management is one of the most critical functions for utility companies managing gas infrastructure. As regulatory pressure mounts and public expectations shift, utility operators face a new era where legacy leak survey workflows are struggling to keep up

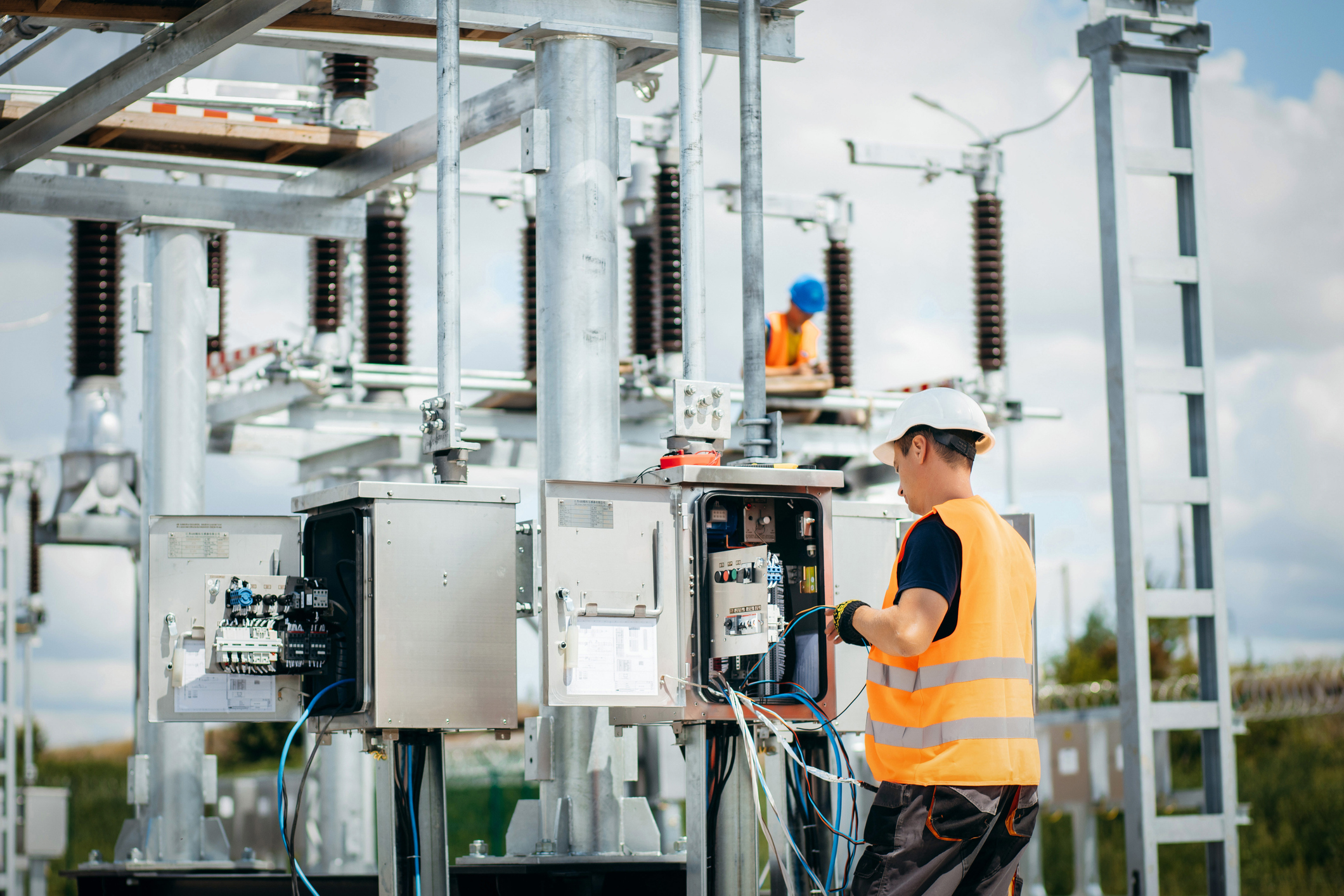

Grid Resiliency: Perspectives Across the Power Grid

April 16, 2025

In today’s changing energy landscape, grid resiliency is a top priority for all power system owners and operators. The ability to absorb disruptions and maintain power is crucial in an increasingly unpredictable world.

Why Utilities Need to Embrace “Control Rooms of the Future” Today

April 9, 2025

The business of utility operations has dramatically changed in the last decade. Managing grid operations, integrating distributed energy resources and ensuring affordable service involves making sense of massive data so business leaders, operational staff and field crews can operate more effectively.

How UK Utilities Can Create Business Value from Smart Metering Data

April 8, 2025

As the UK modernizes its energy infrastructure, smart metering systems have become crucial in forecasting, adapting and managing energy consumption. These advanced digital devices provide real-time data, enabling utilities and consumers to monitor energy usage more effectively.

Take the Right Approach to Implementing DERMS

March 27, 2025

Implementing DERMS can come with challenges. By understanding the unique challenges related to DERMS and adopting the appropriate strategies to mitigate potential pitfalls, utilities can effectively integrate and coordinate DER deployment to align with regulatory commitments and broader business objectives.

How ISOs, RTOs and Utilities Can Effectively Manage Massive Data

March 20, 2025

In today’s rapidly evolving energy landscape, Independent System Operators (ISOs), Regional Transmission Organizations (RTOs) and utilities face unprecedented challenges in managing vast amounts of data.

How to Reduce Risk in Control System Implementations

February 7, 2025

Control rooms serve as the nerve centers of utility operations, orchestrating the interplay of power generation, transmission and distribution. The “control room of the future” represents technology innovation and integration, combining advanced software systems, real-time data analytics and sophisticated visualization tools.

How DERMS Delivers Modern Utility Management

February 5, 2025

Today’s utilities are inundated with data—from sensors, smart meters, EVs, distributed energy resources, and more. But collecting data isn’t the challenge—managing it is. Without a comprehensive data management strategy, utilities risk: Missed opportunities for grid modernization Inefficient operations and rising costs Increased exposure to compliance, cybersecurity, and reliability risks This white paper outlines how utilities can shift from data overload to data-driven decision-making—transforming fragmented systems into a unified, strategic foundation for innovation and performance. What you’ll learn: Why utilities must treat data as a business-critical asset The 5 essential steps for building a resilient data strategy How better data governance improves forecasting, customer service, and asset management Where to focus first to support AI, cloud adoption, and DER integration

What Is Grid Modernization?

December 2, 2024

Today’s utilities are inundated with data—from sensors, smart meters, EVs, distributed energy resources, and more. But collecting data isn’t the challenge—managing it is. Without a comprehensive data management strategy, utilities risk: Missed opportunities for grid modernization Inefficient operations and rising costs Increased exposure to compliance, cybersecurity, and reliability risks This white paper outlines how utilities can shift from data overload to data-driven decision-making—transforming fragmented systems into a unified, strategic foundation for innovation and performance. What you’ll learn: Why utilities must treat data as a business-critical asset The 5 essential steps for building a resilient data strategy How better data governance improves forecasting, customer service, and asset management Where to focus first to support AI, cloud adoption, and DER integration

TRC Acquires Garanzuay Consulting, Amplifying TRC’s Energy Transition Consulting Services in Europe

September 26, 2024

Garanzuay Consulting provides a foundation in Ireland to continue TRC’s growth and expansion in Europe in support of the energy transition for all energy market participants.

Achieve Superior Asset Data Quality by Combining SAP with Lemur Mobile Mapping

September 23, 2024

Utilities struggle with asset data, which impacts every aspect of their business. Market priorities like grid modernization, decarbonization and increased energy demand only compound the problem of poor data quality.

TRC Helps Secure $4.4 Million Grant for Otter Tail Power Company’s Next-Generation Grid Resiliency Program

May 2, 2024

Today’s utilities are inundated with data—from sensors, smart meters, EVs, distributed energy resources, and more. But collecting data isn’t the challenge—managing it is. Without a comprehensive data management strategy, utilities risk: Missed opportunities for grid modernization Inefficient operations and rising costs Increased exposure to compliance, cybersecurity, and reliability risks This white paper outlines how utilities can shift from data overload to data-driven decision-making—transforming fragmented systems into a unified, strategic foundation for innovation and performance. What you’ll learn: Why utilities must treat data as a business-critical asset The 5 essential steps for building a resilient data strategy How better data governance improves forecasting, customer service, and asset management Where to focus first to support AI, cloud adoption, and DER integration

Shifting to the Cloud: Debunking the Myths of Migrating Utility Data Off Premises

April 14, 2024

This blog delves into common misconceptions surrounding cloud migration in the utility industry, addressing concerns about security, reliability, regulatory compliance, cost effectiveness, and complexity, while highlighting the substantial benefits and strategies for successful adoption.

Locana Awarded Modern Network Management at Esri Infrastructure Management and GIS Conference

November 22, 2023

Locana, an international leader in spatial technology, received the Modern Network Management Award at the 2023 Esri Infrastructure Management and GIS (IMGIS) Conference held in Palm Springs, California, October 10-12, 2023.

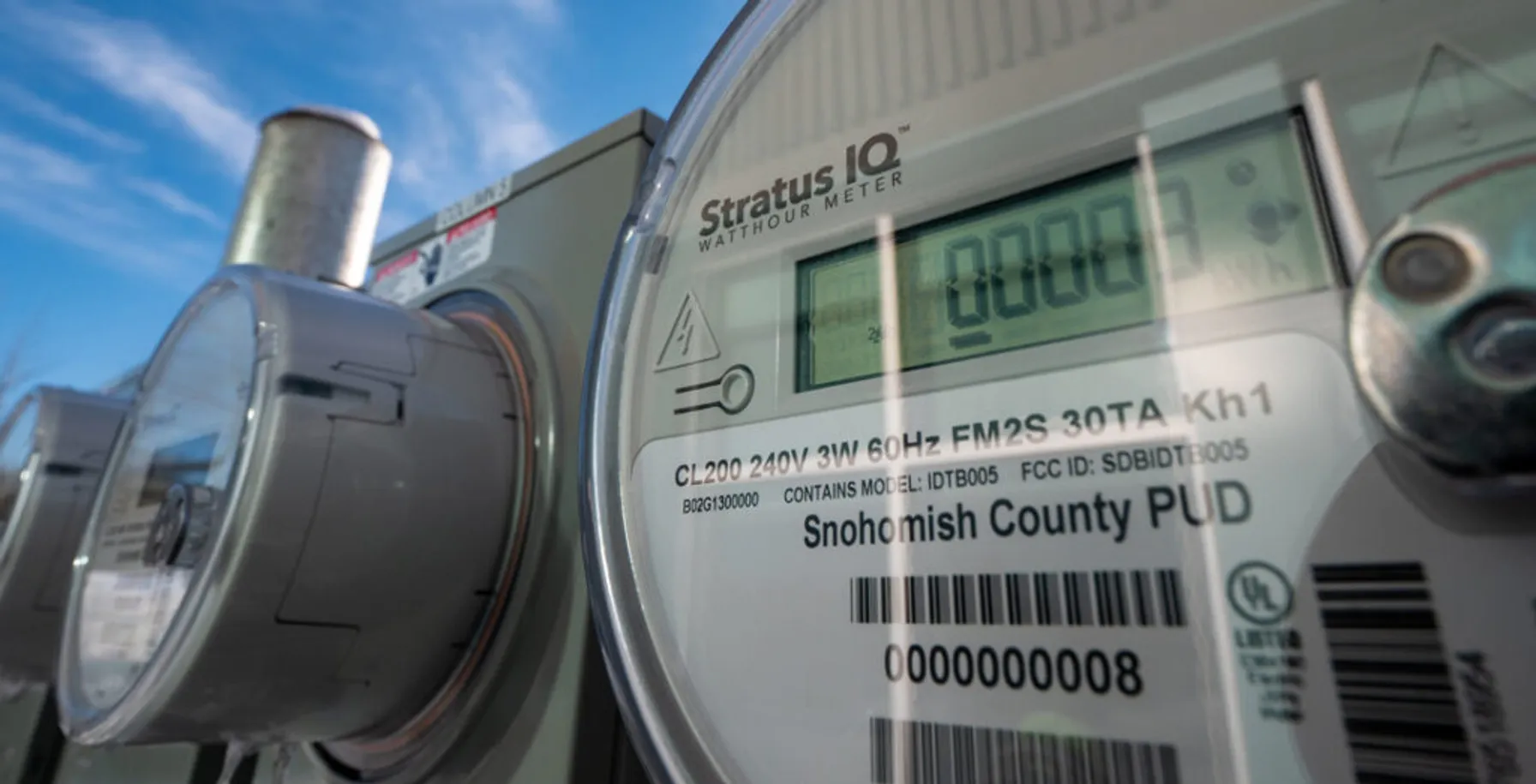

Advanced Metering Infrastructure (AMI) – How Smart Should A Smart Meter Be?

June 26, 2023

According to the Edison Foundation’s Institute for Electric Innovation, over 124 million smart meters were expected to be installed in 78 percent of US households by the end of 2022.

Modernize Your Field Services with GIS and Work Order Management Combined

June 15, 2023

The role of field service management continues to dominate the world economy, as the market grows at an exponential rate. The market was estimated at 3.2 billion in 2021 and is projected to reach 5.7 billion by the end of 2026.

Harness the Power of Geospatial Data to Unlock Big Data Insights

March 16, 2023

For years, companies have been harnessing big data to glean insights that improve decision-making of every kind and at all levels, from entering new markets to building better products to delivering better services and experiences.

TRC and Greenbird Partner to Accelerate Grid Modernization for Utilities

January 31, 2023

Today TRC Companies (“TRC”) announced a go-to-market partnership with Greenbird Integration Technology, a leading integration technology provider based in Norway. Greenbird’s Utilihive platform enables utilities to accelerate their digital transformation and grid modernization efforts.

The Use Case Benefits of GIS Modernization for Utilities

August 10, 2022

Today’s utilities are inundated with data—from sensors, smart meters, EVs, distributed energy resources, and more. But collecting data isn’t the challenge—managing it is. Without a comprehensive data management strategy, utilities risk: Missed opportunities for grid modernization Inefficient operations and rising costs Increased exposure to compliance, cybersecurity, and reliability risks This white paper outlines how utilities can shift from data overload to data-driven decision-making—transforming fragmented systems into a unified, strategic foundation for innovation and performance. What you’ll learn: Why utilities must treat data as a business-critical asset The 5 essential steps for building a resilient data strategy How better data governance improves forecasting, customer service, and asset management Where to focus first to support AI, cloud adoption, and DER integration

Brookings Municipal Utilities Streamlines Processes, Boosts Efficiency with Modern GIS

June 14, 2022

Locana, a global leader in technology consulting and geospatial systems development, announced Brookings Municipal Utilities (BMU) successful deployment of a modern geospatial enterprise leveraging Locana services.

Omaha Metropolitan Utilities District Drives Reliable Operations with Locana Lemur Mobile GIS Solution

June 8, 2022

Locana, a global leader in technology consulting and geospatial systems development, today announced the successful deployment of its LemurSM Solution by Omaha Metropolitan Utilities District (M.U.D.).

Locana Awarded Wildlife Habitat Analysis Task Order For The Bureau Of Land Management

April 27, 2022

Locana, a leading geographic data and technology company, has won a 10-year National Geospatial Data and Technology Support Services contract for the U.S. Bureau of Land Management (BLM).

TRC Selected as Systems Integrator for Otter Tail Power Company’s Advanced Metering Infrastructure Program

April 5, 2022

Otter Tail Power Company selects TRC to serve as systems integrator for their AMI program covering northwestern Minnesota, eastern North Dakota, and northeastern South Dakota.

Six Considerations for a Successful Utility Network Cloud Implementation

October 26, 2021

For any GIS manager or IT professional tasked with implementing ArcGIS Utility Network (UN), knowing where to start can be daunting. If not properly planned, a UN setup in the cloud can be significantly more expensive and less accessible, stable, and secure.

On the Road to Decarbonization: The Role of All-Source Competitive Solicitations

October 14, 2021

All-Source Competitive Solicitations offer utilities an alternative to centralized planning, construction and dispatch of power supplies, helping to usher in a new era of market-driven technology innovation.

Amplifying the Next Phase of Fleet Electrification: The Pickup

September 30, 2021

TRC’s analysis for one client fleet shows that even a $70,000 EV can compete on cost with a comparable gas-hybrid vehicle priced at $40,000 – at least in California where upfront and ongoing incentives stack up quickly.

TRC Digital Selected by Snohomish County Public Utility District to Implement Siemens EnergyIP® Meter Data Management

September 15, 2021

Snohomish PUD selected TRC to implement, integrate and deliver their meter data management system (MDMS) on the Siemens EnergyIP® platform as a part of the utility’s Connect Up program.

Oklahoma Gas & Electric Company uses AI to assess and repair distribution pole damage

August 4, 2021

As part of its grid enhancement program, OG&E will leverage collaborative AI-powered image recognition technology that enables engineers to complete distribution pole inspections with greater accuracy and helps to reduce manual review of images.

Reasons for IT/OT Modernization

August 1, 2021

Opposites attract, and information technology (IT) and operational technology (OT) are no exception. At one end of the digital grid sits IT as a business application, while OT exists at the other end of the digital grid as an asset-oriented application. For decades, IT and OT have been operating separately and are often physically isolated.

IT/OT Convergence Best Practices

August 1, 2021

A successful IT/OT convergence strategy involves identifying desired outcomes, managing the fragmentation of OT solutions, and developing common key performance indicators (KPIs) for both IT and OT teams. This approach helps in optimizing resources, driving effective collaboration, and ensuring a smooth transition towards a unified IT/OT environment.

TRC Acquires Montreal’s Quatric, Expanding Digital Capabilities for Utilities

June 16, 2021

Today, TRC announced the expansion of its digital capabilities with the acquisition of Quatric, a Montreal, QC and Quincy, MA-based firm that provides engineering services and technology solutions to electric and gas utilities.

What’s Next? Preparing for Utility Network Migration

May 12, 2021

In preparing for Utility Network Migration, taking an intermediate approach will allow you to resolve some key points. Utility Network Migration will run smoother if you build a “sandbox environment” and begin to 1) prioritize features 2) explore licensing options and 3) practice moving data.

5 Persistent Questions About ArcGIS on HANA

April 9, 2021

While ArcGIS on HANA implementation patterns are emerging rapidly, we continue to hear 5 persistent questions about how implementing ArcGIS on HANA would benefit an organization. Let’s walk through these 5 questions, I’ll show you how we help you get started with ArcGIS on HANA. Then you may realize the benefits this solution promises.

TRC Digital partners with Dominion Energy to evolve its distributed energy resource strategy

September 22, 2020

Dominion Energy, one of the nation’s largest producers and transporters of energy, has partnered with TRC Digital to evaluate, implement and integrate technology to further the utility’s distributed energy goals. TRC Digital will facilitate Dominion Energy’s strategy development and technology execution, allowing Dominion Energy and its customers to accelerate the shift to distributed energy resources (DER) and net carbon reduction.

TRC Digital and Reactive help utilities measure inertia for a more resilient grid

September 21, 2020

Together, TRC and Reactive combine TRC’s industry-leading power engineering expertise with Reactive’s machine learning software to provide utility teams with high-resolution frequency monitoring and automatic event analysis.

TRC Digital Partners with Treverity to Put Utility Engineers at the Center of Their Data

June 26, 2020

As part of TRC’s LineHub solution, Treverity helps transmission engineers get a holistic view of the grid through powerful digital data visualization and a customer-centric user interface.

TRC Digital and Enbala can help utilities monitor, control and optimize distributed energy resources

April 17, 2020

Distributed energy resources (DERs) are changing the way utilities think about power generation and energy flow. TRC and Enbala can offer utilities a multi-layered solution that highlights the strengths of each company.

David Contant

David is a Senior Program Manager at TRC Companies. Contact David at DContant@trccompanies.com

Daniel Weed

Daniel is a Vice President at TRC Companies. Contact Dan at DWeed@TRCcompanies.com