DOE and Utilities – Working Together on IIJA

View our webinar replay of our IIJA funding initiatives webinar with Jigar Shah, Director of the Loan Programs Office – US Department of Energy

Helping develop future-facing programs that serve communities and customers with clean and equitable energy

Helping Customers Plan, Validate and Execute IIJA-Funded Projects

Nos praticiens partagent leurs idées et leurs points de vue sur les tendances et les défis qui façonnent le marché.

Produced and hosted by the staff of TRC’s Advanced Energy practice, the podcasts are a forum for current trends in the energy industry.

We’re excited to share Episode 8 of TRC’s Energy Talks Podcast, where we’re joined by experts from NEEA and Consumers Energy to explore the vital role of program evaluation in advancing energy efficiency and market transformation.

TRC examine l’environnement opérationnel unique et les meilleures pratiques pour les aéroports alors qu’ils font évoluer la recharge des VE, soutiennent l’électrification côté terre et côté piste et atteignent les objectifs de décarbonisation.

TRC peut maintenant fournir des audits énergétiques équivalents IAC aux petites et moyennes entreprises de fabrication (SMM), qui peuvent recevoir des subventions allant jusqu’à 300 000 $ pour la mise en œuvre des recommandations de vérification.

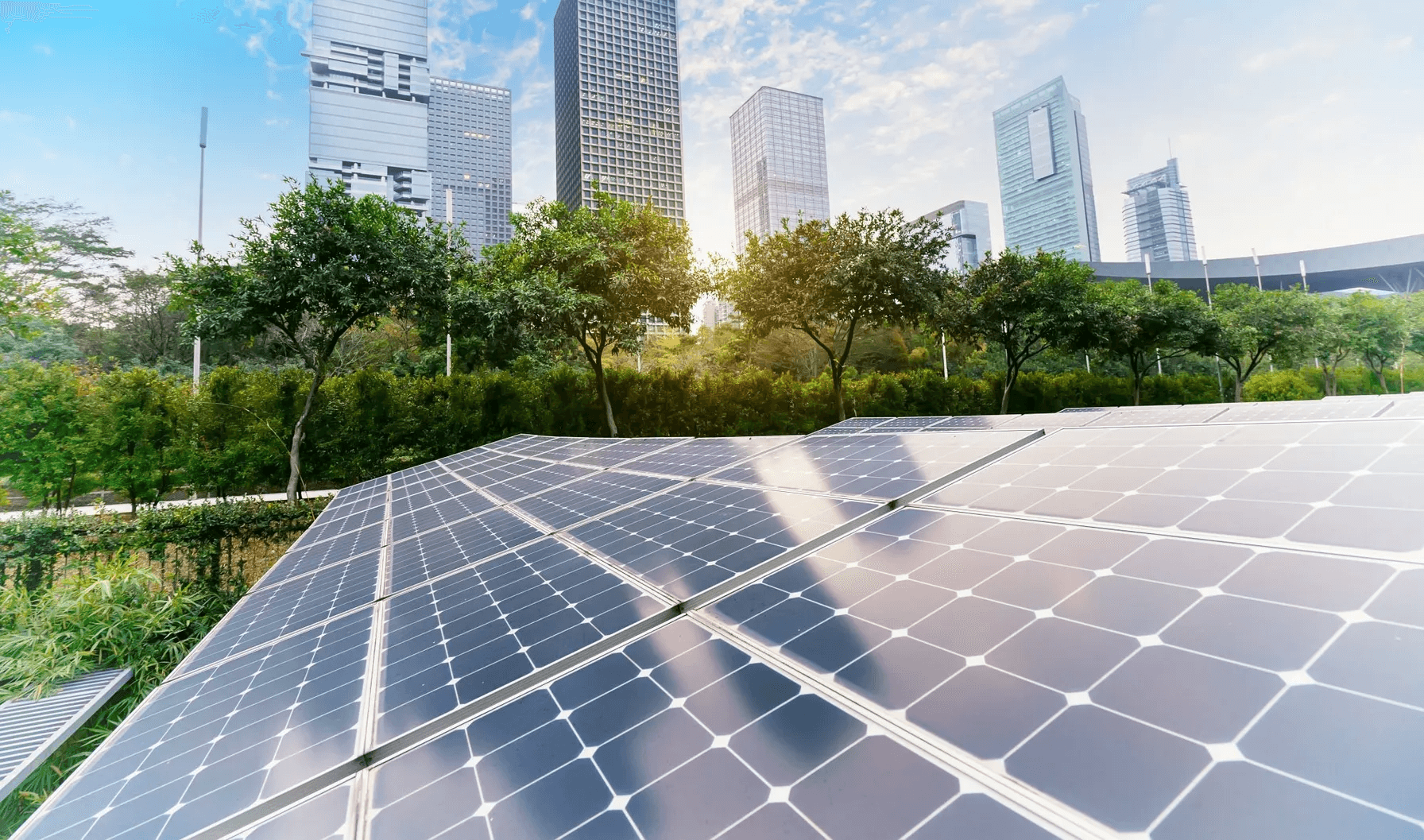

Apprenez à intégrer des pratiques de décarbonisation pour réduire votre contribution aux émissions de dioxyde de carbone. Travaillez à la durabilité avec nos solutions.

À la suite de sa discussion sur l’efficacité énergétique, Duane Baldwin, vice-président de l’énergie avancée de TRC, partage maintenant ses idées professionnelles et son engagement personnel envers l’équité énergétique.

Nous sommes heureux d’annoncer l’épisode 7 du podcast Energy Talks de TRC, où nous nous joignons à des experts des services publics et des fournisseurs de solutions de comptabilisation du carbone pour discuter de la façon dont notre industrie comprend, mesure et travaille à améliorer notre empreinte carbone collective.

TRC analysera les données de la mission de la NASA pour aider à conserver l’eau potable et l’énergie en identifiant les fuites souterraines.

Pour s’attaquer aux inégalités et veiller à ce que les avantages de la transition vers l’énergie propre soient accessibles à tous, il faut examiner de près les processus auxquels on s’appuie depuis longtemps et qui peuvent avoir caché des inégalités enracinées en eux.

Écoutez l’épisode 6 du podcast Energy Talks de TRC, où nous nous joignons à des experts de l’industrie des marchés de gros de l’énergie et des produits environnementaux pour discuter de la façon dont les services publics et les développeurs de projets valorisent les attributs environnementaux des projets de décarbonisation des bâtiments.

Écoutez l’épisode 6 du podcast Energy Talks de TRC, où nous nous joignons à des experts de l’industrie des marchés de gros de l’énergie et des produits environnementaux pour discuter de la façon dont les services publics et les développeurs de projets valorisent les attributs environnementaux des projets de décarbonisation des bâtiments. Avec 40% des émissions de gaz à effet de serre provenant des bâtiments, ce secteur est le plus grand levier disponible pour nous de résoudre le changement climatique causé par les émissions. La décarbonisation des bâtiments fait référence à tout processus ou technologie qui réduit les émissions de dioxyde de carbone associées aux bâtiments. Cela comprend l’efficacité énergétique, l’électrification, la flexibilité de la charge et les projets de production d’énergie renouvelable distribuée. Les services publics investissent traditionnellement dans des programmes de décarbonisation des bâtiments pour obtenir des avantages du réseau, y compris une capacité évitée. Mais en parallèle, ces programmes génèrent des avantages environnementaux sous la forme d’émissions de gaz à effet de serre évitées – connues sous le nom d’attributs environnementaux – et peuvent aider à atteindre les objectifs du gouvernement et des entreprises en matière d’énergie propre. Il existe différents types d’attributs environnementaux, qui peuvent être mesurés en compensations de carbone (tonnes d’eCO2) ainsi que des certificats d’attributs énergétiques (CEE), généralement sous la forme de crédits d’énergie renouvelable ou de CER (mesurés en MWh). La valeur de ces avantages environnementaux augmente et devrait s’envoler au cours des prochaines décennies, ce qui fait du coût évité du carbone un intrant de plus en plus important dans l’évaluation de la rentabilité des programmes de décarbonisation des bâtiments. Cette tendance représente un changement de paradigme, offrant la possibilité d’attirer de nouveaux investisseurs importants dans notre industrie au cours des prochaines décennies et d’élargir considérablement les impacts de nos programmes. Beaucoup d’entre nous dans l’industrie se demandent : comment les services publics et les États qui administrent les programmes de décarbonisation des bâtiments évaluent-ils actuellement les attributs environnementaux générés par leurs programmes ?

La conservation de l’eau est essentielle pour réduire la consommation globale d’énergie et l’impact environnemental. Découvrez comment nos services peuvent vous aider à gérer votre conservation de l’eau.

L’élimination de l’utilisation du gaz naturel dans les nouvelles constructions est une option stratégique qui gagne à la fois du terrain et de la controverse

TRC received an award for advancing the transition to a clean-hydrogen, low-carbon economy by supporting the Appalachian Regional Clean Hydrogen Hub (ARCH2) consortium.

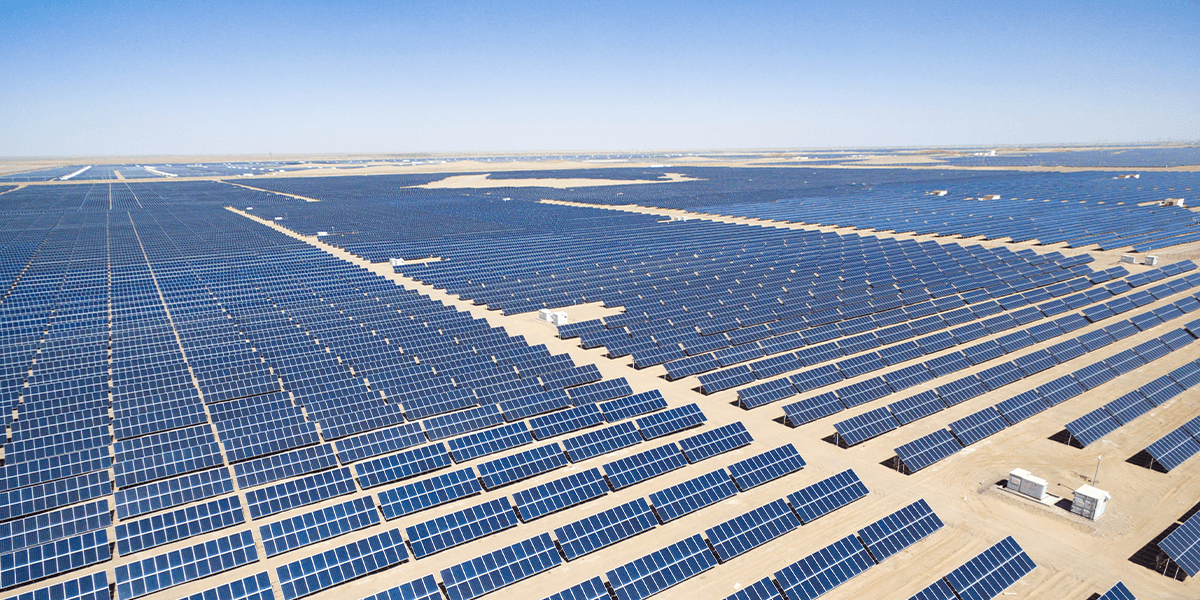

The need to decarbonize our energy systems is urgent – but to successfully transform this vast market requires cross-sector change at scale.

Heat pump technology is still evolving and real challenges exist to widespread market adoption.

Partnering With Local High Schools to Recruit the Next Generation of Clean Energy Workers.

Clean, community microgrids represent a promising and timely opportunity for you to advance your customer offering and deliver meaningful societal benefits, all while modernizing your grid and providing you with load flexibility.

Avec les procédures judiciaires, les appels devant les tribunaux et les actions politiques actuellement en cours, découvrez pourquoi certains États interdisent les nouveaux raccordements au gaz naturel dans certains secteurs dans le cadre des stratégies de décarbonisation et ce que cela signifie pour les consommateurs et les entrepreneurs. Alors que la décarbonisation devient impérative pour lutter contre les impacts du changement climatique à l’échelle nationale, le gouvernement fédéral, les États et les municipalités regardent au-delà du marché de la production d’électricité pour de nouvelles solutions qui peuvent faire une grande différence. Étant donné qu’une source importante d’émissions de carbone provient des combustibles fossiles utilisés dans les bâtiments, l’élimination de l’utilisation du gaz naturel dans les nouvelles constructions est une option politique qui gagne à la fois du terrain et de la controverse. La décarbonisation du secteur de la construction nécessite de réduire ou d’éliminer les émissions provenant des sources de pétrole ou de gaz naturel utilisées pour le chauffage et les foyers ornementaux, l’eau chaude domestique, le séchage des vêtements et la cuisson. Des chaudières aux chauffe-eau, en passant par les fournaises et les cuisinières à gaz, il existe de nombreuses façons dont une maison ou un autre bâtiment peut brûler des combustibles fossiles. L’élimination de ces sources et le remplacement de l’équipement par une nouvelle technologie électrique peuvent réduire la pollution de l’air extérieur, améliorer la qualité de l’air intérieur et améliorer l’environnement – aidant à atteindre les objectifs climatiques – mais cela peut également atténuer l’augmentation des coûts des services publics, protéger les options de logement abordable et s’attaquer aux impacts sur la sécurité, l’air intérieur et la santé humaine qui peuvent se produire avec la combustion de combustibles fossiles à l’intérieur. Alors que les États réglementent le gaz naturel dans les nouvelles constructions, de nombreux intervenants s’inquiètent de ce changement notable. Bien que cela ait conduit à des batailles juridiques et politiques litigieuses, la tendance est là pour rester. Et avec de nombreuses options de remplacement nouvelles et émergentes passionnantes pour les appareils au gaz naturel, combinées à des campagnes continues d’éducation et de sensibilisation des parties prenantes, il peut y avoir une voie positive pour la décarbonisation des bâtiments.

Lessons from TVA’s Non-Road EV (NREV) Program

For community leaders, rebuilding in the wake of disasters creates an opportunity to do more than simply replace homes with the fastest, least-expensive structures.

A significant portion of a building’s energy consumption is wasted through a combination of missing occupant needs and sub-optimal design and operation.

View our webinar replay of our IIJA funding initiatives webinar with Jigar Shah, Director of the Loan Programs Office – US Department of Energy.

As we plan for and make early investments for fleets, we’ll be paving the way for higher degrees of market penetration of passenger vehicles and other modes of transportation as well.

Find out how reach code initiatives are driving decarbonization with TRC. Our team offers decarbonization consulting and solutions. Turn To The Experts at TRC!

Carbon elimination of the magnitude needed to address climate change requires systems-level change that can only be reached by incremental, ground-up progress, building upon what we have achieved thus far.

Carbon elimination of the magnitude needed to address climate change requires systems-level change that can only be reached by incremental, ground-up progress, building upon what we have achieved thus far.

There are compelling reasons to be optimistic about the outcomes of the COP26 meeting. Notably, agreement among all nations that more needs to be done, by both private and governmental bodies, to contain and mitigate climate change.

Most industry experts agree that weather aside, the global energy and gas markets are likely to remain uncertain with supply and market demand becoming tighter and more challenging to forecast.

All-Source Competitive Solicitations offer utilities an alternative to centralized planning, construction and dispatch of power supplies, helping to usher in a new era of market-driven technology innovation.

Pacific Gas and Electric Company (PG&E) formally announced TRC as the designated lead Program Implementer for the Statewide New Construction (SWNC) Residential All-Electric and Mixed Fuel Programs following a competitive solicitation process.

TRC, Slipstream, and the University of Minnesota are working with controls system manufacturers and contractors to develop such a standardized and streamlined building control retrofit process leveraging ASHRAE Guideline 36

Clean energy is a broad term with a fluctuating definition and a complicated lifecycle. We explore the issue, and hope to establish a more productive dialogue about our energy future.

Growing US Offshore Wind Industry Requires Reshoring of Materials and Supply Chain Optimization

NEW BRUNSWICK, NJ and LOWELL, MA. – Jan. 17, 2017 – TRC Companies Inc., a recognized leader in engineering, environmental consulting and construction-management services, today announced it has acquired the contract to serve as Program Administrator of New Jersey’s Clean Energy Program™ (NJCEP), which has provided more than $300 million annually in support to homeowners, businesses…

On October 28, the Camarillo City Council unanimously approved moving forward with the design of Hybrid Microgrids at five City facilities: City Hall, the Corporation Yard, Camarillo Public Library, Police Station, and Wastewater Treatment Plant. The microgrid at the Camarillo Public Library will be designed with solar+storage only, while the other four sites will employ a hybrid design of solar+storage+diesel.

Dominion Energy, one of the nation’s largest producers and transporters of energy, has partnered with TRC Digital to evaluate, implement and integrate technology to further the utility’s distributed energy goals. TRC Digital will facilitate Dominion Energy’s strategy development and technology execution, allowing Dominion Energy and its customers to accelerate the shift to distributed energy resources (DER) and net carbon reduction.

Together, TRC and Reactive combine TRC’s industry-leading power engineering expertise with Reactive’s machine learning software to provide utility teams with high-resolution frequency monitoring and automatic event analysis.

Myszka brings over 30 years of innovation, market development and operations experience to TRC.

COVID-19 and climate impacts are driving a focus on resilience and utilities are helping customers explore behind-the-meter (BTM) energy storage solutions they might not otherwise pursue.

TRC will help support MCE’s community and vulnerable customer resiliency efforts

Grid assets have evolved from traditional grid infrastructure to complex, and agile distributed energy systems today.

EE as a Resource programs that provide capacity and energy savings to the grid must be dependable and persistent to replace essential power plant capacity.

Commercial buildings today represent about 16% of energy use (30% of electricity) and a key source of GHG emissions across the US.

Implementing resilient solutions for many means ensuring power supply to critical facilities, emergency response efforts and local authorities during power outages.

As we look to spur strategic electrification across the US, it will be up energy providers and solution implementers to continue sharing ideas, insights and lessons learned

A place called home: Helping California families rebuild after wildfires

Oregon embarks on a bold initiative to reduce energy costs among low income residents with the help of TRC.

What will the grid of the future look like? Where are scientists and engineers breaking new ground to push energy efficiency even further? Join TRC at ACEEE Summer Study to find out.

TRC is proud to support Huntington, NY bolster power reliability and climate-change resiliency with a sophisticated new “community microgrid’’ combining solar energy, a fuel cell, biogas and traditional natural gas to deliver electricity and heat to local customers and institutions.

Discover eight intelligent grid solutions reshaping the utility sector in 2026, from converged control systems and AMI 2.0 to GIS, cloud, AI and asset intelligence.

Every so often, an industry reaches an inflection point — one of those rare moments when change doesn’t just accelerate, it fundamentally redefines the path ahead. For the utility industry, 2026 is that moment.

Discover five practical strategies utilities, ISOs and RTOs can use to modernize model management, break down data silos and build a single, accurate system of record that supports reliable, compliant grid operations.

Enable AI-powered predictive maintenance with TRC’s remote sensing, computer vision and cloud solutions to reduce outages, enhance grid reliability and turn imagery into actionable asset intelligence for utilities.

Evaluate utility undergrounding with lifecycle cost modeling that quantifies risk, reliability and long-term value to support defensible, data-driven capital planning.

Supercharges its leading position in the Power & Energy sector.

Learn how AI, cloud, digital twins, AMI 2.0 and field mobility empower utilities to modernize resiliency and boost performance.

Discover how cloud-based solutions empower mid-sized utilities to overcome rising operational costs, manage rapid load growth and enhance customer engagement.

Discover how integrating ADMS and AMI empowers utilities with real-time data, smart analytics and grid optimization for reliability and regulatory compliance.

Discover how AMI 2.0 transforms utility operations and customer engagement with real-time data, advanced analytics and robust grid-edge innovation.

As extreme weather and wildfires become more prevalent, is it better to harden overhead systems or eliminate much of the risk through undergrounding?

Explore essential strategies for utilities to overcome challenges posed by massive, diverse data influx from smart meters, IoT and cloud platforms.

Explore how the Resiliency Bow Tie method helps utilities tackle rising outage risks from aging infrastructure, climate extremes and cyber threats. Learn how this strategic framework promotes effective risk mitigation, improves response times and fosters cross-functional collaboration, enabling utilities to deliver reliable service.

Produced and hosted by the staff of TRC’s Advanced Energy practice, the podcasts are a forum for current trends in the energy industry.

Discover how Lemur mobile mapping empowers utilities to improve data quality, streamline field operations and reduce costs. Lemur provides a unified, intuitive mobile solution that works online and offline, ensuring compliance and real-time decision-making.

Discover practical best practices to overcome common DERMS implementation challenges and ensure long-term utility success.

Explore how global energy market participants can reduce risk and improve forecasting through advanced analytics, integrated data strategies, and real-time insights.

Discover how modern 3D facility mapping empowers utilities to modernize infrastructure, improve asset management, and enable remote workflows with accurate digital twins, delivering cost savings and operational efficiency.

Discover how utilities can overcome common challenges and achieve true IT/OT integration by focusing on vision, alignment, change management, standardization, and scalable strategy.

Discover why now is the ideal time for utilities to deploy AMI 2.0, unlocking real-time data, operational efficiency and grid modernization benefits.

Discover how integrating enterprise systems empowers utilities to streamline operations, enhance grid reliability and deliver superior customer service.

In today’s changing energy landscape, grid resiliency is a top priority for all power system owners and operators. The ability to absorb disruptions and maintain power is crucial in an increasingly unpredictable world.

Implementing DERMS can come with challenges. By understanding the unique challenges related to DERMS and adopting the appropriate strategies to mitigate potential pitfalls, utilities can effectively integrate and coordinate DER deployment to align with regulatory commitments and broader business objectives.

Behavioral demand response (BDR) offers a cost-effective solution, reducing energy use during critical periods without requiring a dedicated DRMS.

In today’s rapidly evolving energy landscape, Independent System Operators (ISOs), Regional Transmission Organizations (RTOs) and utilities face unprecedented challenges in managing vast amounts of data.

Supercharges its leading position in the Power & Energy sector Milestone transaction: To welcome a U.S. premier Power & Energy brand of approximately 8,000 people to create the #1 Power & Energy platform in the U.S1 (total cash purchase price of US$3.3 billion). Highly accretive: Expected to be low- to mid-single digit percentage accretive to WSP’s adjusted net earnings per share2 and high-single digit percentage accretive once cost synergies are fully realized2,3 Highly complementary: To expand our offering in the Power & Energy sector and provide potential cross-selling opportunities similar to our POWER Engineers experience. Drives scale across strategic high-growth areas fueled by strong fundamentals: o Grows Advisory capabilities o Expands Program Management expertise o Adds to Digital offering with innovative solutions o Enhances service offering across Water, Infrastructure and Environment Elevates leading position in the U.S.: Combined with TRC, WSP will become the largest engineering and design firm in the U.S. by revenue4, with approximately 27,000 employees. Provides further diversification: 34% of U.S. net revenues to be derived from the Power & Energy sector.5 Accelerates WSP’s organic growth rate profile globally: Approximately two-thirds of WSP’s global net revenues to be derived from Canada and the Americas, and approximately 20% from Power & Energy—a double-digit organic growth rate sector.6 Fully aligned with WSP’s 2025-2027 Global Strategic Action Plan: Pioneering change for empowered growth. ~$850 million equity offering composed of $732 million bought deal and approximately $118 million concurrent private placement with La Caisse. NOT FOR RELEASE, PUBLICATION, OR DISTRIBUTION IN OR INTO THE UNITED STATES OF AMERICA OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES OF AMERICA, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES, OR THE DISTRICT OF COLUMBIA. BASE SHELF PROSPECTUS IS ACCESSIBLE, AND THE PROSPECTUS SUPPLEMENT WILL BE ACCESSIBLE WITHIN TWO BUSINESS DAYS, ON SEDAR+ MONTREAL, December 15, 2025 – WSP Global Inc. (TSX: WSP) (“WSP” or the “Corporation”), one of the world’s leading professional services firms, proudly announces it has entered into an agreement to acquire TRC Companies (“TRC”), a premier U.S. Power & Energy brand delivering end-to-end solutions that support the full infrastructure lifecycle (the “Acquisition”), currently majority-owned by funds managed by Warburg Pincus LLC. The proposed Acquisition, for a total cash purchase price of US$3.3 billion (approximately $4.5 billion based on the exchange rate of $1.3762 USD/CAD as of December 15, 2025), marks a significant step on WSP’s journey to achieve its 2025-2027 Global Strategic Action Plan. The proposed Acquisition will position WSP as the largest engineering and design firm in the U.S., supercharging its Power & Energy offering and enhancing its capabilities across Water, Infrastructure, and Environment. Based in Windsor, Connecticut, TRC has been a pioneer in adaptability and innovation for more than 55 years. TRC has established itself as a leader and recognized strategic advisor in the engineering and consulting industry, maintaining deep, long-term relationships with blue-chip utilities. Its team of approximately 8,000 employees offers an integrated approach that delivers long-term value for clients facing complex infrastructure and energy challenges. The proposed Acquisition complements WSP’s offering in attractive market sectors, will expand its client relationships, and enhance its capabilities throughout the project lifecycle, notably with a portfolio of advisory practices tailored to utilities and program management expertise. It will also create potential cross-selling opportunities across power engineering, environmental solutions, and advisory services. At the same time, TRC will bring a shared commitment to innovation and operational excellence, with investments in digital solutions and a highly skilled workforce—further amplifying WSP’s ability to deliver integrated, future-forward solutions. “The proposed Acquisition of TRC is a defining moment in the execution of WSP’s 2025-2027 Strategic Plan. Building on our track record of excellence and compounding financial performance, this strategic move will cement WSP as the Power & Energy consulting leader in the U.S. and globally. Joining forces will position our business for accelerated organic growth and create an integrated platform with industry-leading capabilities in advisory, engineering, and program management. With TRC’s highly complementary expertise in power delivery, transmission, distribution, and advisory services, our combined offering will cover the entire utility and infrastructure value chain. Together, we are poised to deliver more complex projects and offer expanded end-to-end services to help solve our clients’ critical needs, from aging infrastructure to grid modernization and electrification,” commented Alexandre L’Heureux, President and Chief Executive Officer of WSP. Also commenting on the Acquisition, Christopher P. Vincze, Chairman and Chief Executive Officer of TRC, said: “The joining of our two firms will create significant and exciting opportunities for our people, our clients and the communities in which we live and work. With TRC’s innovative, technology-oriented power business, underscored by an advanced use of digital, we will significantly strengthen WSP’s Power & Energy offering. Additionally, TRC’s globally recognized Environmental & Infrastructure business, which is the seed from which TRC grew, will enhance WSP’s capabilities across Water, Infrastructure and Environment. Our combined skill sets will elevate us to better support, over the next decade and beyond, our people and planet as we face unprecedented growth of power needs on the back of ongoing electrification, the re-emergence of domestic manufacturing in the U.S. and the continued growth of infrastructure. We were an early pioneer in the utility sector and continue to be a trusted thought partner, working to create, implement and manage complex strategies and programs to meet the country’s power needs. TRC’s people continue to be passionate about making the world a better place, and this next chapter will allow us to come together with WSP in a very exciting way to further that goal.” Reflecting on their investment, Kim Thomassin, Executive Vice President and Head of Québec at La Caisse said: “With this investment, La Caisse once again demonstrates its ongoing commitment to WSP, helping to position the company as a leader in engineering and design in the United States and globally, while accelerating the development of its Energy offering, a sector with strong potential. This transaction is at the core of our strategy to support the international expansion of companies firmly rooted in Québec and to give them the means to achieve sustainable growth.” FINANCIAL HIGHLIGHTS Proposed Acquisition of TRC for a total cash purchase price of US$3.3 billion approximately $4.5 billion based on the exchange rate of $3762 USD/CAD as of December 15, 2025). Acquisition price represents 14.5x TRC’s Pre-IFRS 16 CY2026E Adjusted EBITDA6 pre-synergies and 12.5x after including run-rate synergies.8 (TRC’s Pre-IFRS 16 Adjusted EBITDA and earnings before net interest and income tax for the financial year ended June 30, 2025 were approximately US$192.3 million ($268.5 million) and US$87.5 million ($122.1 million), respectively). Expected to be low-to-mid single-digit percentage accretive to WSP’s adjusted net earnings per share before synergies. WSP expects 2027 Accretion (as defined below) to be high single-digit percentage accretive once cost synergies are fully realized (WSP’s basic net earnings per share attributable to shareholders and adjusted net earnings per share were $5.40 and $8.05 respectively, for the financial year ended December 31, 2024).2,9 Expected cost synergies to exceed 3% of TRC’s net revenues for the financial year ended June 30, 20257, plus potential cross-selling revenue synergy opportunities in alignment with our POWER Engineers experience (TRC’s net revenues and revenues for the financial year ended June 30, 2025 were approximately US$1,192.2 million and US$1,498.9 million, respectively). Transaction to be financed with US$3.3 billion of Committed Acquisition Financing (as defined below). Estimated pro forma Net Debt to Adjusted EBITDA ratio6 of ~2.4x upon closing of the Acquisition with the expectation to return to below 2.0x within 12 months6 (WSP’s net debt to adjusted EBITDA ratio for the nine-month period ended September 27, 2025 was 1.4x and adjusted EBITDA and earnings before net financing expense and income taxes for the trailing twelve-month period ended September 27, 2025 were approximately $2,501.4 million and $1,481.0 million, respectively).8 Equity raise of approximately $850 million: $732 million bought deal public offering and approximately $118 million private placement of common shares of WSP (“Common Shares”) expected to close on or about December 22, 2025, with a corresponding reduction of the amounts drawn from the Committed Acquisition Financing. WSP may also opportunistically access debt capital markets to repay a further portion of the Committed Acquisition Financing should market conditions be favourable. WEBCAST WSP will host a webcast today at 4:45 p.m. (Eastern Daylight Time) to discuss the Acquisition. Exceptionally, there will be no question-and-answer session, given the concurrent equity offering. To join the webcast, please register at https://www.icastpro.ca/rp92yd or access https://www.wsp.com/en-gl/investors. A presentation of the Acquisition is accessible on the webcast platform and under the “Investors” section of WSP’s website. CONDITIONS TO THE ACQUISITION Subject to the satisfaction of certain customary closing conditions, including applicable regulatory approvals, the Acquisition is expected to be completed in the first quarter of 2026. ACQUISITION FINANCING Equity Financing The Equity Financing (as defined below) comprises: $732 million bought deal public offering (the “Offering”) of common shares (the “Offering Common Shares”) at a price of $232.80 per Offering Common Share (the “Offer Price”); and Approximately $118 million private placement (the “Concurrent Private Placement” and together with the Offering, the “Equity Financing”) of common shares (the “Placement Common Shares”) at the Offer Price to Caisse de dépôt et placement du Québec (“La Caisse”) WSP intends to use the net proceeds from the Equity Financing to fund in part the purchase price payable in respect of the Acquisition (and related costs and expenses) and accordingly reduce amounts to be drawn on the closing of the Acquisition under the Committed Acquisition Financing to fund the purchase price for the Acquisition. Public Offering WSP has entered into an agreement with CIBC Capital Markets, BMO Capital Markets and National Bank Capital Markets (the “Joint Bookrunners”), on behalf of a syndicate of underwriters (the “Underwriters”), to issue and sell, on a “bought deal” basis, 3,145,000 Offering Common Shares at the Offer Price for gross proceeds to the Corporation of $732 million. The Corporation has granted the Underwriters an over-allotment option (the “Over-Allotment Option”), exercisable in whole or in part, for a period of 30 days following the date of the closing of the Offering to purchase up to an additional number of Offering Common Shares equal to 15% of the Offering Common Shares to be sold pursuant to the Offering at the Offer Price to cover over-allotments, if any, and for market stabilization purposes. The Offering Common Shares distributed pursuant to the Offering will be offered in all provinces and territories of Canada pursuant to a prospectus supplement (the “Prospectus Supplement”) to the short form base shelf prospectus of WSP dated August 8, 2024 (the “Base Shelf Prospectus”) to be filed by WSP on or about December 17, 2025, as well as in the United States by way of private placement to “qualified institutional buyers” in reliance upon the exemption from registration provided by Rule 144A under the U.S. Securities Act of 1933, as amended (the “1933 Act”). The completion of the Offering is subject to the approval of the Toronto Stock Exchange (the “TSX”). Closing of the Offering is expected to occur on or about December 22, 2025 and is conditional upon the concurrent completion of the Concurrent Private Placement. No securities regulatory authority has either approved or disapproved the contents of this press release. The Offering Common Shares have not been, and will not be, registered under the 1933 Act, or any state securities laws. Accordingly, the Offering Common Shares may not be offered or sold within the United States unless registered under the 1933 Act and applicable state securities laws or pursuant to exemptions from the registration requirements of the 1933 Act and applicable state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of the Offering Common Shares in any jurisdiction in which such offer, solicitation or sale would be unlawful. Delivery of the Prospectus Supplement, and any amendments to the documents will be provided in accordance with securities legislation relating to procedures for providing access to a shelf prospectus supplement, and any amendment. The Prospectus Supplement will be (within two business days of the date hereof) accessible on SEDAR+ at www.sedarplus.ca. An electronic or paper copy of the Prospectus Supplement, and any amendment to the documents, may be obtained without charge from CIBC Capital Markets at 161 Bay Street, 5th Floor, Toronto, ON M5J 2S8 or by telephone at 1-416-956-6378 or by email at mailbox.Canadianprospectus@cibc.com by providing the contact with an email address or address, as applicable. The Prospectus Supplement contains important, detailed information about the Corporation and the proposed Offering. Prospective investors should read the Prospectus Supplement (when filed) before making an investment decision. Concurrent Private Placement Concurrently with this announcement, WSP has also entered into a subscription agreement pursuant to which the Corporation will complete the Concurrent Private Placement at the Offer Price with La Caisse for aggregate gross proceeds to the Corporation of approximately $118 million. La Caisse has also been granted an option (the “Additional Subscription Option”) to purchase a number of additional Placement Common Shares representing up to 15% of the number of Placement Common Shares subscribed by them on closing, subject to, and in the same proportion as the Over-Allotment Option being exercised by the Underwriters. The issuance of the Placement Common Shares under the Concurrent Private Placement is subject to the approval of the TSX. Closing of the Concurrent Private Placement is scheduled to occur concurrently with the closing of the Offering and is conditional upon the concurrent completion of the Offering. Assuming completion of the Concurrent Private Placement and the Offering, but not the exercise of the Over-Allotment Option or the Additional Subscription Option, La Caisse will beneficially own, or exercise control or direction over, directly or indirectly, an aggregate of 18,619,100 Common Shares representing approximately 13.9% of the then issued and outstanding Common Shares. The Placement Common Shares will be subject to a four month hold from the closing date of the Concurrent Private Placement. In accordance with the terms of the Subscription Agreement, the Placement Common Shares will also be subject to contractual lockups for a period of four (4) months following the date of issuance of such Placement Common Shares. La Caisse (or their respective designee) will be entitled to a capital commitment fee equal to 4% of the aggregate purchase price for the Placement Common Shares for which they have subscribed (and any additional Placement Common Shares they have subscribed pursuant to the Additional Subscription Option, as applicable). Committed Acquisition Financing Concurrently with the announcement of the Acquisition, Canadian Imperial Bank of Commerce and JP Morgan Chase Bank, N.A., acting as co-lead arrangers and joint bookrunners, provided commitments for US$3,300 million senior unsecured non-revolving term loans (collectively, the “Committed Acquisition Financing”). The Committed Acquisition Financing will be governed by an incremental facility supplement to the Corporation’s seventh amended and restated credit agreement dated as of April 27, 2023, as amended and supplemented from time to time, with a syndicate of financial institutions to be entered into on or before the closing of the Acquisition. All of the above elements of the Acquisition financing plan have been designed and structured with a view to preserving WSP’s investment grade rating. Related Party Transaction Matters La Caisse beneficially owns, or has control or direction over, directly or indirectly, Common Shares representing more than 10% of the issued and outstanding Common Shares of WSP. As a result of the foregoing, the Concurrent Private Placement is a “related party transaction” for the purposes of Multilateral Instrument 61-101 – Protection of minority security holders in special transactions (“MI 61-101”). The Corporation has relied on the exemptions from the valuation and minority approvals of MI 61-101 contained in paragraphs 5.5(a) and 5.7(a) of MI 61-101 on the basis that neither the fair market value of the Concurrent Private Placement (including the capital commitment fee payable thereunder), nor the consideration thereof, exceeds 25% of the market capitalization of the Corporation. FINANCIAL AND LEGAL ADVISORS JP Morgan and CIBC Capital Markets are acting as financial advisors to WSP on the Acquisition. Legal advice is being provided to WSP by Skadden, Arps, Slate, Meagher & Flom LLP in the United States and Stikeman Elliott LLP in Canada. Harris Williams, UBS Investment Bank, AEC Advisors, and Houlihan Lokey are acting as financial advisors to TRC on the Acquisition. Legal advice is being provided to TRC by Paul, Weiss, Rifkind, Wharton & Garrison LLP. About TRC TRC stands for adaptability. With direction setting perspectives and partnerships, our 8,000+ tested practitioners in advisory, consulting, construction, engineering and management services deliver unique resolutions that answer any built or natural imperative. By creating new pathways for the world to thrive, we help our clients adapt to change and achieve long-lasting results while solving the challenges of making the Earth a better place to live — community by community and project by project. TRC is ranked #17 on ENR’s list of the Top 500 Design Firms, #5 for Power and #3 for Transmission & Distribution. Learn more at TRCcompanies.com and follow us on LinkedIn. About La Caisse At La Caisse, formerly CDPQ, we have invested for 60 years with a dual mandate: generate optimal long term returns for our 48 depositors, who represent over 6 million Quebecers, and contribute to Québec’s economic development. As a global investment group, we are active in the major financial markets, private equity, infrastructure, real estate and private credit. As at June 30, 2025, La Caisse’s net assets totalled CAD 496 billion. For more information, visit lacaisse.com or consult our LinkedIn or Instagram pages. La Caisse is a registered trademark of Caisse de dépôt et placement du Québec that is protected in Canada and other jurisdictions and licensed for use by its subsidiaries. About WSP WSP is one of the world’s leading professional services firms, uniting its engineering, advisory and science-based expertise to shape communities to advance humanity. From local beginnings to a globe-spanning presence today, WSP operates in over 50 countries and employs approximately 75,000 professionals, known as Visioneers. Together they pioneer solutions and deliver innovative projects in the transportation, infrastructure, environment, building, energy, water, and mining and metals sectors. WSP is publicly listed on the Toronto Stock Exchange (TSX:WSP). FORWARD-LOOKING STATEMENTS Certain information contained herein is not based on historical facts and may constitute forward-looking statements or forward-looking information under Canadian securities laws (collectively, “forward-looking statements”). Forward-looking statements may include estimates, plans, strategic ambitions, objectives, expectations, opinions, forecasts, projections, guidance, outlook, expectations regarding the requirements of various end markets, demand for and investments in power and energy related services and infrastructure, trends or other statements that are not statements of fact. Forward-looking statements made by the Corporation in this document may include statements about the Acquisition, the benefits, synergies and opportunities of the Acquisition, the Offering and the Concurrent Private Placement and the use of proceeds therefrom; the closing of the Offering and the Concurrent Private Placement; the conditions precedent to the closing of the Acquisition; the expected closing date of the Acquisition; the Committed Acquisition Financing, available liquidities, the attractiveness of the Acquisition from a financial perspective and expected accretion in various financial metrics (including estimated 2027 Accretion, Accretion Upon Closing of the Acquisition, TRC Pre-IFRS 16 Adjusted EBITDA and WSP’s Pro Forma Net Debt to Adjusted EBITDA ratio upon closing of the Acquisition and within 12 months following closing of the Acquisition); expectations regarding anticipated cost savings and synergies; the strength, complementarity and compatibility of TRC’s business with WSP’s existing business and teams; other anticipated benefits of the Acquisition and their expected impact on WSP’s delivery of its strategic plan and its long-term vision, future growth, results of operations, financial performance, business, prospects and opportunities, WSP’s business outlook, objectives, development, plans, integration, growth strategies and other strategic priorities, and WSP’s leadership position in its markets; and statements relating to WSP’s future growth, results of operations, performance business, prospects and opportunities, the expected synergies to be realized and certain expected financial ratios and other statements that are not historical facts. Forward-looking statements can typically be identified by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “forecast,” “project,” “intend,” “target,” “potential,” “continue” or the negative of these terms or terminology of a similar nature. Such forward-looking statements reflect current beliefs of Management and are based on certain factors and assumptions, which by their nature are subject to inherent risks and uncertainties. While the Corporation considers these factors and assumptions to be reasonable based on information available as at the date hereof, actual events or results could differ materially from the results, predictions, forecasts, conclusions or projections expressed or implied in the forward-looking statements. Forward-looking statements made by WSP are based on a number of assumptions believed by WSP to be reasonable as at the date hereof, including assumptions set out through this document and including, without limitation, principal assumptions about the satisfaction of all closing conditions and the successful completion of the Offering and the Concurrent Private Placement within the anticipated timeframe; the expected timing of completion of the Acquisition and the conditions precedent to the closing of the Acquisition (including the receipt of regulatory approvals); WSP’s ability to retain and attract new business, achieve synergies and maintain market position arising from successful integration plans relating to the Acquisition; WSP’s ability to otherwise complete the integration of TRC within anticipated time periods and at expected cost levels; WSP’s ability to attract and retain key employees in connection with the Acquisition; Management’s estimates and expectations in relation to future economic and business conditions and other factors in relation to the Acquisition and resulting impact on growth and accretion in various financial metrics; Management’s expectations in relation to the future performance and economic conditions and other factors in relation to TRC; the realization of the expected strategic, financial and other benefits of the Acquisition in the timeframe anticipated; the accuracy and completeness of the information (including financial information) provided by TRC and publicly available information; the absence of significant undisclosed costs or liabilities associated with the Acquisition; general economic and political conditions; organic growth expectations; economic and market assumptions regarding competition; the state of the global economy and the economies of the regions in which WSP or TRC operates; the state of and access to global and local capital and credit markets; interest rates; working capital requirements; the collection of accounts receivable; WSP obtaining new contract awards; the type of contracts entered into by WSP; the anticipated margins under new contract awards; the adequate utilization of WSP’s workforce; the ability of WSP to attract new clients; the ability of WSP to retain current clients; changes in contract performance; project delivery; WSP’s competitors; the ability of the Corporation to successfully integrate businesses; the acquisition and integration of businesses in the future; WSP’s ability to manage growth; external factors affecting the global operations of WSP; the state of WSP’s backlog and pipeline of opportunities in various reportable segments; the joint arrangements into which WSP has entered or will enter; capital investments made by the public and private sectors; relationships with suppliers and subconsultants; relationships with management, key professionals and other employees of WSP; the maintenance of sufficient insurance; the management of environmental, social and health and safety risks; the sufficiency of the WSP’s current and planned information systems, communications technology and other technology; the sufficiency of the Corporation’s cybersecurity measures; compliance with laws and regulations; future legal proceedings; the sufficiency of internal and disclosure controls; the regulatory environment; impairment of goodwill; foreign currency fluctuation; the expected benefits of acquisitions and the expected synergies to be realized as a result thereof; the tax legislation and regulations to which WSP is subject and the state of WSP’s benefit plans, as well as the assumptions underlying the 2025 financial outlook set out in WSP’s press releases dated February 12, 2025, August 6, 2025 and November 5, 2025. If any of these assumptions prove to be inaccurate, WSP’s actual results could differ materially from those expressed or implied in forward-looking statements. In evaluating these forward-looking statements, investors should specifically consider various risk factors, which, if realized, could cause WSP’s actual results or events to differ materially from those expressed or implied in forward-looking statements. Such risk factors include, but are not limited to: risks and uncertainties relating to the dilutive effect of the Offering on holders of Common Shares; the fact that the declaration of dividends on the Common Shares is at the discretion of the board of directors of WSP; the fact that the price at which the Common Shares under the Offering are sold by the Underwriters may be less than the Offering Price; WSP’s inability to successfully integrate TRC’s business upon completion of the Acquisition; the possible delay or failure to close the Acquisition; the potential failure to realize anticipated benefits from the Acquisition; the potential failure to obtain regulatory approvals in a timely manner, or at all; the currency exchange risk and foreign currency exposure related to the purchase price payable in respect of the Acquisition; WSP’s reliance upon publicly available information and information provided by TRC in connection with, and for the purposes of, the Acquisition; risks associated with historical and pro forma financial information; potential undisclosed costs or liabilities associated with the Acquisition; WSP’s or TRC’s businesses being adversely impacted during the pendency of the Acquisition; and change of control and other similar provisions and fees, as well as other risk factors discussed in greater detail in section 20, “Risk Factors,” of WSP’s Management Discussion and Analysis for the fourth quarter and year ended December 31, 2024 and in section 17, “Risk Factors,” of WSP’s Management Discussion and Analysis for the third quarter and nine-month period ended September 27, 2025, and as may be supplemented from time to time in reports filed by the Corporation with securities regulators or securities commissions or other documents that the Corporation makes public, which are available on SEDAR+ at www.sedarplus.ca and which sections are incorporated herein by reference into this cautionary statement. Although we have attempted to identify important risk factors that could cause actual results or events to differ materially from those contained in forward-looking statements, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking statements. WSP cautions that the foregoing list of risk factors is not exhaustive and other unknown or unpredictable factors could have also a material adverse effect on the performance or results of WSP or TRC. Actual results and events may be significantly different from what we currently expect because of the risks associated with our business, industry and global economy and of the assumptions made in relation to these risks. As such, there can be no assurance that actual results will be consistent with forward-looking statements. The completion of the Acquisition is subject to customary closing conditions, termination rights and other risks and uncertainties, including, without limitation and as applicable, regulatory approvals, and there can be no assurance that the Acquisition will be completed. There can also be no assurance that if the Acquisition is completed, the strategic and financial benefits expected to result from the Acquisition will be realized. To the extent any forward-looking statement in this document constitutes financial outlook or future-oriented financial information within the meaning of applicable Canadian securities laws, such information is intended to provide investors with information regarding the Corporation, including the Corporation’s assessment of future financial plans, and may not be appropriate for other purposes. Financial outlook (including assumptions about future events, including economic conditions and proposed courses of action, based on the Corporation’s assessment of the relevant information currently available), as with forward-looking statements generally, is based on current estimates, expectations and assumptions and is subject to inherent risks and uncertainties and other factors. Any financial outlook or future oriented financial information included in this document has been prepared by, and is the responsibility of, Management. PricewaterhouseCoopers LLP, the independent auditor of the Corporation, has not audited, reviewed, examined, compiled nor applied agreed-upon procedures with respect to any such financial outlook or future-oriented financial information and, accordingly, PricewaterhouseCoopers LLP does not express an opinion with respect thereto. The PricewaterhouseCoopers LLP report incorporated by reference in the Prospectus Supplement relates to the Corporation’s previously issued financial statements for the financial year ended December 31, 2024. It does not extend to any financial outlook or future-oriented financial information and should not be read to do so. Differences could arise because of events announced or completed after the date of this press release. All of the forward-looking statements contained in this document are expressly qualified in their entirety by this cautionary statement. The forward-looking statements contained in this document are made as of the date hereof (unless otherwise specified) and, accordingly, are subject to change after such date. Except to the extent required by applicable law, WSP does not assume any obligation to publicly update or to revise any forward-looking statements made in this document or otherwise, whether as a result of new information, future events, or otherwise. Readers should not place undue reliance on forward-looking statements. Readers are also referred to cautionary language regarding forward-looking statements included in the Prospectus Supplement. Additional Underlying Assumptions The Corporation cautions that the assumptions used to prepare the estimated 2027 Accretion, Accretion Upon Closing of the Acquisition, TRC Pre-IFRS 16 Adjusted EBITDA, TRC Post-IFRS 16 Adjusted EBITDA, and WSP’s Pro Forma Net Debt to Adjusted EBITDA ratio upon closing of the Acquisition and within 12 months following closing of the Acquisition could prove to be incorrect or inaccurate. Accordingly, the actual results could differ materially from the Corporation’s expectations as set out in this press release. The Corporation considered numerous economic and market assumptions regarding the foreign exchange rate, competition, political environment, and economic performance of each region where the Corporation and TRC operate. In addition to the assumptions disclosed above under “Forward-Looking Statements”, the following assumptions were used to develop these forward-looking financial measures: 2027 Accretion: WSP’s net revenue organic growth of approximately the same level as the average of the last three years for each of the years until 2027 (WSP’s revenue and net revenue were $16,166.8 million and $12,172.2 million, respectively, for the financial year ended December 31, 2024); TRC’s net revenue organic growth in line with the last 4-year compound annual growth rate (“CAGR”) revenue growth (TRC revenue and net revenue were approximately US$1,498.9 million and US$1,192.2 million, respectively for the financial year ended June 30, 2025); TRC Pre-IFRS 16 Adjusted EBITDA margin and Post-IFRS 16 Adjusted EBITDA margin expansion supported by a combination of levers, including utilization and pricing, where significant opportunity has been identified; Expected cost synergies of the Acquisition being fully realized by the end of 2027, with 50% expected to be realized in the first 12 months after closing of the Acquisition. Accretion Upon Closing of the Acquisition: The Acquisition is expected to be immediately accretive upon closing, excluding synergies. WSP’s net revenue organic growth of approximately the same level as the average of the last three years for each of the years until 2027 (WSP’s revenue and net revenue were $16,166.8 million and $12,172.2 million, respectively, for the financial year ended December 31, 2024); TRC’s net revenue organic growth in line with the last 4-year compound annual growth rate (“CAGR”) revenue growth (TRC revenue and net revenue were approximately US$1,498.9 million and US$1,192.2 million, respectively for the financial year ended June 30, 2025); TRC Pre-IFRS 16 Adjusted EBITDA margin and Post-IFRS 16 Adjusted EBITDA margin expansion supported by a combination of levers, including utilization and pricing, where significant opportunity has been identified. TRC Pre-IFRS-16 Adjusted EBITDA and TRC Post-IFRS 16 Adjusted EBITDA: TRC high single digit revenue organic growth for the financial year ending December 31, 2026, in line with TRC’s actual performance for the last four years. TRC Pre-IFRS 16 Adjusted EBITDA margin and Post-IFRS 16 Adjusted EBITDA margin expansion supported by a combination of levers, including utilization and pricing, where significant opportunity has been identified; WSP’s Pro Forma Net Debt to Adjusted EBITDA ratio (upon closing of the Acquisition, and a targeted range within 12 months following closing of the Acquisition): Acquisition closing date assumed to be March 28, 2026; WSP’s Adjusted EBITDA2 for the financial year ending December 31, 2025 ranging from $2.54 billion to $2.56 billion10; TRC’s Post-IFRS 16 Adjusted EBITDA for the financial year ending June 30, 2026 being in line with TRC’s actual performance of the first 3 months of the financial year ending June 30, 2026; All elements of WSP’s consolidated statements of cash flows for the applicable period being in line with those generally experienced by WSP in comparable periods; WSP’s net revenue between $13.8 billion and $14.0 billion for the financial year ending December 31, 2025 (WSP’s net revenue was $12,172.2 million for the financial year ended December 31, 2024, and WSP’s revenue was $16,166.8 million for the financial year ended December 31, 2024); and Cash flow of TRC for the financial year ending June 30, 2026 being in line with TRC Pre-IFRS 16 Adjusted EBITDA for the first 3 months of the financial year ending June 30, 2026. NON-IFRS AND OTHER FINANCIAL MEASURES The Corporation reports its financial results in accordance with International Accounting Standard 34 Interim Financial Reporting. WSP uses a number of financial measures when assessing its results and measuring overall performance. Some of these financial measures are not calculated in accordance with International Financial Reporting Standards Accounting Standards (« IFRS »). Regulation 52-112 respecting Non-GAAP and Other Financial Measures Disclosure prescribes disclosure requirements that apply to the following types of measures used by the Corporation: (i) non-IFRS financial measures; (ii) non-IFRS ratios; (iii) total of segments measures; (iv) capital management measures; and (v) supplementary financial measures. In this document, the following non-IFRS and other financial measures may be used by the Corporation: 2027 Accretion; Accretion Upon Closing of the Acquisition; Net Revenues; Net Revenue Organic Growth, Adjusted EBITDA; Adjusted Net Earnings; Adjusted Net Earnings Per hare; and Net Debt to Adjusted EBITDA ratio. Other than in respect of 2027 Accretion and Accretion Upon Closing of the Acquisition which are each defined below, explanations of the composition and usefulness of these measures can be found in section 19, “Glossary of segment reporting measures, non-IFRS and other financial measures” of WSP’s MD&A for the third quarter and nine-month period ended September 27, 2025 (the “Q3 2025 MD&A”), which section is incorporated by reference in this document, as posted on WSP’s website at www.wsp.com, and filed on SEDAR+ at www.sedarplus.ca. Reconciliations of such measures to the most directly comparable measure under IFRS are provided in section 8, “Financial Review” and section 9, “Liquidity” in each of WSP’s MD&A for the second quarter and six-month period ended June 29, 2024, WSP’s MD&A for the third quarter and nine-month period ended September 28, 2024, WSP’s MD&A for the fourth quarter and year ended December 31, 2024 (the “2024 MD&A”), WSP’s MD&A for the second quarter and six-month period ended June 28, 2025 and in the Q3 2025 MD&A, which sections are also incorporated by reference in this document, as posted on WSP’s website at www.wsp.com, and filed on SEDAR+ at www.sedarplus.ca. The information in this document also includes non-U.S. GAAP financial measures and non-U.S. GAAP financial ratios with respect to TRC, namely TRC Net Revenues, TRC Pre-IFRS 16 Adjusted EBITDA, TRC Post-IFRS 16 Adjusted EBITDA, TRC Pre-IFRS 16 Adjusted EBITDA margin and TRC Post-IFRS 16 Adjusted EBITDA margin. These measures are not recognized measures under U.S. GAAP and do not have standardized meanings prescribed by U.S. GAAP and therefore may not be comparable to similar measures presented by other companies, including WSP’s. Rather, these measures are provided as additional information to complement U.S. GAAP measures by providing further understanding of TRC’s results of operations. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of TRC’s financial statements reported under U.S. GAAP. WSP discloses TRC Pre-IFRS 16 Adjusted EBITDA because this non-U.S. GAAP measure is a key measure used by TRC to evaluate its business, measure its operating performance and make strategic decisions. WSP believes TRC Pre-IFRS 16 Adjusted EBITDA is useful for investors and others in understanding and evaluating its operations results in the same manner as TRC. However, TRC Pre-IFRS 16 Adjusted EBITDA is not a financial measure calculated in accordance with U.S. GAAP and should not be considered as a substitute for net income, income before income taxes, or any other operating performance measure calculated in accordance with U.S. GAAP. Using this non-U.S. GAAP financial measure to analyze TRC’s business would have material limitations because the calculations are based on the subjective determination of Management regarding the nature and classification of events and circumstances that investors may find significant. In addition, although other companies in its industry may report measures titled adjusted EBITDA or similar measures, such non-U.S. GAAP financial measures may be calculated differently from how TRC calculates non-U.S. GAAP financial measures, which reduces their overall usefulness as comparative measures. Because of these limitations, you should consider these non-U.S. GAAP financial measures alongside other financial performance measures, including net income and TRC’s other financial results presented in accordance with U.S. GAAP. These measures are defined as follows: “TRC Net Revenues” has the same definition as WSP’s definition of “net revenues,” being revenues less direct costs for subconsultants and other direct expenses that are recoverable directly from clients. “TRC Pre-IFRS 16 Adjusted EBITDA” is defined as TRC earnings before net interest and income taxes, excluding depreciation, amortization and acquisition and integration expenses and unusual items. “TRC Post-IFRS 16 Adjusted EBITDA” is defined as the TRC Pre-IFRS 16 Adjusted EBITDA adjusted for operating lease costs. “TRC Pre-IFRS 16 Adjusted EBITDA margin” is defined as the TRC Pre-IFRS 16 Adjusted EBITDA, divided by TRC Net Revenues. “TRC Post-IFRS 16 Adjusted EBITDA margin” is defined as the TRC Post-IFRS 16 Adjusted EBITDA, divided by TRC Net Revenues. WSP uses the following non-IFRS and other financial measures in this document with respect to the Corporation, in each case on a pro-forma basis after giving effect to the Acquisition, the Offering, the Concurrent Private Placement, advances and funds expected to be drawn under the Committed Acquisition Financing and any Acquisition related adjustments, as if each had been completed at the beginning of the relevant period: “WSP Pro Forma Adjusted EBITDA,” for the purpose of calculating the WSP Pro Forma Net Debt to Adjusted EBITDA ratio; “WSP Pro Forma Net Debt to Adjusted EBITDA ratio”; and “WSP Pro Forma Net Revenues”. “2027 Accretion” or “accretive” is calculated as the increase in WSP’s forecasted pro forma adjusted net earnings per share for the financial year ending December 31, 2027 after giving effect to the Acquisition, the Offering, the Concurrent Private Placement, advances and funds expected to be drawn under the Committed Acquisition Financing and any Acquisition-related adjustments, as if it had been completed on January 1, 2027, as compared to WSP’s forecasted adjusted net earnings per share for the financial year ending December 31, 2027 on a stand-alone basis. Refer to “Additional Underlying Assumptions” in this document. “Accretion Upon Closing of the Acquisition” is calculated as the increase in WSP’s forecasted pro forma adjusted net earnings per share immediately after giving effect to the Acquisition, the Offering, the Concurrent Private Placement, advances and funds expected to be drawn under the Committed Acquisition Financing and any Acquisition-related adjustments, as compared to WSP’s forecasted adjusted net earnings per share on a stand-alone basis. Refer to “Additional Underlying Assumptions” in this document. A reconciliation of TRC earnings before net interest and income tax to TRC Pre-IFRS 16 Adjusted EBITDA and TRC Post-IFRS 16 Adjusted EBITDA for the financial year ended June 30, 2025, is provided in the table below: Financial year ended June 30,2025 (in million U.S. dollars) Earnings before net interest and income taxes 87.5 Depreciation 13.8 Amortization 73.1 Acquisition and integration expenses and unusual items 17.9 TRC Pre-IFRS 16 Adjusted EBITDA 192.3 Operating lease costs (IFRS 16 Adjustment) 14.9 TRC Post-IFRS 16 Adjusted EBITDA11 207.2 A reconciliation of TRC Revenues to TRC Net Revenues for the financial year ended June 30, 2025, is provided in the table below: Financial year ended June 30,2025 (in million U.S. dollars) Revenues 1,498.9 Subconsultants and direct costs (306.7) TRC Net Revenues12 1,192.2 A reconciliation of WSP’s Pro Forma Net Revenues for the trailing twelve months ended September 27, 2025 for WSP and financial year ended June 30, 2025 for TRC, is provided in the table below: Trailing Twelve months ended September 27, 2025 (in million U.S. dollars) WSP Net revenues* 13,680.4 TRC Net Revenues (for the financial year ended June 30, 2025 and converted into Canadian dollars) 1,663.4 WSP Pro Forma Net Revenues 15,343.8 * Total of segments measure A reconciliation of WSP’s Pro Forma Adjusted EBITDA for the trailing twelve months ended June 28, 2025 for WSP and financial year ended June 30, 2025 for TRC, is provided in the table below: Trailing Twelve months ended September 27, 2025 (in million U.S. dollars) WSP Adjusted EBITDA 2,501.4 TRC Post-IFRS 16 Adjusted EBITDA (for the financial year ended June 30, 2025 and converted into Canadian dollars) 289.2 WSP Pro Forma Adjusted EBITDA 2,790.6 A reconciliation of WSP’s Pro Forma Net Revenues for the trailing twelve months ended June 28, 2025 for WSP and financial year ended June 30, 2025 for TRC, is provided in the table below: Trailing Twelve months ended June 28, 2025 (in million U.S. dollars) WSP Net revenues* 13,214.2 TRC Net revenues (for the financial year ended June 30, 2025 and converted into Canadian dollars) 1,663.4 WSP Pro Forma Net Revenues 14,877.6 * *Total of segments measure A reconciliation of WSP’s Pro Forma Adjusted EBITDA for the trailing twelve months ended June 28, 2025 for WSP and financial year ended June 30, 2025 for TRC, is provided in the table below: Trailing Twelve months ended June 28, 2025 (in million U.S. dollars) WSP Adjusted EBITDA 2,386.4 TRC Post-IFRS 16 Adjusted EBITDA (for the financial year ended June 30, 2025 and converted into Canadian dollars) 289.2 WSP Pro Forma Adjusted EBITDA 2,675.6 The non-IFRS and other financial measures used in this document do not have a standardized meaning as prescribed by IFRS. Management of the Corporation believes that these non-IFRS and other financial measures provide useful information to investors regarding the financial condition and results of operations of the Corporation and the other entities referenced herein as they provide additional key metrics of their performance. Refer to section 19 “Glossary of segment reporting, non-IFRS and other financial measures” of the Q3 2025 MD&A for more information on the usefulness to investors of each such measures. These non-IFRS and other financial measures are not recognized under IFRS, do not have any standardized meanings prescribed under IFRS and may differ from similar computations as reported by other issuers, and accordingly may not be comparable. These measures should not be viewed as a substitute for the related financial information prepared in accordance with IFRS. PRESENTATION OF FINANCIAL INFORMATION Unless otherwise indicated, all references to “$” in this document are to Canadian dollars and all references to “US$” refer to United States dollars. Where financial information of TRC has been converted from U.S. dollars to Canadian dollars for purposes of comparison to and combination with, financial information of WSP, U.S. dollars have been converted to Canadian dollars at an exchange rate of $1.3952 Canadian dollars per US$1.00. TRC’s financial statements were prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). IFRS differs in certain material respects from U.S. GAAP. The financial information of TRC presented in this document has not been adjusted to give effect to the differences between U.S. GAAP and IFRS or to accounting policies that comply with IFRS and as applied by WSP, nor has such financial information been conformed from accounting principles under U.S. GAAP to IFRS as issued by the IASB, and thus may not be directly comparable to WSP’s financial information prepared in accordance with IFRS. We have assessed the differences between U.S. GAAP and IFRS for TRC and have determined the impact to be immaterial except for Lease Accounting. Under IFRS, Lease Accounting is governed by IFRS 16 while under U.S. GAAP, it is governed by Accounting Standard Codification (ASC) 842. While similar with regards to the recognition of leases on the balance sheet, the standards have many differences in application. However, the impact of the differences between U.S. GAAP and IFRS for Lease Accounting on the pro forma financial measures presented in this document, namely WSP Pro Forma Net Revenue and WSP Pro Forma Adjusted EBITDA, is immaterial, such that no adjustments would be necessary. WSP’s financial information for the trailing 12-month period ended June 28, 2025 presented herein has been derived by adding WSP’s unaudited interim consolidated financial information for the six-month period ended June 28, 2025 to its audited consolidated financial information for the financial year ended December 31, 2024, and subtracting its unaudited interim consolidated financial information for the six-month period ended June 29, 2024. WSP’s financial information for the trailing 12-month period ended September 27, 2025, presented herein has been derived by adding WSP’s unaudited interim consolidated financial information for the nine-month period ended September 27, 2025 to its audited consolidated financial information for financial year ended December 31, 2024, and subtracting its unaudited interim consolidated financial information for the nine-month period ended September 28, 2024. NO OFFER OR SOLICITATION No securities regulatory authority has either approved or disapproved the contents of this press release. For more information, please contact: Alain Michaud Chief Financial Officer WSP Global Inc. alain.michaud@wsp.com (438) 843-731 1 Based on Engineering News-Record’s (ENR) Top 20 U.S. Design Firms by Sector (Power) list in August 2025, calculated on U.S. domestic revenues (U.S. Revenues) and adjusted to reflect annualization of POWER Engineers, Incorporated’s contribution for the financial year ended December 31, 2024, the assumed completion of the Acquisition as well as WSP U.S. Pro Forma Revenues. The approximate number of employees is as at December 2, 2025. 2 Non-IFRS financial measure or non-IFRS financial ratio that is forward-looking, without a standardized definition under IFRS, which may not be comparable to similar measures or ratios used by other issuers. Please refer to the “Non-IFRS and Other Financial Measures” and « Forward-Looking Statements » disclaimers below. For the financial year ended December 31, 2024, WSP’s adjusted EBITDA was $2,185.7 million, basic net earnings per share attributable to shareholders was $5.40 and adjusted net earnings per share was $8.05. 3 Cost synergies to exceed 3% of TRC’s net revenue are expected to be achieved by the end of 2027, with 50% expected to be realized in the first 12 months after closing of the Acquisition. The cost to realize synergies is estimated at the same level of synergies. 4 Based on ENR’s Top 500 U.S. Design Firms list in August 2025, calculated on U.S. Revenues and adjusted to reflect annualization of POWER Engineers’ contribution for the financial year ended December 31, 2024, the assumed completion of the Acquisition as well as WSP U.S. Pro Forma Revenues. Please refer to the « Forward-Looking Statements » disclaimer below. 5 Based on WSP U.S.’s Power and Energy net revenues for the trailing twelve-month (TTM) period ended June 28, 2025, and TRC’s Power and Energy net revenues for the financial year ended June 30, 2025. USD/CAD exchange rate used to convert TRC net revenue Power and Energy sector into Canadian dollars is 1.3952. Please refer to the “Non-IFRS and Other Financial Measures” and « Forward-Looking Statements » disclaimers below. 6 Pro forma Net Revenues are for the trailing twelve-month period ended June 28, 2025 for WSP, adjusted to reflect annualization of POWER Engineers’ contribution for the financial year ended December 31, 2024 and the assumed completion of the Acquisition. Please refer to the « Forward-Looking Statements » disclaimer below. 7 Non-IFRS financial measure or non-IFRS ratio that is forward-looking, without a standardized definition under IFRS, which may not be comparable to similar measures or ratios used by other issuers. Please refer to the “Non-IFRS and Other Financial Measures” and « Forward-Looking Statements » disclaimers below. 8 Cost synergies to exceed 3% of TRC’s net revenue for the financial year ended June 30, 2025 are expected to be achieved by the end of 2027, with 50% expected to be realized in the first 12 months after closing of the Acquisition. The cost to realize synergies is estimated at the same level of synergies. 9 The Corporation’s assessment of potential synergy opportunities for the Acquisition is primarily based on the information received as part of its due diligence investigation of TRC, its own outside-in perspectives, previous acquisition experience and publicly available information. 10 The target ranges were prepared assuming no fluctuations in foreign exchange rates in markets in which the Corporation operates. The Corporation anticipates organic growth in net revenues by segment will be in the mid-to-high single digits in its Canadian operations, mid single digit growth for its Americas operations, mid-single digits growth in EMEIA and low-to-mid single digit organic contraction in APAC. Head office corporate costs in 2025 are expected to be between $145 million and $160 million. 11 TRC pre-IFRS 16 Adjusted EBITDA and TRC Post-IFRS 16 Adjusted EBITDA for the financial year ended June 30, 2025 are not including the pro forma annualized contribution of acquisitions completed during the 2025 exercise. If we include the annualized contribution of these acquisitions, the pro forma TRC Pre-IFRS 16 Adjusted EBITDA and TRC Post-IFRS 16 Adjusted EBITDA would have been $US196.8M and $US211.7M, respectively. 12 TRC net revenues for the financial year ended June 30, 2025 are not including the proforma annualized contribution of acquisitions completed during the June 30, 2025 financial year-end. If we include the annualized contribution of these acquisitions, the pro forma TRC net revenues would have been $US 1,206.8M.

NFPA 660 will make it easier for all industries to manage dust related hazards making for safer work environments.

On November 1, 2024, FERC Commissioners led a technical conference regarding co-locating large loads at generating facilities.

On Tuesday, December 17th, the United States Environmental Protection Agency (USEPA) issued a final rule reclassifying several ozone nonattainment areas as “Serious » nonattainment for the 2015 ozone national ambient air quality standard.

In 2023, the Texas State Legislature approved Senate Bill 1397 and House Bill 1505, which require that “A person who holds a temporary permit or permit with an indefinite term shall report to the commission annually whether the activity subject to the permit is ongoing” and that the person “shall first report to the Texas Commission on Environmental Quality the status of the permitted activity not later than December 31, 2024”. The Texas Water Code has been amended to include this requirement in Sec. 5.587.

On November 1, 2024, FERC Commissioners led a technical conference regarding co-locating large loads at generating facilities.

Additional Restrictions for Major Modifications Other restrictions will come into play for new Major Sources, those that have a potential to emit 50 tons per year or more of VOC or NOx and “major modifications” that result in a VOC emission increase that exceeds 25 tons per year and also exceeds 25 tons per year when aggregated with all creditable increases and decreases in emissions of VOC from the source over any period of five consecutive years, which includes the calendar year in which the increase will occur. For sources that are major due to NOx emissions, a NOx emission increase that exceeds 25 tons per year and exceeds 25 tons per year when aggregated with creditable increases and decreases over the five-year period is also deemed to be a major modification. If a major modification occurs, the source is required to utilize the Lowest Achievable Emission Rate (or LAER) for the pollutant(s) that exceed 25 tons per year aggregated over the five-year period. However, Best Available Control Technology (BACT) can be substituted for LAER under certain conditions. Additionally, emissions must be offset as a means to advancing the area toward attaining the ozone standard. These same requirements will apply to newly constructed Major Sources. Upcoming Deadlines With these actions, the impacted areas will now have until August 3, 2027, to reach attainment. If they do not, USEPA is again obligated to reclassify ongoing nonattainment status to Severe nonattainment, reducing the Major Source threshold in half to just 25 tons per year. In the meantime, the states will be required to revise State Implementation Plans to demonstrate that attainment will be achieved by this deadline. A unique consideration in Wisconsin affects sources subject to a Registration Operation Permit. These permits establish annual emission limits as a percentage of the Major Source threshold (25, 50, or 80 percent depending on the Permit). For these sources, the annual emission limit for VOC and NOx will automatically be cut in half on January 16, 2025. Sources in the ozone nonattainment areas that hold these permits should evaluate whether the Registration Permit provides a long-term option given that the annual emission limits have been cut in half now and may again be cut in half in three years’ time. Next Steps: TRC Can Help TRC is available to support your air compliance and permitting needs by offering expert in-house resources to perform: Ambient Monitor Siting Evaluation Ambient Monitor Deployment, Operation and Maintenance For more information, contact Melanie Klamar, Robert VandenMeiracker and Mike Zebell.