Cryptocurrency (also known as crypto) is taking the fintech industry by storm, despite the economic experts who still dismiss it as a viable form of currency. Even with a global market cap of $1.34 trillion, cryptocurrency adoption is in the “early majority” stage. Bitcoin, the credited original crypto, is by far the biggest in terms of adoption and market cap. There were nearly 278 Bitcoin transactions made every second in January 2021 and more than 15,000 businesses worldwide currently accept Bitcoin as payment.

The proposed benefit of cryptocurrency is that, unlike most global currencies, it does not depend on a single point of failure or the political whims of any government. Intermediaries like banks are not needed for cryptocurrencies, as transaction ledgers are instead based on decentralized technology. Central currency value is generally determined by the market and regulation, whereas most cryptocurrencies are valued based on supply and demand. All cryptos have a limited supply of digital coins to control scarcity and inflation, but demand for them can greatly fluctuate causing price instability.

While cryptocurrency is often criticized for this volatility, whistleblowers are also further shining a light on the severe toll that these digital currencies are taking on the environment. As a result, cryptocurrencies like Bitcoin have been facing increasing pressures to go green.

How Does A Non-Physical Asset Impact The Environment?

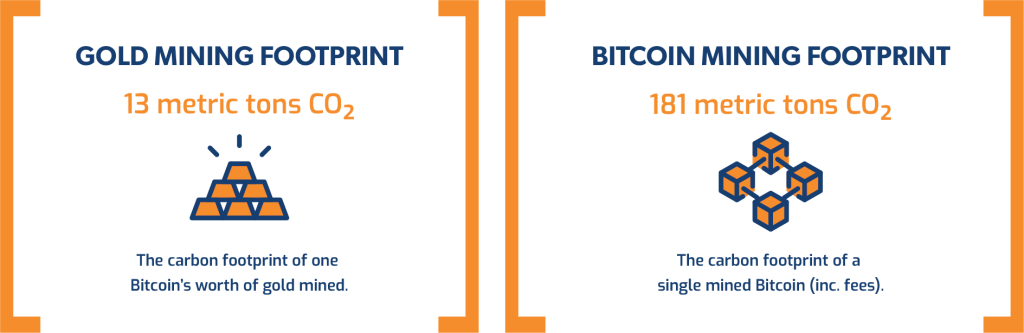

Unlike gold, acquiring cryptocurrency coins doesn’t involve digging holes into the ground. The bigger coins like Bitcoin operate under a so-called proof-of-work (POW) protocol and are obtained through mining. This entails solving difficult cryptographic equations, which serve to validate the transactions made with the currency.

Successful miners are rewarded coins as compensation for their work. Presently, nearly $200,000 worth of Bitcoin is awarded to the first miner to solve each puzzle, and new computations come out about every ten minutes. This makes mining a lucrative and highly profitable business, especially for large scale operations. Globally, it’s estimated that there are over a million individual miners competing tirelessly for rewards.

Solving these equations takes up massive amounts of computing power; this requires specialized computers running 24/7 in order to keep the Bitcoin market churning. Large scale operations run data warehouses full of these computers. Naturally, enormous amounts of electricity are required to keep these extensive computer networks running.

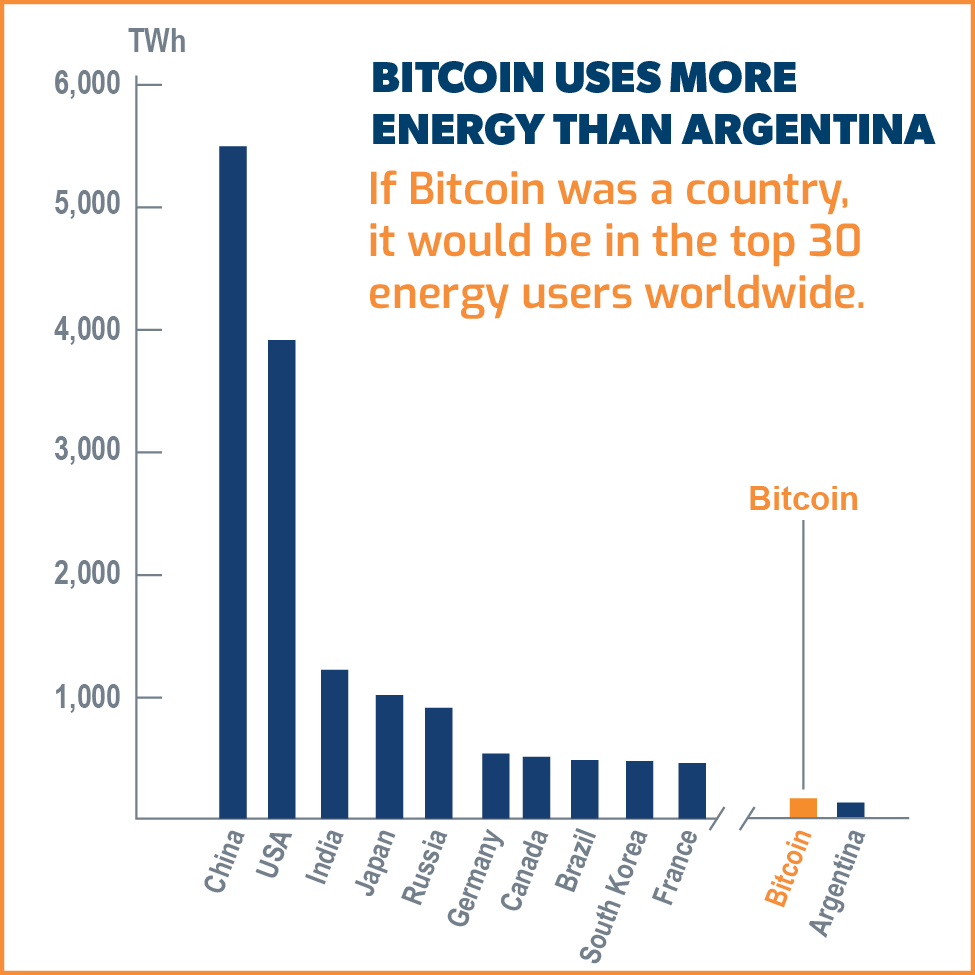

- The Bitcoin network has an annual energy consumption of 126 terawatt hours, which is

roughly equivalent to the annual energy consumption of Argentina. - To record a single Bitcoin transaction, approximately 1,547 kilowatt hours is needed,

which is enough electricity to power the average US household for 53 days.

What’s Powering The Bitcoin Network?

Currently, Bitcoin has a reputation for being less than clean when it comes to power usage. Fossil fuels make up approximately 61% of the total energy consumption by the crypto’s network. That’s equivalent to 77 terawatt hours per year. The remaining energy is fueled by renewables, but that still leaves Bitcoin with a severe carbon footprint.

However, in a Cambridge University survey, over 76% of POW miners reported that they

want to use renewable energy sources; clearly, the lack of clean energy usage isn’t due to a lack of interest.

In fact, cheap hydropower is in high demand for energy-guzzling mining operations, but they struggle to gain and maintain access to this cleaner energy. To power all of Bitcoin with hydropower, nearly 3% of the global hydro capacity would be required. This means that many local dams would no longer be able to satisfy regional electricity demand, which governments are not happy about.

China, in a recent push to control energy consumption, has banned Bitcoin miners from

direct access to Sichuan’s hydro dams. Similarly, a county in Montana declared that crypto miners were siphoning too much energy from local dams and thus forcing the county to meet its power demands with coal.

As a result, crypto mining operations seeking to go green will need to build their own renewable power sources. US-based Gryphon Digital Mining raised $14 million this year to do exactly that as they aim to be the first 100% renewable mining venture. It’s likely that other mining companies follow suit, as environmental impact is becoming increasingly more important in the minds of investors. For these solely profit-driven operations, carbon taxes and high electricity bills will likely be motivation enough to push them towards cheaper, cleaner energy. So, while Bitcoin mining right now is more dirty than desirable, it has the potential to usher in a new wave of demand for renewable energy sources.

A Computational Arms Race

In the early years of crypto when one Bitcoin was worth mere pennies, the first adopters could use their personal computers to mine. Now computers in the cryptocurrency network are so specialized that they serve very little function outside of mining. Theoretically, one could still use their laptop to try to mine, but it would be like a newborn racing against Olympians.

Professional Bitcoin miners must constantly buy up the latest technology to even stay competitive in this cutthroat space. With the rapid advancement in computing technology, mining equipment becomes virtually obsolete every 18 months. Mining operations cannot afford the electricity prices to keep nonprofitable equipment running; it’s more cost effective to only run the newest computers and simply scrap the rest. This amounts to 10,948 tons of electronic waste being dumped by the Bitcoin network every year.

Globally, only about 20% of e-waste is properly recycled, and the rest is sentenced to rust away in landfills. A conservative back-of-the-envelope calculation estimates that the yearly unrecycled Bitcoin e-waste contains over $2 million worth of precious metals. And these computers also contain toxic materials like lead, cadmium, mercury and chromium, all carcinogenic and not easily decomposed. Without interventions, these toxins can contaminate soil and water near landfills. Recycling Bitcoin’s e-waste is not only a potentially lucrative venture, but also necessary to mitigate cryptocurrency’s environmental impact.

Green: The Color Of Money

Bitcoin’s current model is hampered by its environmental and energy use implications, but it’s teeming with potential. Despite its flaws, governments are rushing to figure out how to tax Bitcoin — an indication that crypto isn’t going anywhere soon. This further emphasizes cryptocurrency’s need to build the foundation for sustainability and environmental responsibility. Efforts to help Bitcoin go greener will surely be daunting, but it could be the catalyst for more renewable energy infrastructure and electronic recycling. This can already be seen in countries like Iceland where Bitcoin miners flock to take advantage of the abundance of clean, green (and cheap) geothermal and hydroelectric dams that power the island. These mining operations contribute nearly $240 million to Iceland’s GDP, making them welcome guests.

Cryptocurrency, by virtue, has always promised to shake the table. Bitcoin mining becoming a driver for additional renewable investment is a less expected, yet highly exciting outcome. Ultimately, Bitcoin’s substantial influence means that the effort to clean it up could have the same impact as an entire country going green. The future of cryptocurrency has the potential to spur incredible positive change, as a greener foundation helps pave the path to a greener world.

Download the PDF to Access Additional Resources

Adapt to

Change

Partner With TRC’s Tested Practitioners