January 1, 2024, marks the start of the first reporting timeframe for companies in scope of the European Union’s Corporate Sustainability Reporting Directive (CSRD). Companies currently required to report under the existing Non-Financial Reporting Directive (NFRD) are in scope for the 2024 reporting period. To stay prepared, it is important to understand the key ESG Standards and how they are determined as material based on “double materiality”, what timelines are relevant, and the CSRD’s relationship/overlap with ESG regulations and reporting frameworks. To stay prepared, it is important to understand the key concept of double materiality, what relevant sustainability topics fall under CSRD, the major reporting timelines for companies in scope and the CSRD’s interaction with other ESG regulations and reporting frameworks.

Impact Materiality and Double Materiality

The CSRD requires companies to only disclose information it considers material. The concept of financial materiality is now a well-recognized approach to incorporating environmental, social and governance (ESG) factors into business considerations. The European Financial Reporting Advisory Group (EFRAG), has defined the reporting standards for CSRD, and stipulates that identifying information for disclosure should be based on two dimensions under the principle of double materiality: impact materiality and financial materiality. The European Financial Reporting Advisory Group (EFRAG), tasked with defining the reporting standards linked to the CSRD, stipulates that a sustainability topic needs to be reported on if the topic is financially material to the business (“outside-in”) and/or material from an environmental or social impact perspective (“inside-out”). Under EFRAG’s European Sustainability Reporting Standards (ESRSs), impact materiality is defined as:

A sustainability topic or information is material from an impact perspective if the undertaking is connected to actual or potential significant impacts on people or the environment and is related to the sustainability topic over the short, medium or long term. This includes impacts directly caused or contributed to by the undertaking and impacts which are otherwise directly linked to the undertaking’s upstream and downstream value chain.

Double Materiality:

Sustainability Topics under CSRD

Mandatory general topics to report on under CSRD are:

Further topics that need to be reported on under CSRD if deemed material from a financial or impact perspective range across:

Under CSRD, all reported sustainability information must go through an assurance process by an independent third-party auditor.

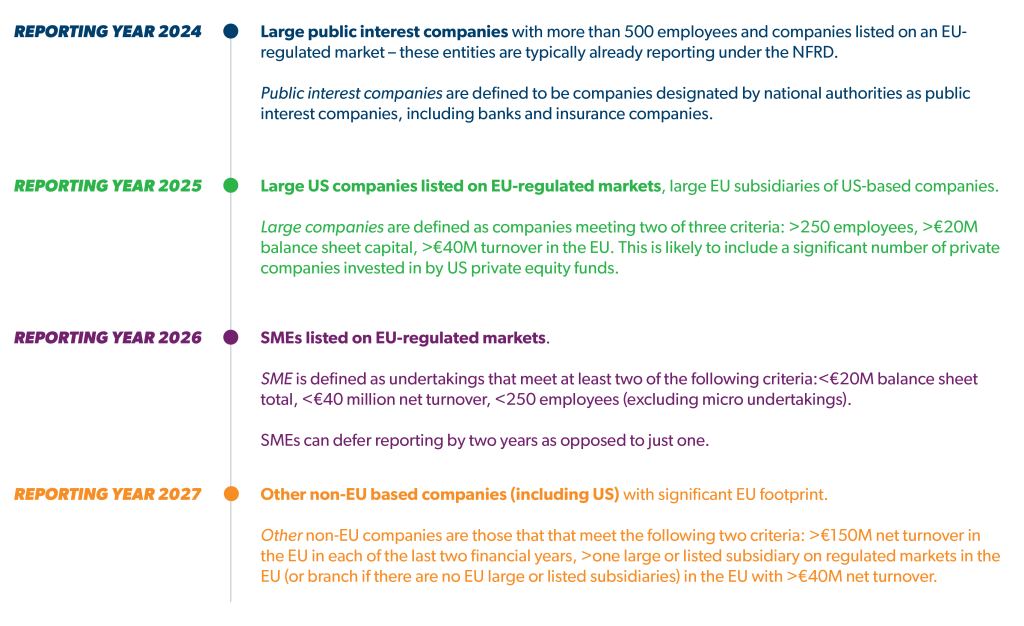

Timeline and Scope

The Non-Financial Reporting Directive (NFRD), established in 2014, mandates that large public-interest companies, listed within the EU and employing over 500 individuals, incorporate non-financial disclosures pertaining to ESG aspects alongside their annual financial reports. The CSRD supersedes and broadens the NFRD’s stipulations, expanding the range of companies obligated to disclose sustainability information from approximately 11,700 to 50,000 within the EU. Additionally, it is anticipated to impact over 3,000 US-based companies. Companies in scope generally must report in the year following the reporting timeframe. However, EU lawmakers have already approved reporting delays for non-EU companies and specific sectors. Stay tuned.

Interaction with other ESG Regulation

The Securities and Exchange Commission (SEC) has drafted a rule on climate disclosures that is much narrower in scope than the CSRD. The latter is set to mandate disclosure and assurance across a more extensive range of ESG topics compared to the SEC’s proposed rule, which specifically addresses climate-related disclosures concerning impacts and risks. Notably, the CSRD encompasses non-climate-related environmental aspects and various social issues, significantly expanding the breadth of information required beyond the SEC’s focus.

The Sustainable Finance Disclosures Regulation (SFDR) mandates specific transparency measures for financial market participants and advisors. It necessitates the disclosure of ESG qualities of financial products, along with information on how sustainability factors are integrated into investment decisions. These requirements, supplementing those of the CSRD, are applicable to entities offering investment products in the European Union, financial advisors serving EU consumers and non-EU financial institutions operating in the EU or engaging with EU-based clients.

Alignment with other Reporting Frameworks

The Task Force on Climate-related Financial Disclosures (TCFD) stands as the predominant climate reporting framework globally. A notable commonality between the CSRD and TCFD is their shared emphasis on comprehensive reporting of companies’ climate-related financial risks and opportunities. The CSRD’s provisions regarding climate disclosures closely align with the TCFD’s four pillars—governance, strategy, risk management and metrics and targets. A distinctive feature of the CSRD is its mandate for companies to disclose alignment with a 1.5°C global warming scenario, reflecting the EU’s commitment to limiting temperature rise as outlined in the 2015 Paris Climate Agreement. The TCFD focuses on companies assessing their resilience against a 2°C warming scenario. In 2023, the Financial Stability Board has asked the International Financial Reporting Standards Foundation (IFRS Foundation) to take over the monitoring of the progress on companies’ climate-related disclosures from TCFD. The IFRS S1 and IFRS S2 standards fully incorporate the recommendations of TCFD. We will update you on what that means for your climate-related reporting.

The good news? Other key corporate reporting frameworks such as the Global Reporting Initiative (GRI) have emphasized the goal to align their approach with the ESRSs – the intention being that GRI reporting and CSRD reporting can be achieved through a single report.

What Should Your Organization Do Next?

If your organization is already collecting data and has in-house resources to focus on sustainability reporting, the CSRD reporting effort will naturally be driven by those sustainability professionals. However, it will be important to complete a gap analysis to understand the steps required to align existing reporting with the ESRS requirements and prepare for independent auditing.

If your company is in scope and sustainability reporting is a new undertaking, your organization will have to identify resources and define processes to get CSRD reporting underway sooner rather than later.

Please contact me at bploix@trccompanies.com if you have questions on your EU reporting obligations under CSRD or other emerging EU, US and other international ESG regulations.