Key Actions to Take Now: Four Recommendations

Adapting to a new regulatory framework on a tight timeframe can be overwhelming, especially with delayed regulatory instructions. There are clear steps that companies can take now, though, to achieve compliance.

1. Determine your company’s eligibility status for SB 261.

If your organization has over $500M in annual revenue and does business in California, then it is likely in scope. If you are not sure whether your company does business in California, check the Secretary of State’s database, which lists entities that had an active agent for service of process in California as of 2022. You can also check whether your company pays sales tax in California as a likely indicator of activity there. Most critically, work with internal or external legal counsel regarding an eligibility determination.

2. If your company is in-scope, assess its current climate-related reports.

Does your annual Environmental, Social and Governance (ESG) or Corporate Social Responsibility (CSR) report discuss climate risk-related topics? Has your organization conducted a qualitative or quantitative climate scenario analysis? Are climate-related risks explicitly integrated into your company’s Enterprise Risk Management (ERM) framework? Do you have a TCFD-aligned report published on your corporate website? If you answered “yes” to each of these questions then it will be fairly straightforward to follow CARB’s Draft Checklist to prepare a report for SB 261 compliance. If you answered “no” to most of the questions above, then additional work will be needed.

3. Act quickly to launch a scenario analysis and develop disclosure responses, if needed.

The regulatory compliance deadline of January 1, 2026, is quickly approaching. If your company is in-scope and does not yet have a public report or a prior climate risk assessment, it is time to begin a climate scenario analysis, which can take one to two months to complete. Follow the TCFD’s technical recommendations for scenario analysis. Then, draft a public-facing report, following CARB’s Draft Checklist for minimum compliant disclosures. Keep in mind that the entire disclosure process can take three months or more, particularly if new to the TCFD framework. While the deadline for compliance remains January 1, 2026, CARB’s public docket to upload a link to your report is expected to remain open until July 1, 2026. TRC’s team of climate risk and resilience experts can also help you quickly level up your climate risk processes and draft a compliant report.

4. Plan for future compliance cycles.

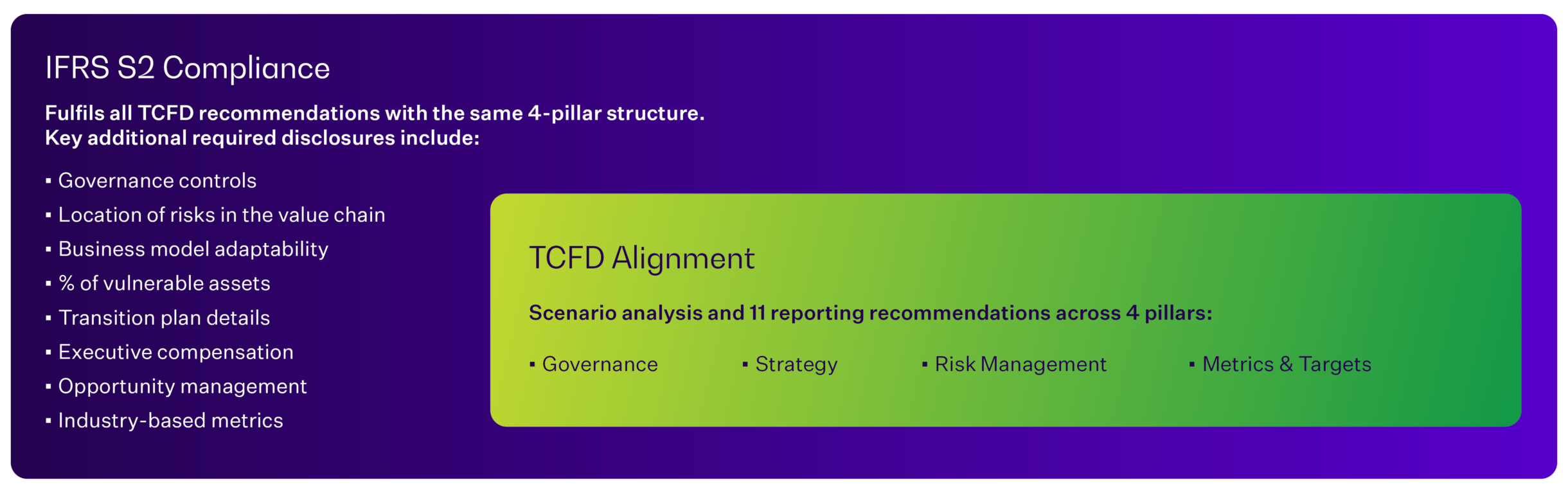

Evaluate your company’s eligibility and preparedness for SB 261’s sibling bill, SB 253, which requires companies doing business in California with annual revenue over $1 billion to publish a greenhouse gas (GHG) inventory with limited assurance by the proposed deadline of June 30, 2026. Next, assess budgets, timelines, goals, and data gaps for the next SB 261 reporting cycle, due January 1, 2028. If you’ve done a qualitative climate scenario analysis for this first cycle, consider conducting a more rigorous, quantitative dive into your physical risks in 2026 or 2027. If your company already has a public TCFD-aligned report, work to understand what additional steps would be needed for IFRS S2 compliance.